Analysis

Week Ahead Playbook: Trump-Watching Gives Way To A Risk Event Bonanza

The Week That Was – Themes

When sitting down to write this week’s note, the first phrase that springs to mind is ‘damp squib’.

For all the campaign bluster, for all the ramp up in implied vols, and for all the endless column inches filled by guesstimates of what may happen upon President Trump’s return to the White House, that return actually proved to be relatively uneventful.

From a market perspective, at least, there has been little by way of concrete information on the areas about which participants care most – trade, and taxes. On the former, there was no ‘Day 1’ universal tariff announcement as had been concerned, nor one on any of the subsequent days. While Trump has vaguely touted that 1st February may be the date that tariffs are imposed on Canada and Mexico, this remains unconfirmed, and at this stage seems little more than a negotiating tactic to bring parties to the table ahead of the scheduled USMCA re-negotiation next year.

Besides the matter of trade, taxes have barely had a mention, while Trump has also reprised his first term act in calling for lower oil prices, along with lower interest rates, farcically claiming that he knows better on monetary policy than Fed Chair Powell. A failed real estate developer, or a pragmatic policymaker who shepherded the economy through the most tumultuous time since the Great Depression? I know who I’d rather have setting the fed funds rate.

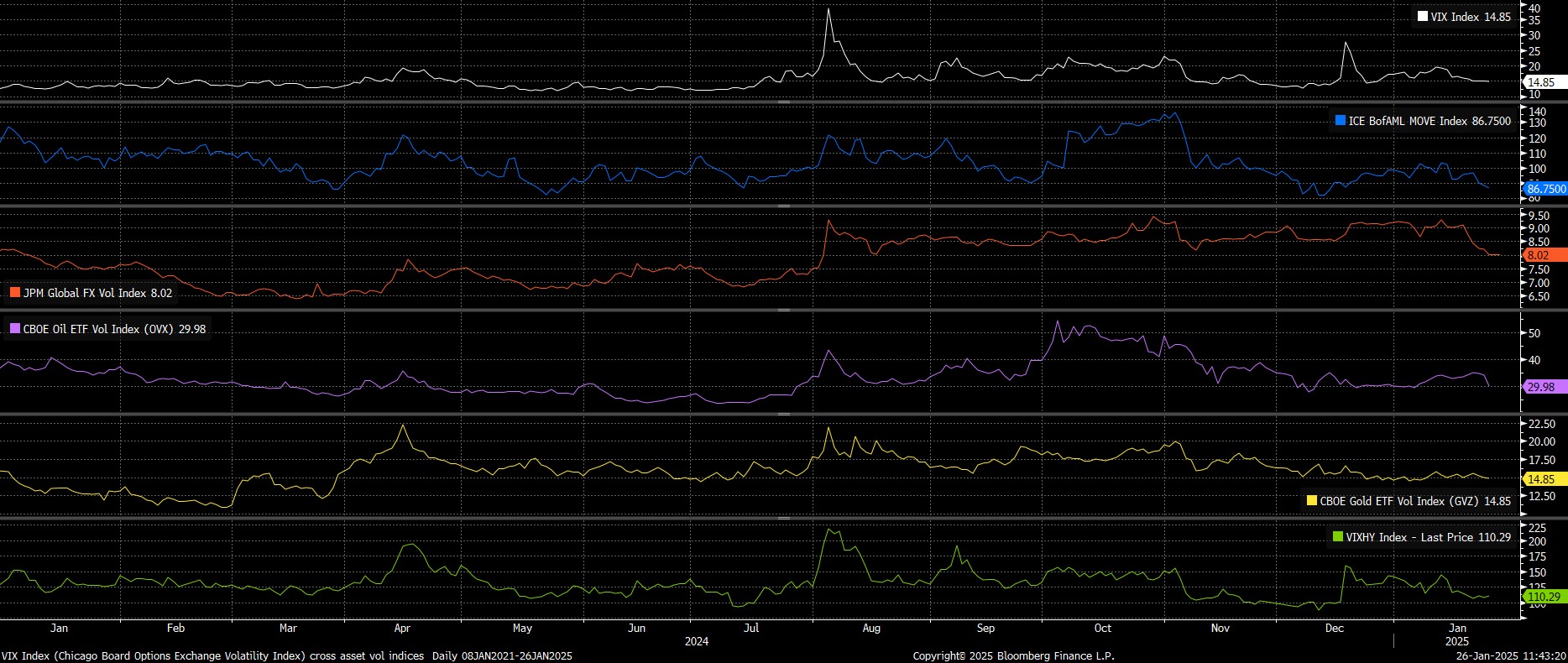

Anyway, the nub of all this is that – so far – Trump’s ‘bark’ has proved considerably worse than his ‘bite’, leading to some degree of relief for market participants, and seeing implied vols back away from pre-election highs across the board.

That said, it still feels too early to sound the ‘all clear’ on the Trump-risk front, and markets perhaps run the risk of becoming a little too complacent, over-extrapolating from the lack of concrete trade action in week one to assume that issue is no longer one of concern. Of course, that would be a foolish assumption to make.

The other impact of the lack of significant week one action is to have caused a degree of market paralysis. Not only are participants finding it difficult to discount a future policy path, when said path isn’t clear whatsoever, there is also a general reluctance, and lack of conviction. Nobody wants to be the one who puts on a trade, only to find that the market has moved adversely while they were away from the desk due to a Trump social media post. Understandably, folk would rather wait for increased certainty, with the current stasis likely to persist until that is obtained.

Away from the political sphere, a few other talking points from the last few days spring to mind.

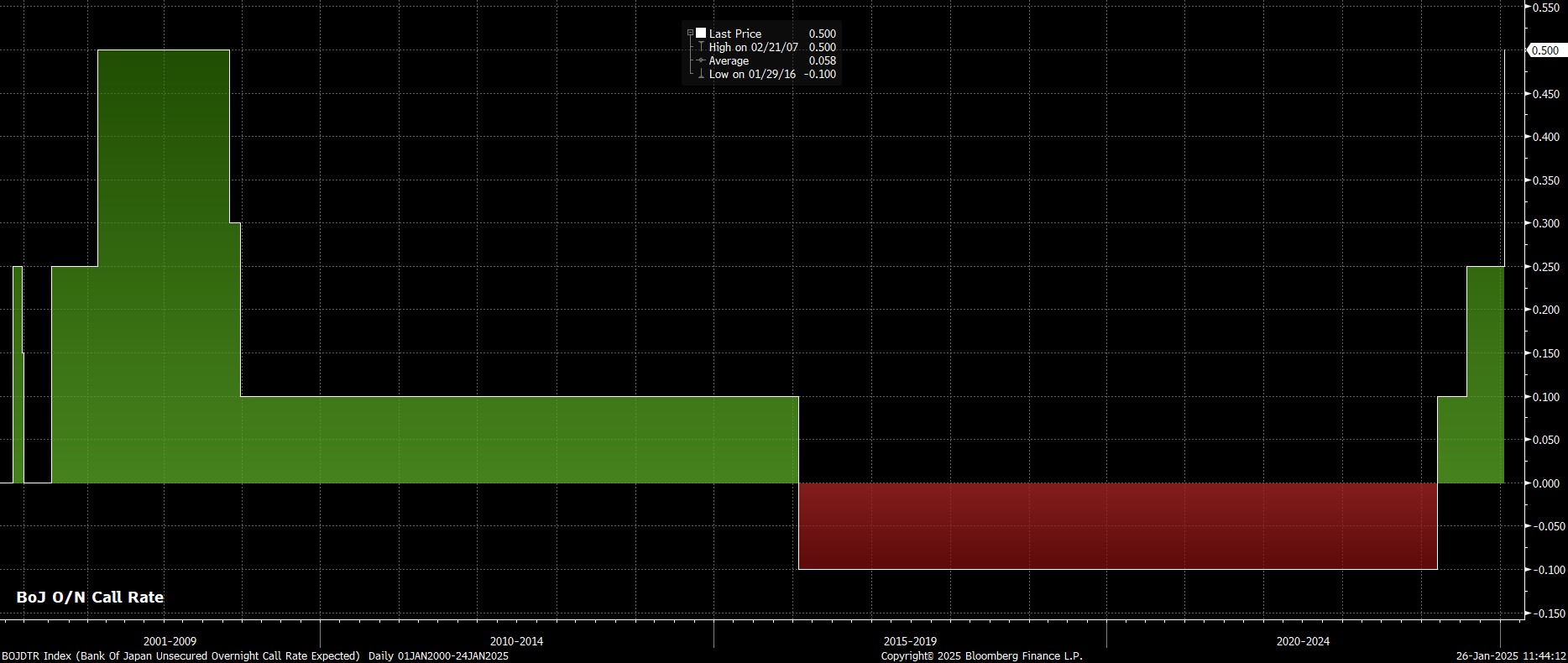

In the monetary policy world, the Bank of Japan – as expected – delivered a 25bp hike, doubling the policy rate to 0.50%, its highest level since 2008.

The move itself was unsurprising, given the inordinate amount of pre-meeting sources reports which had strongly suggested such an outcome would be forthcoming, with the accompanying policy guidance also providing little cause for surprise, as policymakers reiterated that further hikes will be delivered if the economy evolves in line with the BoJ’s forecasts. Governor Ueda, though, was somewhat more neutral in the post-meeting press conference, stressing that policymakers have ‘no preconception’ of when the next hike should be delivered, or how high rates may have to rise.

On a broader level, the BoJ’s continued tightening cycle, no matter how modest in nature, will likely raise some questions over the longevity of carry trades in 2025. Narrowing monetary policy divergence is bad enough news on its own, though that is likely to combine with higher volatility to create something of a ‘double-whammy’ to deter participants from said positions. While a carry unwind en masse isn’t the biggest risk to the global equity rally, it’s certainly something worth keeping on the radar.

Also in the policy space this week, the Norges Bank held rates steady, though reiterated that this cycle’s first cut is likely to be delivered in March, in keeping with prior guidance. A deluge of ECB speakers, meanwhile, reaffirmed that a 25bp cut remains on the cards this Thursday, with most, if not all, sticking to the script that policy remains on a data-dependent path, but that further easing remains appropriate.

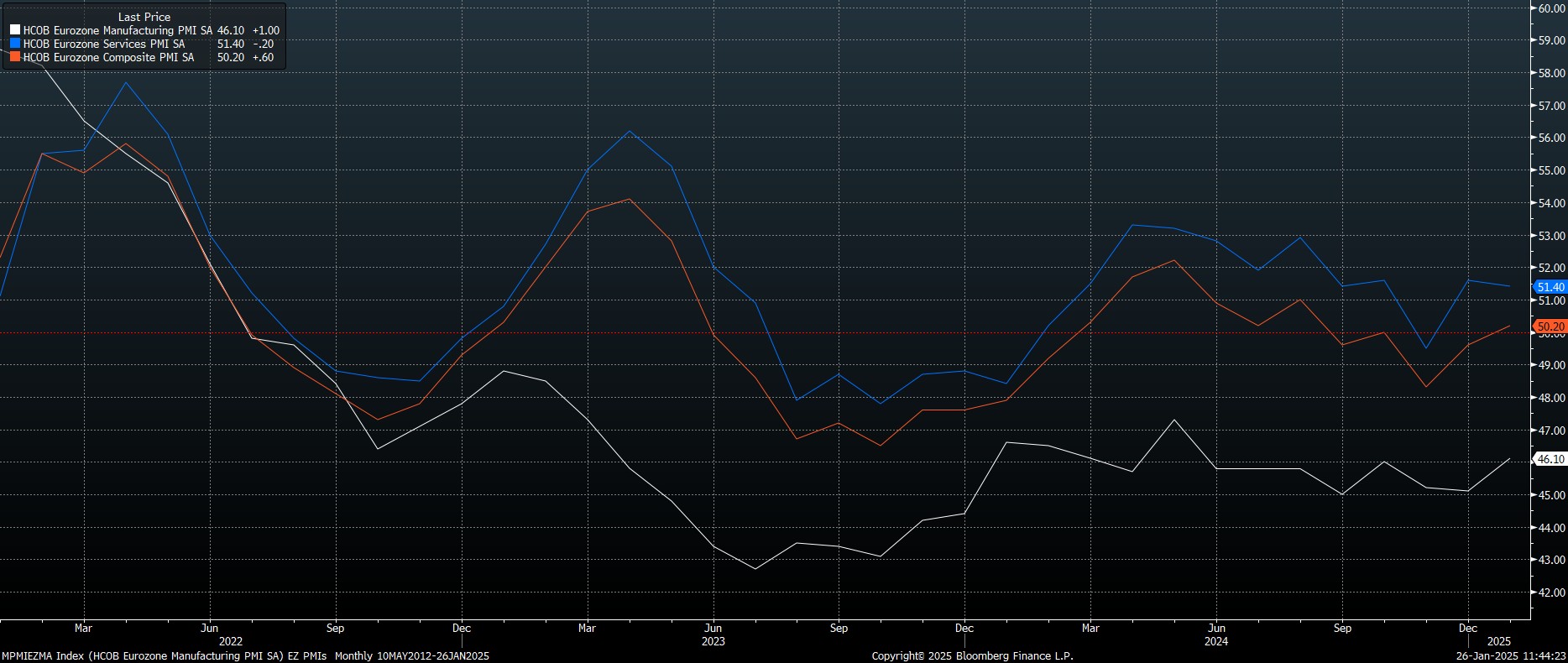

That said, Friday did bring something of a miracle for the eurozone, in the form of a slate of better than expected PMI surveys.

The composite output gauge unexpectedly rose back into expansionary territory, per the ‘flash’ January PMI print, as the index rose to a 5-month high 50.2. Of course, such a print is only narrowly above the breakeven mark, but the eurozone economy will celebrate any win these days, no matter how small – a little bit like Tottenham Hotspur fans, really!

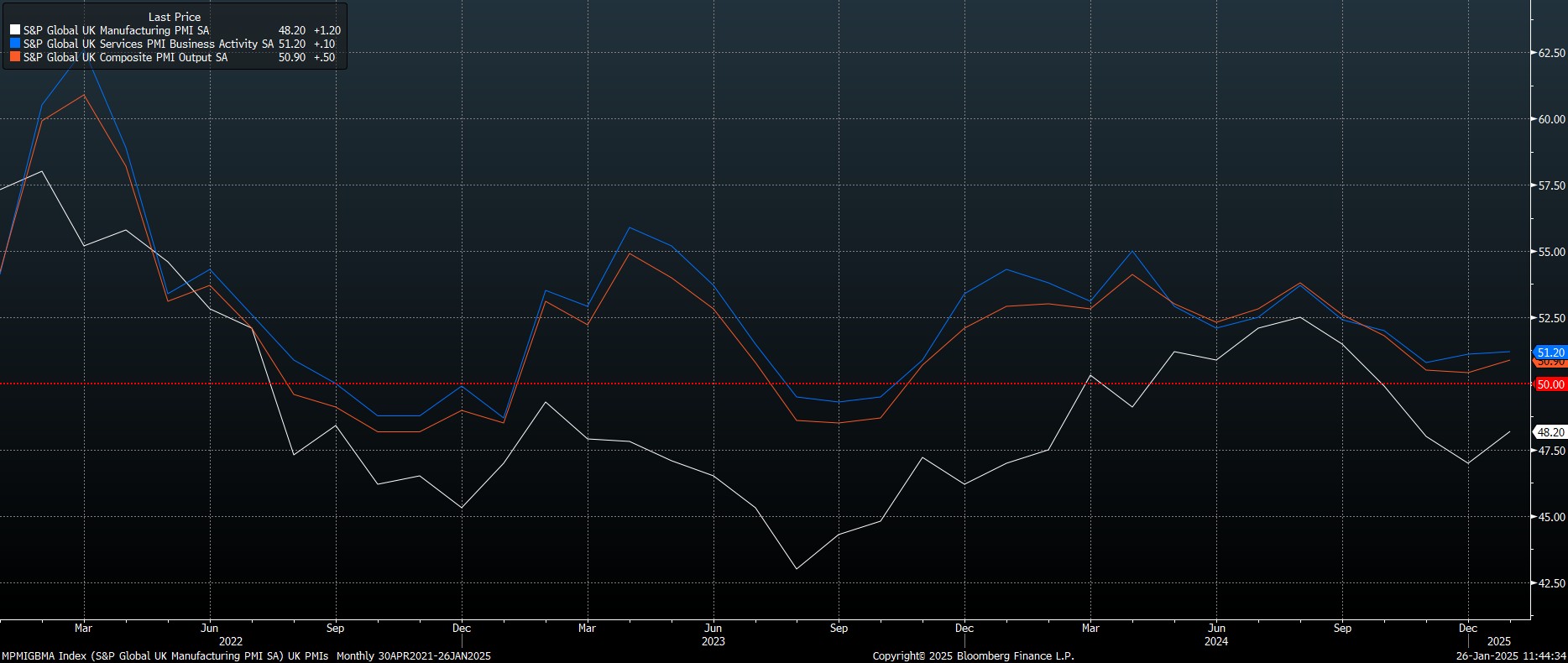

January’s UK PMI surveys, meanwhile, also delivered upside surprises across the board, with the manufacturing, services, and composite indices all rising to 3-month highs. That said, optimism was tempered by the report noting that, outside of the pandemic, the rate of job shedding in the UK economy was its fastest since 2009.

Chancellor Reeves can run around as many TV studios as she likes screaming about a ‘mission for growth’, but the truth of the matter is that October’s Budget has dramatically raised businesses’ costs, and is in fact only serving to choke off economic activity. Data out last week showed unemployment rose to its highest level since May towards the tail end of 2024, with a further rise in joblessness on the cards as the new year gets underway. There is still, frankly, little to like about GBP assets, or the stagflationary UK economy.

The Week That Was – Markets

Having said that, as the old adage goes, the stock market is not the economy.

Once more, markets proved that adage true last week – London’s FTSE 100 rose to a fresh record high, before paring gains; Germany’s DAX notched a third weekly gain, and a new all-time high; while the pan-European Stoxx 600 advanced for a fourth week in a row.

Similar gains were also seen on Wall Street, where the benchmark S&P 500 notched back-to-back weekly gains, and also chalked up fresh record highs in the process. Incidentally, the weekly advance was the market’s best first week of a presidential term since Reagan – an accolade that, I’m sure, the Oval Office’s current resident won’t hesitate to boast about.

More broadly, I still see the path of least resistance as leading to the upside on Wall Street, with solid economic growth, and resilient earnings growth, enough to power the market higher despite the comfort blanket of a ‘Fed put’ having been removed, and in spite of increased policy uncertainty under the new Administration. Though I remain a bull, a pivotal week of event risk and earnings lies ahead (see below), and it wouldn’t be entirely surprising to see a little position trimming into that bonanza.

Away from equities, the week saw some of the wind come out of the dollar’s sails, as the greenback slipped almost 2% against a basket of peers, in the DXY’s worst week since the tail end of 2023. This seemed a relatively straightforward ‘buy the rumour, sell the fact’ reaction to Trump’s initial days in office which, as mentioned earlier, were not as market-negative as participants had feared.

All other G10s gained ground against the greenback, with cable touching its best levels in a fortnight, the EUR testing the 1.05 figure to the upside after Friday’s solid PMIs, and a decent recovery also seen elsewhere in the AUD, the NZD, and the CAD.

I would caution, though, that a large chunk of the USD’s softness last week seemed to be driven by longs trimming exposures, and taking profit on positions, as opposed to a dramatic shift in sentiment. Options markets, for example, point to a continued bullish USD undertone, with risk reversals seeing other G10 puts continuing to trade at a sizeable premium to calls, implying increased demand for upside USD protection.

For what it’s worth, this is a view that I agree with, as the US exceptionalism macro narrative looks set to continue, as US economic growth continues to vastly outpace that of peers, and as the FOMC adopt a considerably more hawkish stance than their G10 counterparts. I continue to find it tough to bet against the buck, and would be buying dollar dips for the time being.

Meanwhile, Treasuries spent most of last week stuck in that aforementioned rut, with participants lacking conviction both as a result of the Trump-linked uncertainty, but also ahead of a chunky week of supply, and of course the upcoming FOMC decision.

The commodities space, though, was considerably more volatile, as WTI crude notched its worst week since last November, and Brent pulled back below $80bbl once more. These moves have less to do with Trump’s push for OPEC+ to lower oil prices, and much more to do with concern that the “drill baby, drill” plan for US producers will collide with a still-dire demand outlook to create something of a perfect storm to force prices lower. Further downside seems the most probable outcome here.

In contrast, gold continues to glimmer, with the yellow metal having last week notched a 4th straight weekly advance, to now trade within $15 of the prior record highs set last October, in the spot market at least.

What’s perhaps most interesting about this move, though, is how it has gone rather ‘under the radar’, with mentions of the yellow metal in news stories running around 30% below the level seen last time a record high was set. While this is a somewhat crude measure, it suggests that positioning is perhaps a little light, and that sentiment is by no means over-exuberant, in turn pointing to a break of those all-time highs likely being on the cards, particularly as uncertainty remains elevated.

The Week Ahead

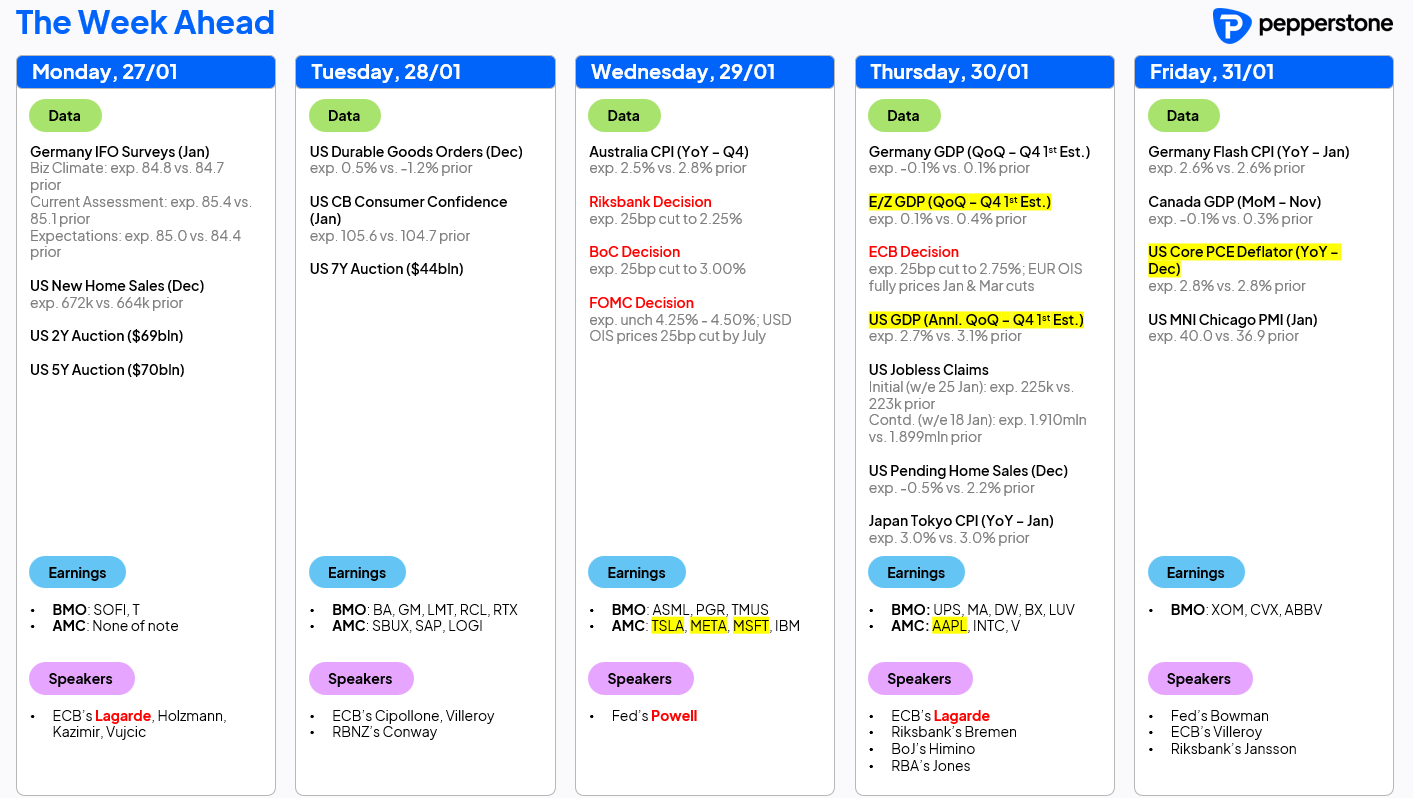

A risk event bonanza lies ahead over the next few days, with the week ahead calendar giving no shortage of themes for participants to get their teeth into.

Of course, policy decisions will likely take centre stage, with both the FOMC and ECB, along with the Riksbank and BoC, making their first announcements of the year.

The FOMC are set to hold the target range for the fed funds rate steady at 4.25% - 4.50%, ‘skipping’ the January meeting to take stock of the impact of the 100bp of cuts delivered last year, and also to assess how President Trump’s initial policy moves may impact the economic outlook. Of course, the resilient nature of the US labour market, as well as continued albeit bumpy disinflationary progress, has given policymakers the flexibility to stand pat for now. Though concrete guidance on the outlook will likely be lacking, with a data-dependent approach to be followed throughout the first quarter, participants will be seeking to gauge the likelihood of a January ‘skip’ turning into a more prolonged ‘pause’.

In contrast, the ECB show no sign of pausing the easing cycle any time soon, nor can they afford to, as downside growth risks continue to mount, political uncertainty remains rife in both France and Germany, and as the probability of inflation undershooting the 2% target grows. Lagarde & Co, hence, will deliver a 25bp cut this week and, although policymakers will stress that no ‘pre-commitment’ to future moves is being made, continue with further such cuts until the deposit rate is back at a more neutral level (2.00% - 2.50%).

The Bank of Canada and the Riksbank will also continue their own easing cycles this week, each delivering 25bp cuts, with the respective policy guidance likely to maintain a bias towards further cuts in the coming months.

Away from monetary policy, a busy week of economic data awaits, with particular attention likely to fall on the first estimate of Q4 GDP growth due from both the US and the eurozone. The figures, though, are likely to re-affirm what we already know, namely that the US economy continues to outperform, and that the eurozone economy continues to stagnate.

Other notable releases this week include CPI from Australia and Germany, as well as PCE inflation figures from the US. Furthermore, this week’s US continuing jobless claims print pertains to the January NFP survey week.

Last, but by no means least, a busy week of corporate results awaits, with 102 S&P 500 constituents set to report over the coming five days. Naturally, most attention will fall on reports from members of the ‘Magnificent Seven’, with Tesla (TSLA), Microsoft (MSFT), Meta (META), and Apple (AAPL) all due to report. Combined, these names have an 18% weighting in the S&P, and an even chunkier 24% weighting in the tech-heavy Nasdaq 100, likely leading not only to these results causing substantial post-release volatility, but also to them having an outsized impact on risk sentiment more broadly.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.