Analysis

September 2024 FOMC Preview: Time To Cut

As mentioned, the FOMC are set to reduce the target range for the fed funds rate by 25bp at the conclusion of the September meeting, bringing rates to 5.00% - 5.25%, in what is set to be the first rate cut since March 2020. Money markets, per the USD OIS curve, fully price such a move, while also seeing around a one-in-three chance of a larger 50bp cut, with dovish bets on a jumbo reduction having been spurred by recent softer-than-expected nonfarm payrolls figures. Nevertheless, the FOMC’s decision to cut by 25bp this time around is likely to be unanimous.

Given the near-certain rate cut, the policy statement is likely to see some significant alterations from the language which has now become familiar to market participants. There is unlikely, however, to be any concrete guidance within the statement, or absolute pre-commitment, on the future policy path.

Instead, the statement is likely to reaffirm that policymakers will follow a data-dependent approach when determining future policy adjustments, continuing to base their judgement on an assessment of ‘incoming data, the evolving outlook, and the balance of risks’. On that latter note, the statement is likely to flag that risks to each side of the dual mandate – price stability, and maximum employment – are now balanced, while probably also adding that the FOMC’s “strong commitment” to returning inflation to target, now also extends to ensuring that full employment is maintained.

Financial markets, however, may prove to be somewhat disappointed by the lack of concrete policy guidance. This is especially true when considering the aggressively dovish rate path that is currently discounted by the USD OIS curve, which prices over 100bp of cuts this year, and a total of 235bp of cuts by next July.

The key debate here appears not to be one of whether the Fed will deliver a 25bp, or a 50bp, reduction in September, but instead centres around the pace at which the fed funds rate will return to a more neutral setting. Most estimates see the neutral rate, in nominal terms, at around 3%, leaving 200bp of easing to be delivered before such a level is achieved.

Markets, for now at least, appear to be in the ‘hurry up and get on with it’ camp, given the aggressive pace of easing that the curve currently implies. Other G10 central banks have, thus far, taken a ‘slow and steady’ approach to removing restriction, with most delivering a cut once per quarter. Any firm answers as to which path the FOMC will plot are unlikely to be delivered just yet, with Powell & Co. instead likely wanting to walk a tightrope between the two, providing as much policy flexibility as is possible.

Of course, the September FOMC also brings with it the latest Summary of Economic Projections, which is likely to contain some notable revisions to the prior forecasts, published back in June.

For markets, the updated ‘dot plot’ is likely to be of most interest. At present, the median dot points to just 25bp of easing being delivered this year, followed by a further 100bp of cuts in 2025. This time around, the median dot will likely point to 75bp of cuts this year – broadly ‘marking to market’ the FOMC’s expectations – followed by a further 100bp of cuts in 2025, leaving the fed funds rate at 3.00% - 3.25%, its neutral level, by the end of next year. The longer-run dot is likely to remain unchanged, at 2.75%.

For markets, the key focus from the dots will not be solely on the median rate path, but also on the dispersion of the dots around this path, which is likely to be relatively wide, and can be taken as a proxy for the high degree of uncertainty among FOMC members as to the appropriate policy path over the medium-term.

Meanwhile, the FOMC’s other economic projections are also likely to be revised.

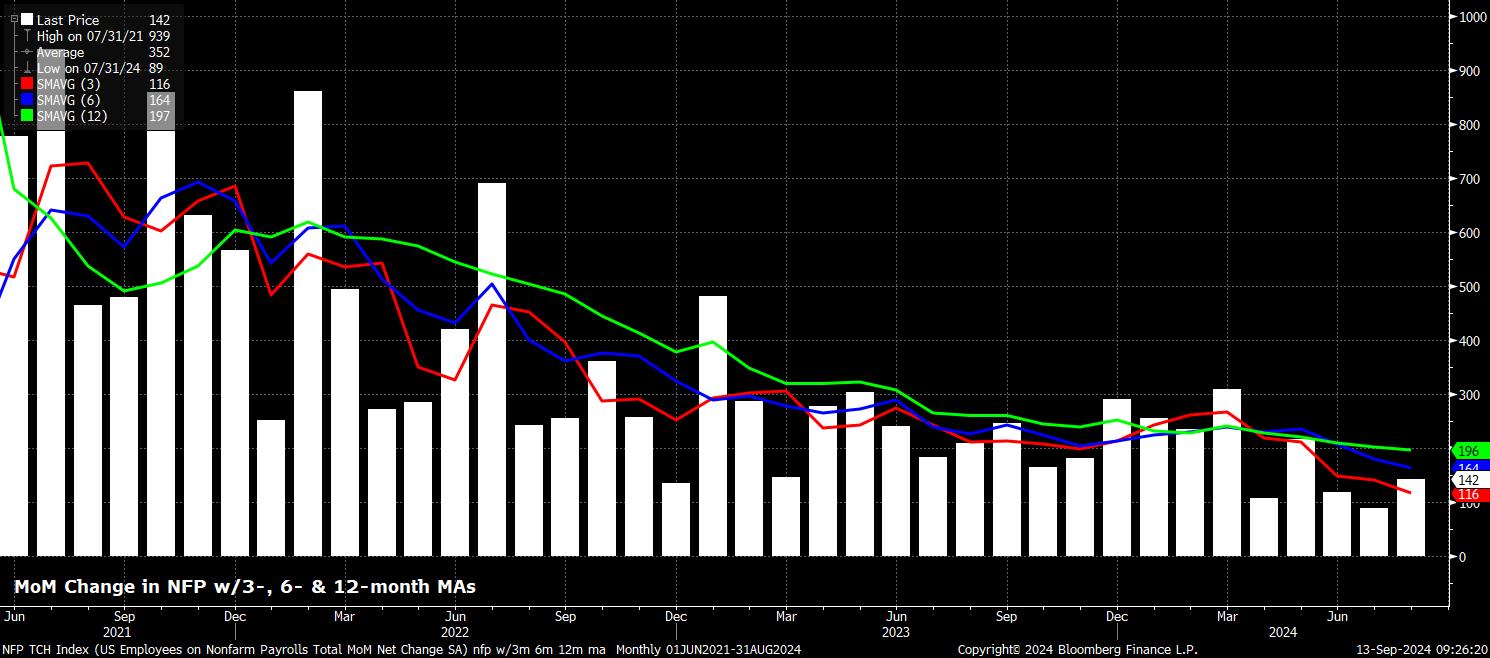

The labour market has continued to lose momentum of late, with the pace of headline nonfarm payrolls growth continuing to moderate, as the 12-month moving average of job gains has fallen below 200k for the first time this cycle, and unemployment ticking higher, having risen to 4.3% in July, its highest level since October 2021, before pulling back a touch to 4.2% in the August report.

The Committee are, hence, likely to upwardly revise expectations for unemployment this year, probably in line with the August figure, while keeping projections unchanged further out along the forecast horizon, given a desire among policymakers to prevent any significant further weakening in the labour market.

Turning to the inflation outlook, progress in returning price pressures has been somewhat quicker than expected. Headline CPI rose by 2.5% YoY in August, its slowest annual increase in over three years, while core and supercore inflationary pressures have also continued to ebb. At the same time, the Fed’s preferred PCE inflation metric has also continued to fall, having risen by 2.5% YoY at a headline level, and 2.6% YoY on a core basis, in July. Per recent remarks, policymakers have indeed now obtained adequate confidence in inflation returning to the 2% target in order to begin to normalise policy.

As a result of the quicker progress made in bringing inflation back under control, forecasts are likely to be revised 0.1pp – 0.2pp lower across the horizon, though it seems unlikely that policymakers would pencil in an undershoot of the inflation aim at this stage.

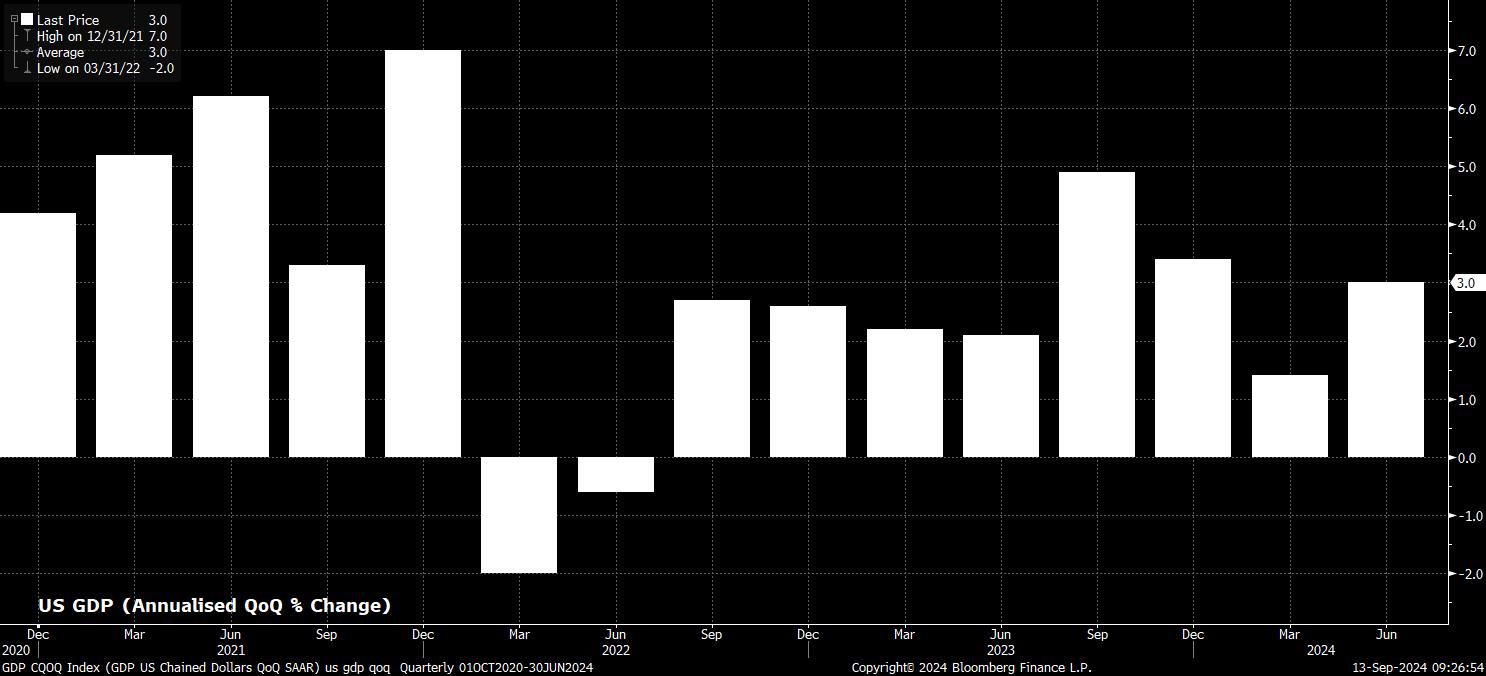

Finally, on growth, the Committee’s expectations may be revised a touch higher, at least for this year, given the continued resilience shown by the US economy. Not only has the economy grown at an annualised rate in excess of 2% in seven of the last eight quarters, leading indicators point to such a pace being maintained in the third quarter, with the Atlanta Fed’s GDPNow model tracking growth at around 2.5% for the three months to September.

At the post-meeting press conference, Chair Powell is likely to try and play most journalists’ questions with a ‘straight bat’, refusing to pre-commit to the size, or pace, of further rate reductions. More broadly, Powell’s remarks are likely to echo those given at the Jackson Hole Symposium a month ago, noting that confidence in inflation returning to 2% “has grown”, and that policymakers “don’t seek or welcome” any further labour market cooling.

For financial markets, the September FOMC will be a tricky risk event to navigate, and is likely to cause significant knee-jerk volatility over the release, given the one-in-three chance that money markets still assign to the possibility of a larger 50bp move. A more hawkish-than-expected cut, and accompanying statement, would likely spark significant USD demand, while also pressuring both equities and Treasuries.

That said, over the longer-term, what matters for participants, and particularly for equities, is not what the Fed will do next, but what they have the ability to do if so required. In other words, with 500bp of room to reduce rates, plus the ability to further slow or even end quantitative tightening, policymakers are in a position to provide significant support, and liquidity, if it were to be required – the very essence of the ‘Fed put’. Of course, with risks to the dual mandate now back in balance, that ‘put’ has become even stronger, with the Fed now prepared to respond forcefully to prevent any further labour market weakness.

This, then, should continue to provide a backstop to sentiment over the medium-term, keeping equity dips relatively shallow in nature, and seeing the ‘path of least resistance’ continue to lead higher, as investors remain comfortable to reside further out on the risk curve.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.