Analysis

January 2025 ECB Preview: Plenty More Cuts To Come

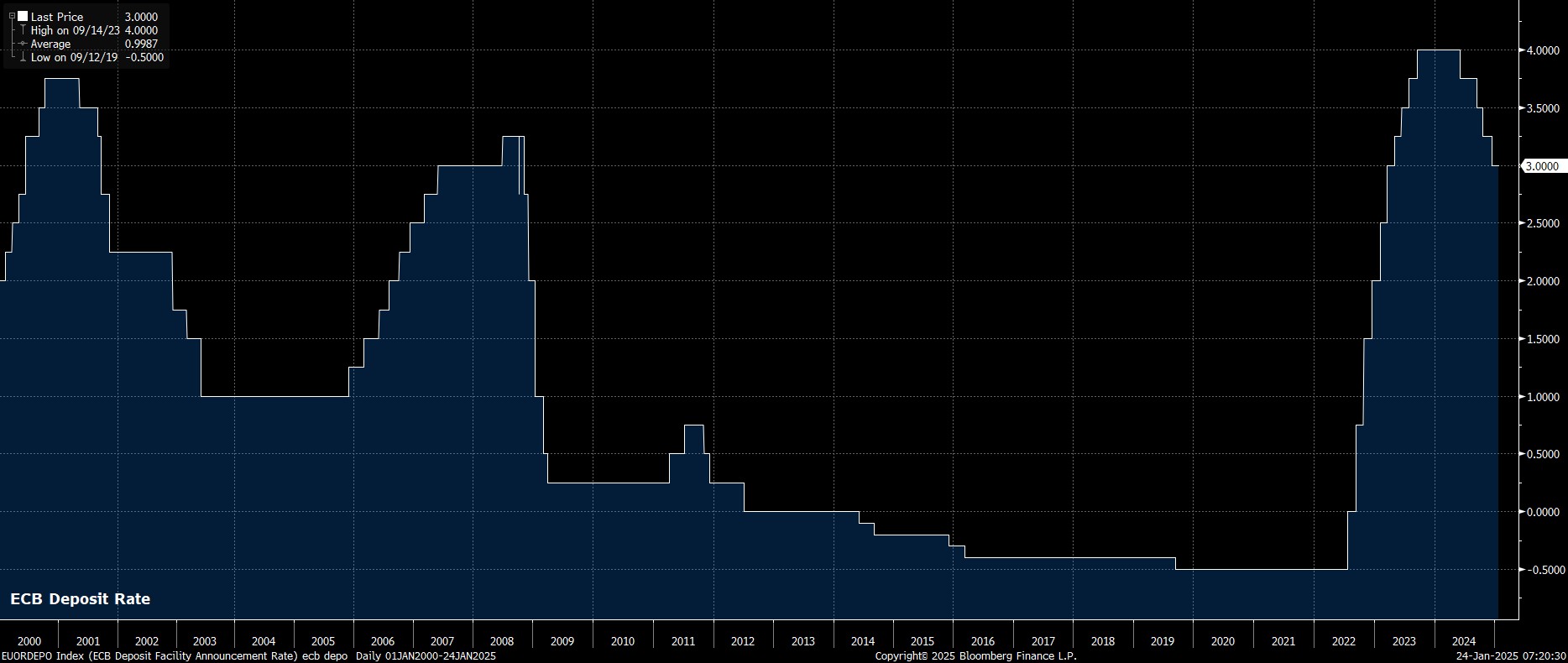

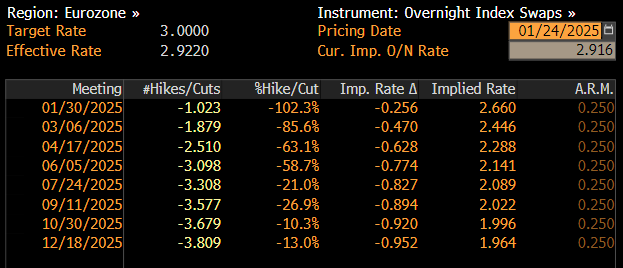

As mentioned, the ECB’s Governing Council are set to deliver a 25bp cut at the conclusion of the January meeting, lowering the deposit rate to 2.75%, in what will mark this cycle’s fifth rate reduction. The EUR OIS curve fully discounts such a cut, while also almost fully pricing another 25bp step lower at the March meeting, when updated staff macroeconomic projections will also be released.

Though a formal voting record is not published, it seems likely that the decision to deliver a 25bp cut will be a unanimous one, with no significant overtures towards standing pat, or delivering larger moves, having been evident from recent policymaker speeches. That said, with sources reports having indicated that a larger 50bp move was discussed at the December confab, it’s logical to expect such a move to again feature on the agenda this time out, even if Lagarde & Co are ultimately likely to plump for a more modest reduction.

In any case, accompanying the rate decision is likely to be a reiteration of the Governing Council’s extremely familiar forward guidance. Consequently, the policy statement will stress that a ‘data-dependent, meeting-by meeting approach’ will continue to be taken when it comes to future rate decisions, with policymakers also likely to reiterate that they are making no ‘pre-commitment’ to a particular course of policy action. Still, money markets discount just over 100bp of easing between now, and year-end.

Said magnitude of cuts would, if delivered, see the deposit rate end the year at the bottom of the reasonable range of estimates for the neutral rate within the eurozone, which stands between 2% - 2.5%.

That, in fact, is likely to be the key discussion among Governing Council members as 2025 progresses, whether or not economic conditions allow the deposit rate to remain within that neutral range, or whether risks are significant enough that a move into outright ‘easy’ territory, and further cuts beyond neutral, proves necessary.

As has been the case for some time, risks to the eurozone economic outlook remain firmly tilted to the downside. Domestic uncertainties persist, with both Germany and France remaining politically rudderless, and with the former likely to experience prolonged coalition negotiations in the aftermath of February’s elections. Furthermore, geopolitical risks, to which the bloc remains highly exposed, rumble on, with conflict continuing in Ukraine, and in the Middle East.

Further afield, China’s economy continues to sputter, showing little sign of a sustained recovery, which will continue to pose headwinds to the bloc’s economy, particularly the luxury goods sector. Though Chinese activity indicators picked-up towards the end of last year, much of this was likely due to overseas firms ‘front-running’ the potential imposition of tariffs by President Trump.

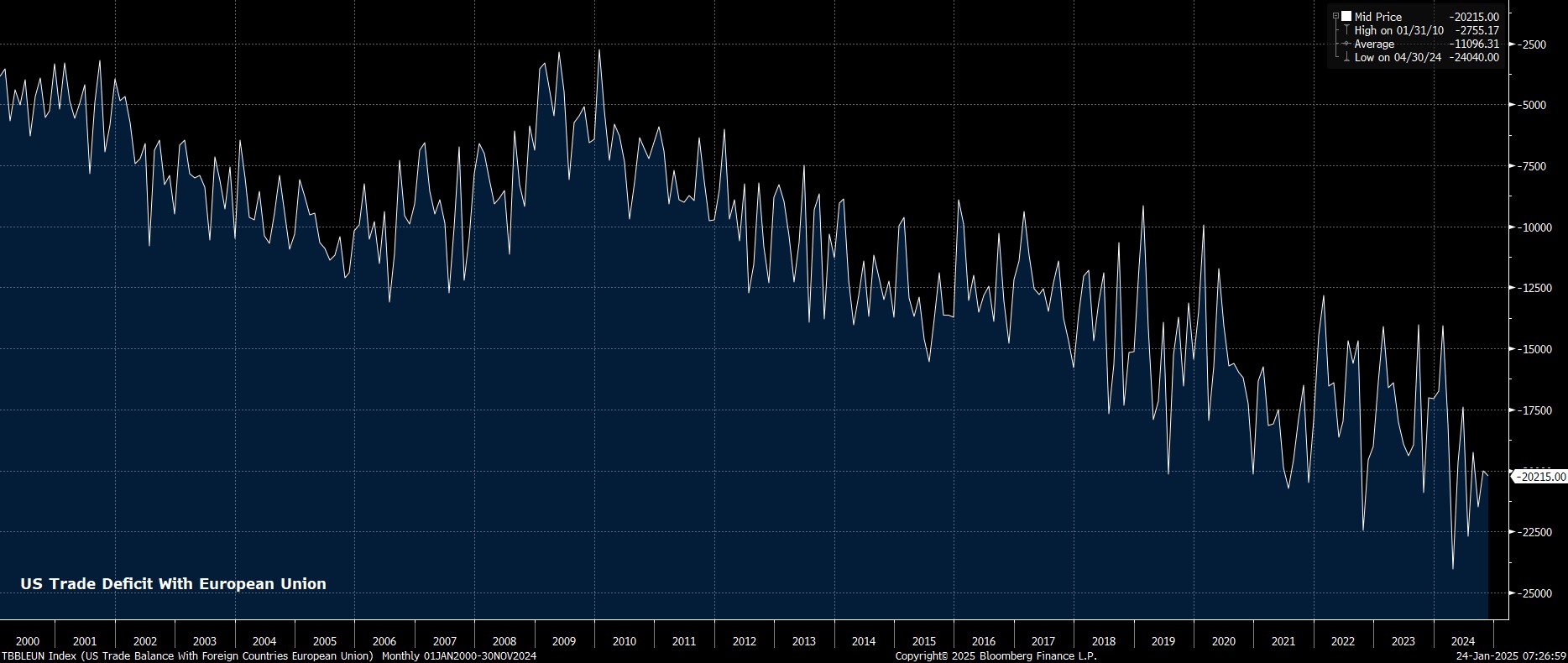

Speaking of which, although Trump’s initial days in the Oval Office have seen a somewhat more conciliatory tone than had been expected, particularly on the issue of trade, it remains likely that tariffs will be imposed on the European Union at some stage. Said tariffs will, if they arrive, be a further stiff headwind for the economy to battle.

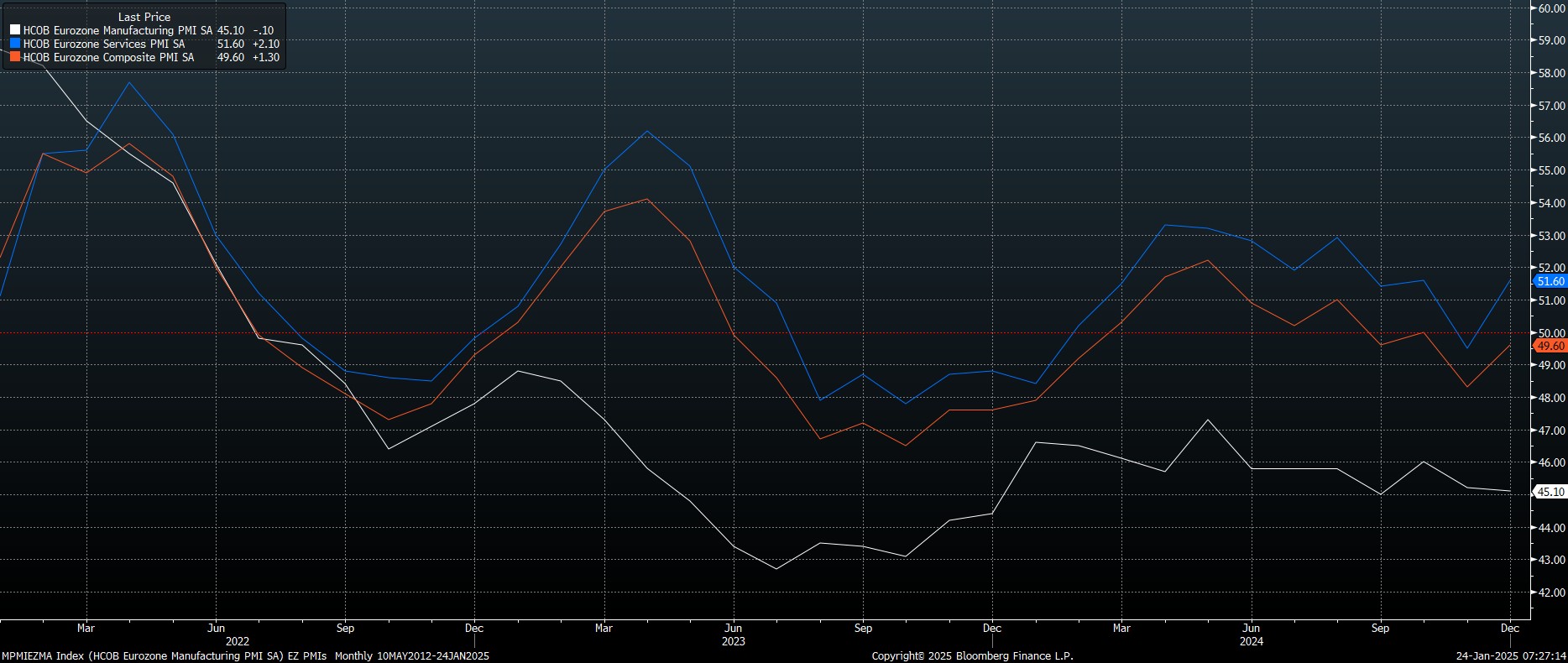

Of course, even before said tariffs arrive, eurozone economic momentum remains lacklustre. The most recent round of PMI surveys pointed to a continued contraction in overall economic output as last year drew to a close, with the manufacturing sector continuing to contract at a rapid pace.

Consequently, GDP growth of – at best – 0.2% QoQ is likely to have been recorded in the final three months of 2024, with even that anaemic pace of expansion likely to prove difficult to achieve this year.

Though the growth outlook remains dour, inflation metrics have picked-up in recent months. Headline CPI rose 2.4% YoY in December, the second straight monthly increase in price pressures, and the highest such reading since July.

That said, policymakers are, by and large, likely to look through this recent rise in headline inflation, with much of the increase driven by base effects, and by higher energy prices. Instead, Governing Council members will likely seek solace in core CPI having held steady at 2.7% YoY, and core CPI remaining at 4.0% YoY, implying little by way of more intense underlying price pressures.

While the risk of sustainably undershooting the 2% inflation aim seems relatively low for now, more rapid disinflation in the aforementioned metrics of underlying price pressures would likely raise such a possibility, in turn potentially sparking a more serious debate among policymakers over the potential for moving in larger clips, though that is a matter for the spring, and not now.

In the here and now, President Lagarde’s January press conference is unlikely to be particularly ground-breaking with its contents. While it will be interesting for participants to gauge both the unanimity around the January decision, as well as whether a larger rate reduction was under discussion, Lagarde seems highly unlikely to pre-commit to any course of policy action, and is unlikely to offer concrete guidance, either on the future path for interest rates, or the economy, given the uncertainty stemming from potential upcoming changes to US trade policy.

As has been the case for some time now, we seem likely to gleam more by way of clarity from any post-meeting ‘sources’ reports, a deluge of which is likely once the presser draws to a close.

Looking ahead, the base case remains that the ECB will deliver 25bp cuts at every meeting, until policymakers believe they have reached the midpoint of the neutral rate range, likely early in the second quarter. At that stage, were downside growth risks to have intensified, and the probability of undershooting the inflation target risen, further cuts into ‘loose’ territory would be on the table. Larger rate reductions, though, seem not to be on the table for now, being held in reserve by policymakers for the time being.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.