Analysis

A Balance Sheet ‘Put’ To Give Stocks A Helping Hand

Chiefly, this issue has come back onto the radar as daily usage of the NY Fed’s reverse repo facility has fallen back to levels last seen since before the tightening cycle begun, and below $100bln on numerous occasions.

A significant factor driving this substantial drop-off in usage of the facility is the Fed’s decision to lower the rate offered at the RRP to the bottom end of the fed funds rate target range, currently 4.25%, around 5bp lower than where said rate has sat for the bulk of the cycle. In turn, this has lessened the attractiveness of parking cash at the NY Fed, and contributed to declining demand, with the yield on short-term bills now above that of the RRP.

That said, despite these technical adjustments, usage of the facility remains a useful gauge of liquidity conditions, as the Fed continue the quantitative tightening process, and running down the size of the balance sheet.

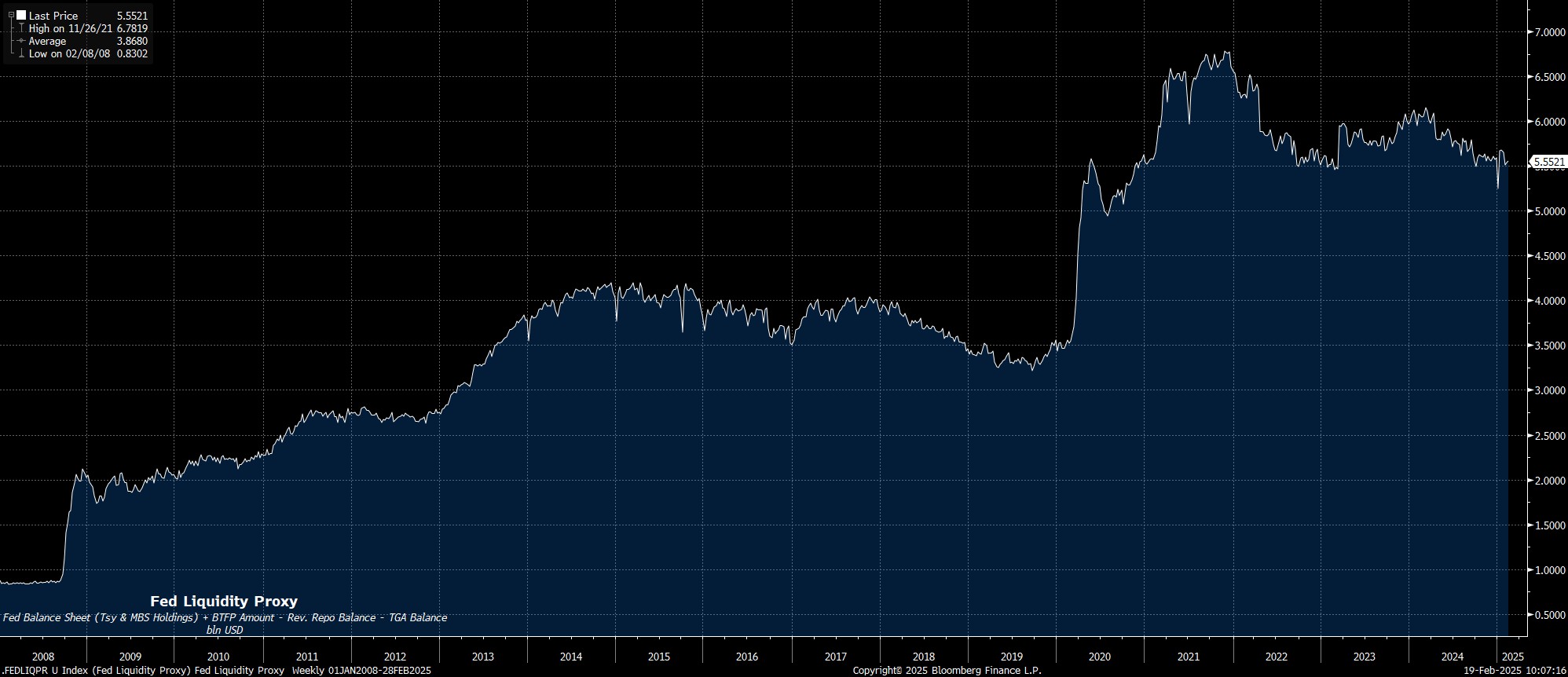

Using RRP as a liquidity gauge is, however, something of a crude way of viewing things. That said, a broader proxy of liquidity provision by the Fed – shown below – also points to a tightening in conditions, which, per this metric, were briefly at their tightest in five years as the new year got underway. Having since loosened a touch, the broad trend of declining liquidity, and tighter conditions, remains intact.

Of course, such a trend is to be expected. While the Fed have continued to lower the fed funds rate, delivering 100bp of cuts in 2024, balance sheet run-off has also continued during this time period, in turn lessening the overall impact of the rate reductions that have been delivered.

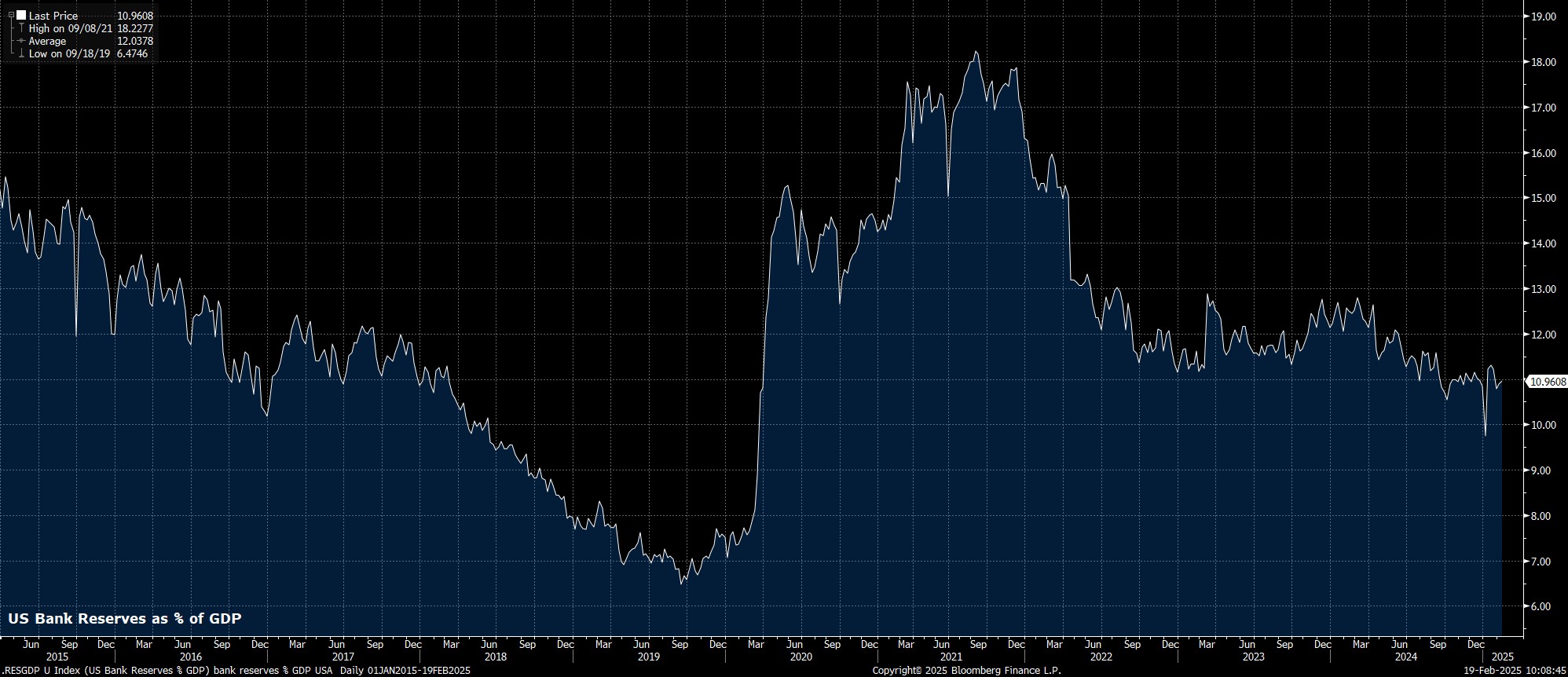

The question, now, for policymakers, is when to bring QT to an end. With RRP usage having dried up, the liquidity drained by continued QT will have to instead come from bank reserves, in turn raising the risks of a potential ‘dash for cash’ were reserves to fall too low. Such a scenario seems unlikely for now, with Fed officials noting that reserves remain ‘ample’, and a comparison of reserves to bank liabilities indicating few signs of a squeeze akin to that experienced at the tail end of 2019.

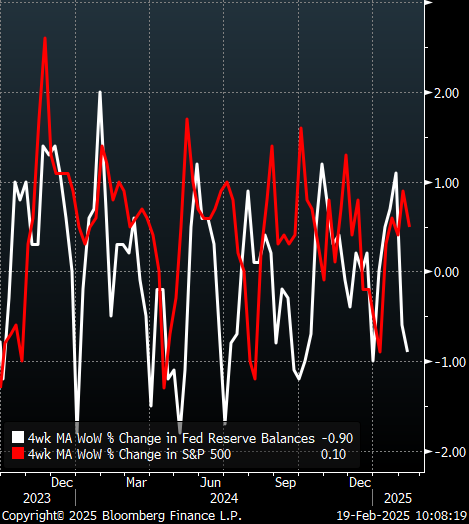

That said, the continued drain in liquidity may well pose a near-term headwind to risk assets, with Wall Street equities, as has been the case since the GFC, continuing to display a close correlation with shifts in the degree of funds sloshing around the financial system. Modestly negative seasonality at this time of year, until mid-March, might also be something that the bears’ have on their radars.

Looking further ahead, though, as bank reserves further decline, and become less “ample” in nature, the Fed will likely be forced to bring QT to an end. Incidentally, reserves are currently running at around 10% of GDP – compared to 18% at this cycle’s peak, and as low as 7% during the 2019 squeeze.

Consequently, the QT process looks set to come to a conclusion during the second quarter of the year, if current trends continue, possibly as soon as the May FOMC meeting.

With that in mind, while this year may not see the presence of a ‘Fed put’ in terms of lower rates, with the Committee on hold on that front pending better news on inflation, there could well be a comfort blanket for market participants in the form of a looser balance sheet stance. An end to QT, coupled with a subsequent increase in liquidity, and renewed build in bank reserves, would likely provide something of a cushion for equities against exogenous shocks, particularly in the trade arena.

As a result, while there is likely to be some considerably choppiness in the short-term, as participants struggle to discount the likely future fiscal policy path, the longer-run path of least resistance should continue to lead higher. Strong economic growth, and solid earnings growth, remain the primary pillars supporting the bull case, though a balance sheet ‘put’ will be another welcome helping hand for the bulls.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.