Analysis

The GOP will be disappointed not to have a president in the White House especially given Trump was the incumbent, but they'll be pleased with the trends they're seeing in the House, picking up 12 seats. While we may not know the full outcome of the Senate until 5 January, the GOP has held on so regardless of the outcome. This means no higher corporate or personal taxes in 2021, no Green New deal and suggests the hard left of the DEM party will have a reduced influence on the private sector.

75 million votes for Joe Biden is incredible and his weekend speech was a great way to start what is going to be a tough four years. The markets certainly expect a more orthodox policy on trade and a belief that Biden will approach international diplomacy in a far more finessed, less blunt manner. We need to adapt as to how we will receive news and Twitter will perhaps become less of an influence when it comes to key policy announcements. I'm not sure we can expect the US and China to suddenly drop tariffs and march on into the sunset, but a change in tactics when it comes to diplomacy is coming.

We certainly saw some wild swings to get to this juncture. I recall around midday on Wednesday (AEDT) that if we had projected the favourite (derived from the betting odds) for each remaining battleground state that Trump was projected to have close to 300 Electoral College Seats, with one site given Trump an 80% chance of winning at that point. 8 hours later this probability had swung back to an 80% chance for Biden to win and he didn’t look back.

Risk was unnerved and while some will say this is a function of a split Congress, the real story has been the collapse in implied volatility (vol). The VIX index traded into 42% pre-election and now sits at 24.8%, so a 16-volatility reduction in this period is huge. FX implied vol notably in USDCNH had blown out to record levels relative to realised volatility. Bond vol moved to 63% the highest since April and now sits at 39.8%, so all these metrics have since collapsed. In the case of FX vol we can see the move here, with 1-week implied trading at a discount to realised.

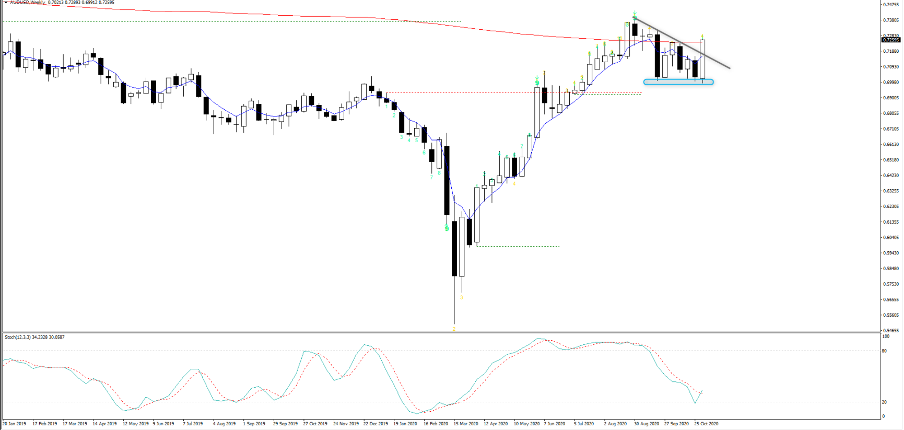

The unwind of disaster hedges has been the key reason why risks assets did what they did last week, with equities working strongly higher, high yield credit spreads coming in some 60bp (and now the tightest since March at 4.42%) and the USD offered a punchy 1.9% on the week. Look at the weekly charts of most USD pairs and you’ll see weekly key reversals in the USDX, AUDUSD, NZDUSD, GBPUSD, EURUSD, USDMXN, USDCNH, USDJPY, USDCHF – if we see follow-through this week it will confirm the ownership structure that the USD bears have got the upper hand and go some way to assist our probability assessment.

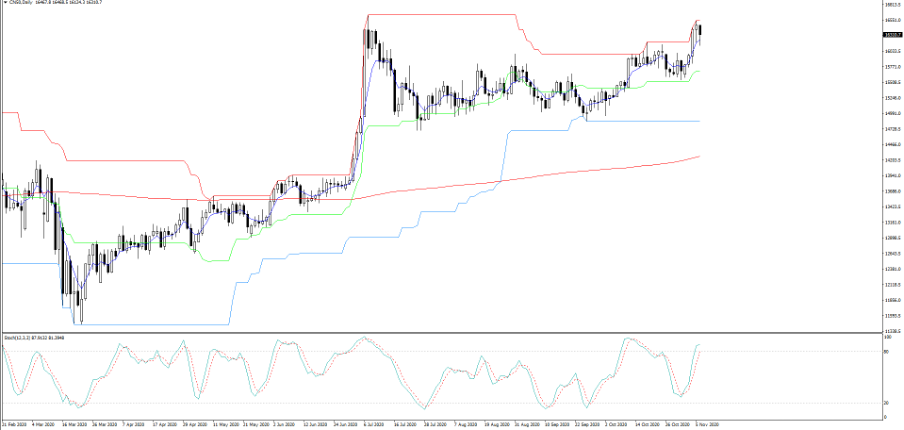

The reduction in vol may abate this week and consolidate, and therefore it seems feasible that we catch our breath and consolidate in risk assets (such as equities) too. The US500 is pushing into the top of its range and all-time highs. This is true of the NAS100 which is eyeing the 13 October swing and I have an eye on the AUS200 index which is eyeing a test of 6250 and the multi-month range high. If the EM trade is to really outperform which many feel is the case, watch the CN50 index (top 50 Chinese mainland companies traded on the Singapore futures exchange) as this is testing the July highs and a breakout could be very powerful. The EEM ETF is also one to watch (trade on MT5).

Daily chart of CN50

The US bond market gets close attention. After a collapse in yields on Wednesday we’ve seen a steady sell-off and grind higher (in yield), with UST 10s +6bp on Friday. Granted, crude was hit 4% but copper and iron ore futures were well bid, the USD fell 0.3% and reflation it seems as a key trading thematic is back on the agenda. The market has the perception that the US may be getting less fiscal with Mitch McConnell as Senate leader, but there's a view that if the GOP are to press its momentum in the House and advantage in the Senate then they need to go harder on stimulus and perhaps close to a $1 -$1.5t range. Let’s see how COVID-19 shapes up and the impact on economics, because at this stage leadership cannot come soon enough as the case count is on the move and if hospitalisation rates move sharply higher then that stimulus may be coming sooner.

The week ahead

We watch for vaccine headlines which may not come this week, but soon. Of course, the actual rollout will not take place until well into 2H21 but the market needs hope if it is to stay desensitised to Covid-19 case trends. Economic data needs to hold up too and Friday’s US payrolls were certainly well received. This week there's limited tier one data, with CPI out of US, EUR, CNY, SEK and NOK, and GDP data out of EU and UK. We hear from a number of Fed officials while in US trade on Thursday (Friday 03:45 AEDT) we hear from ECBs Lagarde, BoE Bailey and Fed chair Powell at the ECB forum.

Also, on the docket we have central bank meetings in NZ and MXN, with the Banxico expected to ease the overnight rate by 25bp to 4%. In China, we also get money supply and credit data.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.