Analysis

Our clients are now countering this move with 86% of all open positions in USDJPY, 83% in GBPJPY and 72% in AUDJPY now held short. I guess this flow is in fitting with leveraged funds in JPY futures, where we see a 36k contract short position (source TFF report).

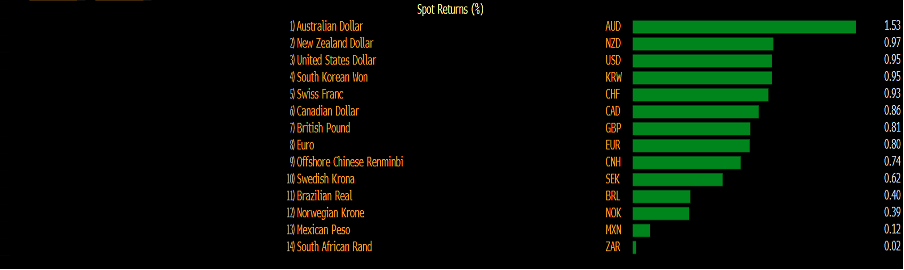

Moves on the day vs JPY

(Source: Bloomberg - Past performance is not indicative of future performance)

AUDJPY has absolutely gone for it, sailing through the 82-handle and into 83.50 – the highest levels since 6 July. Granted, Sydney has new freedoms, but this is a ‘carry’ or rates inspired move driven seemingly by Japanese pension funds.

While linked to the demand for Aussie yield from Japanese funds, the move in Aussie rates remains one of the biggest divergences in global macro right now – the markets are pricing the RBA cash rate closer to 90bp in 2 years’ time – suggesting at least 3 rate hikes with rates lift-off priced for late 2022 – the RBA of course have guided to 2024 as their lift-off base case date.

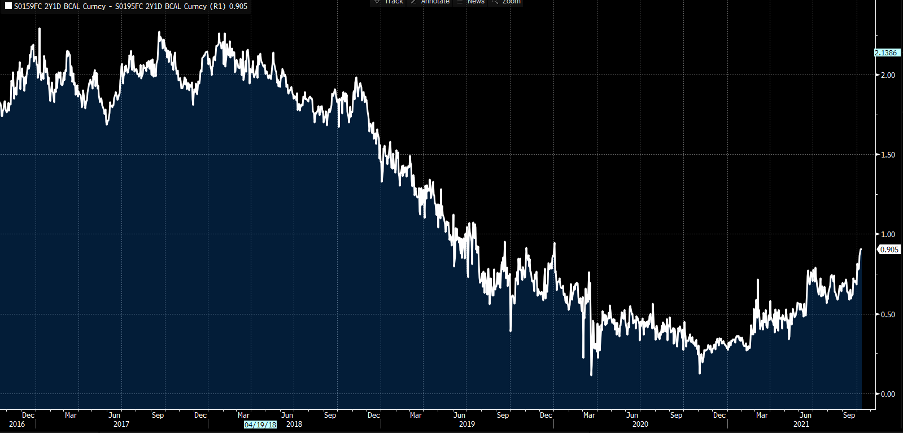

Aussie – Japan 2yr rates – a 90bp advantage for Oz

(Source: Bloomberg - Past performance is not indicative of future performance)

We can see (above) how the path of expected interest rates diverges in the swaps market. The moves represent implied central bank policy divergence on favour of the RBA. This is FX fundamentals 101 – divergence creates wider yield spreads in bond markets and this is where we see one-way capital flows into the currency, as we see assess the relative attractiveness of each jurisdiction as an investment destination.

USDJPY is eyeing 113.50 taking the gains from 109.12 just 13 bars ago. Overbought? For sure, but CTAs (trend-following funds) and momentum funds are likely just getting started on this and its bull trending.

GBPJPY holds 154 and after the weekend BoE commentary we’ve seen the implied probability of a rate hike lift to 33% on 4 November and 86% for 16 December.

In fact, we now see the trade-weighted JPY at the weakest levels since October 2018.

Carry making a comeback with a vengeance

Consider the role of a corporate Treasurer. They have a currency exposure that is due for settlement – they can let the position settle at the settlement date and take delivery of the bought currency, deliver what they sold. Or they can delay settlement for a period by entering into a forward rate agreement.

In effect, the entity can speak to a counter-party (an investment bank for example) and have the settlement delayed for a set period and the trade adjusted for the forward points, which are set by the market – forward points reflect interest rate differentials. So if you’re long a currency where interest rate expectations are rising on a relative basis then you’ll receive positive carry and vice versa.

This is also a concept known as interest rate parity and the forward rate removes the arbitrage.

Perhaps a corporate has a USD-denominated liability which not actually due for 12-18 months – they can hedge it into USDs and earn income (carry) on the position – they need to buy USDs against a lower-yielding currency, and they need to see what duration/tenor pays the best carry levels.

Conversely, a European corporate (for example) may have forecasted revenues in the US and want to hedge that back to EUR for certainty, then they would be paying carry (they will be long EUR). To limit the damage, they would need to assess which period/tenure has the least negative carry.

Blue – AUDJPY, white – Aussie 10yr treasury adjusted for JPY hedging costs

(Source: Bloomberg - Past performance is not indicative of future performance)

It isn’t just corporate hedging, but this principle guides currency hedging flow-through investment channels too. We see the effect hedging costs can have for Japanese funds – with the effects of JPY hedging we can see where Japanese funds are deploying their funds. A weaker JPY from here? It seems we need to anticipate where Japanese pension funds capital is moving and how much of it will be hedged.

So on the one hand, Japanese funds are driving the show with regards to JPY weakness. But carry is making a comeback – it's early days and it requires low volatility in FX markets, but if we really are due to see interest rates going up in 2022 and beyond, then we’re seeing dispersions pick up in global rates pricing and this is having an increasing effect on FX markets. Short EURAUD anyone? Trade the potential opportunity with Pepperstone.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.