A Brazil-Argentina Currency Union; Realistic or a Pipe Dream?

The topic of monetary unions is again on the radar this week amid reports that Brazil and Argentina may be considering a common currency; perhaps, with other Latin American economies joining in for good measure.

Quite why the Brazilian government would seek to tie their fortunes to the economic sick man of South America remains to be seen — even if a proposed new currency is to run in parallel with the BRL for some time.

_2023-01-23_20-25-33.jpg)

It must be said that such a proposal remains far from being fully formed. It took over 3 decades for the euro to go from the drawing board to a fully implemented project; considering the substantially more volatile nature of the economies involved here, this would likely take even longer.

Nevertheless, it pays to be cognisant of the potential trading opportunities that more concrete moves towards a shared LATAM currency could present.

Namely, these would be to play such assets from the short side, with investors likely to take a dim view of such an unsuitable and unstable economic marriage. Think of something like the eurozone but made up of 20 economies all like Greece, multiply that by 10, and you’re halfway to envisaging how this potential union could shape up. Mismatches in growth dynamics, inflationary backdrops, monetary policy settings, and global trade relationships mean any such shared currency would be built on the shakiest possible foundations.

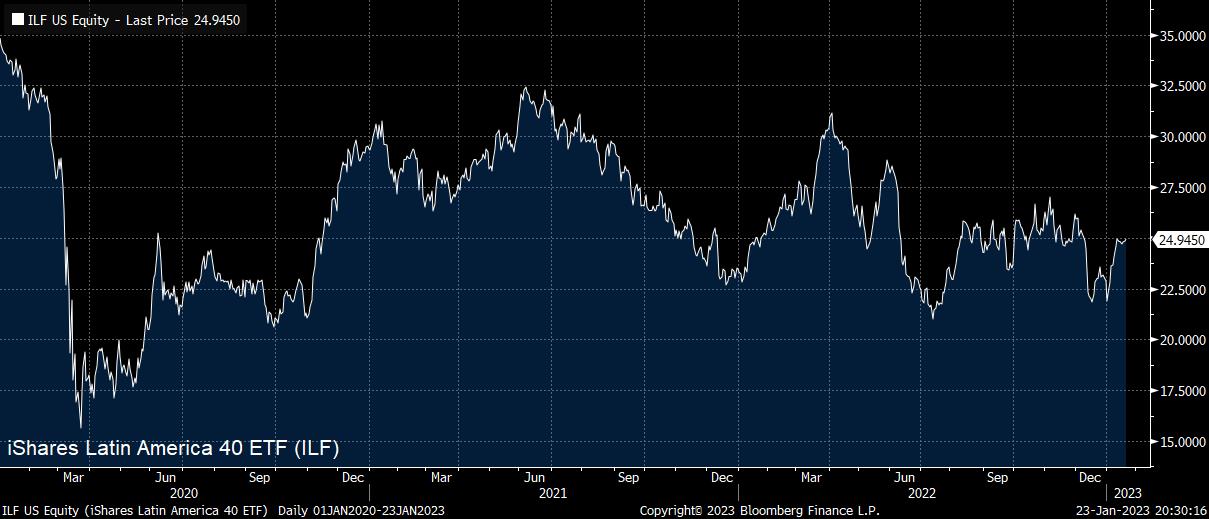

While a currency play may be the obvious trade here, there are other ways to gain exposure to this theme. ETFs is one such method, with Pepperstone offering a range of such products, including broad LATAM funds, in addition to those particularly focused on Brazil.

While this speculative shared currency project may never come to fruition, and thus fail to have outsized influence on the aforementioned instruments, there are other rationales for holding a bearish view.

Even if the Fed are nearing the conclusion of this tightening cycle, idiosyncratic factors are likely to continue to pressure assets in the region. Leftward political shifts in Chile and Colombia were looked upon poorly by the market last year, with a similar jolt to Brazilian politics – particularly given President Lula’s campaign promises to increase welfare spending – likely to be met with a similar impact on domestic assets.

In Argentina, meanwhile, the huge debt burden still owed after 2018’s IMF bailout, as well as practical isolation from global debt markets after 2020’s default, both continue to loom large, denting the attraction of the market to most international investors.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.