On one hand, the attraction to own USDs is almost too obvious and that worries me as a USD bull – we have inflation far higher than where the Fed has been forecasting only back in September and unemployment is also trending towards what the Fed considers ‘full employment’. We get the November CPI print on 11 December and that promises to be even hotter than the October print of 6.2% YoY. The Fed meet on 16 December, and in response we should get some punchy upward revisions to their forecasts on labour and inflation.

Given the potential revisions on economic projections, it feels incredibly likely that the pace of QE tapering should subsequently accelerate - this sets up an earlier finish for asset purchases and ultimately opens the door to potentially start hiking from as early as May 2022.

The Fed’s median projection for the fed funds rate (the dots) in 2022 is for one hike – it’s feasible to believe this lifts to two hikes next year.

So, it's straightforward to take a constructive view on the USD, especially when you hear from former Fed officials Bill Dudley and Jeffery Lacker that they think the fed funds rate may need to move to 3% to control inflation. That would get the USD bulls excited, although 3% would probably be seen as a potential policy mistake by many.

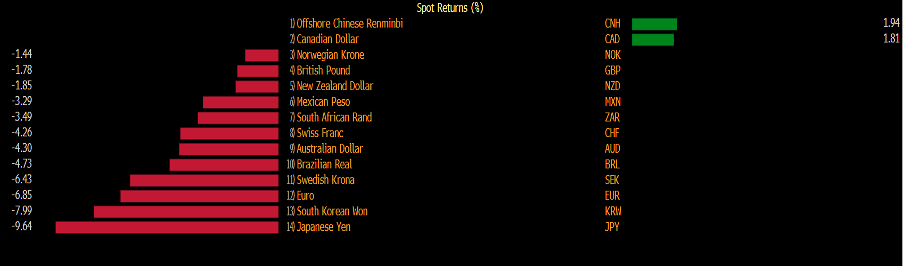

Year-to-date moves vs the USD

(Source: TradingView - Past performance is not indicative of future performance.)

The market has some key event risks in its sight and are clearly running a progressively greater short EURUSD position into the Nov CPI print and FOMC meeting – and that has started now. We also have an important ECB meeting (also on the 16 December) and that too could be a volatility event – it promises to be a huge 24 hours for EURUSD and the EUR crosses!

We can talk up the USD but looking across the FX universe this appears to be a EUR move, with our EUR spot basket (EURX on MT4/5) at the lowest levels since May 2020. Aside from the JPY, the EUR is the weakest G10 currency in 2021 – and is at the bottom of the pack on a 1-, 3- or 6- month basis – a true momentum play.

EURUSD has been at the heart of the falls in our EUR basket and has been predictably well traded by clients. Maybe this is as simple as a central bank divergence play – with the ECB aggressively pushing back on expected rate hikes in 2022, hell-bent on the view that inflation is in fact ‘transitory’.

While the Fed, on the other hand, are open-minded to hiking, if it's required, and the market certainly is adamant it will be in 2022 - and could soon be pricing 3 hikes in 2022. Trading diverging monetary policy paths is perhaps the most simplistic form of tactical trading, in essence, it's FX trading 101, and it's working and we’re all witnessing the trend lower.

We’re seeing a similar theme play out in EURCAD and EURNZD, and EURCAD is especially interesting as the cross has broken its consolidation range and if we see a hot Canadian CPI print (Thursday 00:00 AEDT) then the market will expect a rate hike in January by the BoC.

Diverging monetary policy expectation’s part explains the move in EURCHF, but it clearly doesn’t explain the one-way move in EURJPY from 133.50 to sub-130. As we explain here EURCHF should be on all FX traders’ radars.

So the market is clearly happy to sell EURs and the order books at banks would have become quite one-sided. Trend-followers and momentum-based funds, many of them systematic, would have been all over this move lower adding to shorts as price broke level after level. And, while EURUSD implied or realised volatility hasn’t picked up markedly, the rallies from 1.2260 (in May) have been corrective in nature and short-lived

(Source: TradingView - Past performance is not indicative of future performance.)

The question I'm asking now and noting that US non-farm payrolls, CPI and FOMC meetings are still some way off, is how to best trade the EURUSD in the near term. That's of course determined by strategy – in this case, mean reversion or momentum.

- To buy EURUSD as a mean reversion play – personally, I feel the counter rallies should be limited so would change to an ultra-short-term moving average (such as the 5-day EMA) over a traditional 20-day MA

- Leave limit orders to sell into the former downtrend at 1.1415, or take the timeframe in and see the reaction, price action and behaviour into the former trend before initiating shorts

- Or, just to stay short as a pure momentum trade and have a stop above 1.1464.

One way moves and mature trends eventually come to an end, notably when positioning becomes too extreme – over loved consensus trades rarely end well if you’re the last one in. However, while the street is clearly short of EURs, the fundamentals justify this and if heat come out of the move, then it should offer a renewed chance to short as we head into a huge December for FX traders. That’s how I see it as we head towards a wild December of major event risk.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.