Analysis

However, while the VIX fell 6.6 vols, it's still above 20% and elevated and this is a fickle market - I don’t trust it one bit. It’s prudent to start small and add when the price starts to find further bullish flow.

I also don’t think a rising tide lifts all ships and one needs to be selective in one’s approach to taking on risk – the US and Australia seem logical places to express a more positive bias – while taking a less constructive view in countries where lockdowns are being (or could be) implemented.

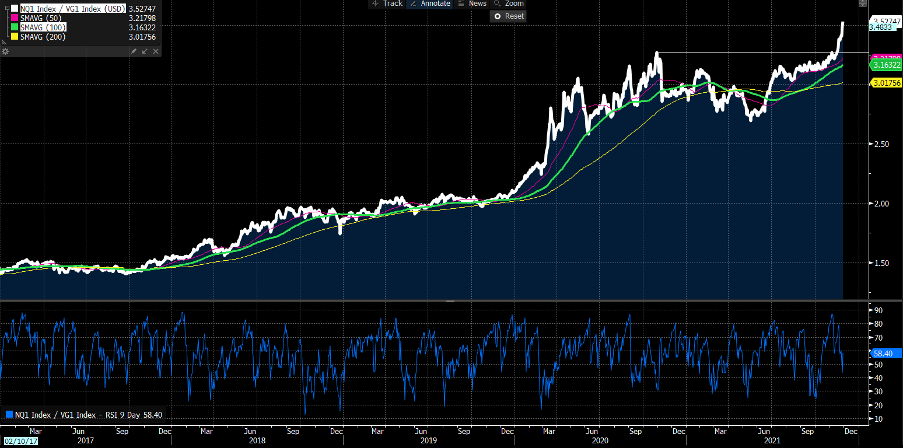

Long NAS100 and short EU Stoxx ratio

(Source: Bloomberg - Past performance is not indicative of future performance.)

I can look at this as a straight long, or through a market-neutral (long/short) approach – Look at the long NAS100 (or US500) and short EU Stoxx ratio. It's roaring ahead here and I think there's more juice here – here’s the basic math involved in long and short strategies – if we want to get technical, we can beta weight the legs, but I've just looked at a strategy long and short idea and FX adjusted

Crypto is a good vigil on risk – I see it as a high beta risk asset and momentum vehicle, and we’re seeing good buying activity here, although it's not overly aggressive by any means. In the majors, Bitcoin looks solid and maybe this is a feel on broad sentiment, while MicroStrategy (MSTR) might be worth putting on the radar – it's having a solid day and forms support on both the 100 and 200-day MA (Moving Average).

I like the feel of the moves in the NAS100 – we made a higher low and have recouped Friday’s sell-off in the cash and nearly in the futures (which is what our cash market is priced off) – a closing break of 16,420 would suggest we revisit the ATHs. It's not far off now. Perhaps a bit more volume through cash trade would have been good, although poor volume this isn’t the case in the US500 where cash volumes are 22% above the 30-day average, and 1.92m S&P500 futures have traded.

Europe has not seen the sort of bounce I’d have liked either and it's not surprising as there's still so much to work through. In the US, headlines that Biden is ruling out shutdowns through the winter is helping and again we may be playing relative Covid trends in markets, and the US looks the best house in the neighbourhood here.

I would have liked a better feel on Crude

Granted, a 2.2% rally is obviously a positive if you bought Fridays close or early enough on Monday, but the highs were literally the 50% retracement of Friday's high-low range and sellers have rejected this quite aggressively. A break of Friday’s low of $67.40 would likely lead to negative flows in FX and equity markets too and suggest going straight into long JPY positions vs CAD and NOK.

We watch the big pharma names, with Moderna (+11.7%) having another flyer. If Omicron is going to challenge Delta, then Moderna is testing three boosters for its efficacy and the market see Moderna as the top play here. AstraZeneca closed -0.5% but are also in the process of obtaining the necessary data and as the full suite of big pharma have been anticipating mutations to come along.

So, in one camp you have buyers of risk in the hope that when we do get ever clearer intel the current vaccines will hold up and high vaccinations rates mean the barriers to lockdowns are sufficiently high that it may only modestly impact economics, if at all. In this case, we’re back on to watching the improving US data flow and whether the Fed accelerates its QE program, even open the door to hikes in 2022 at the mid-Dec FOMC meeting.

In the other camp, one could also argue that if the Omicron starts to impact consumer behaviours the Fed should take the path of least regret and halt increasing the pace of tapering its QE program until it gets clarity. Some have already argued that the big debate around policy normalisation has been pushed back by a couple of months given we’re playing the waiting game.

Early signs are that the hawks within the Fed’s ranks are not swayed by Omicron – however, they've made it perfectly clear in the November FOMC statement that Covid trends remain their dominant concern and will react accordingly to new findings. If there's any hint that Omicron will impact consumer behaviour, even in the absence of lockdowns, the market knows the core of the Fed will keep QE unchanged and pumping at the same rate.

We’ve already seen the response in the UK, with a 15bp hike in mid-Dec now priced at 57% and GBP is one of the weaker currencies out there in G10 FX. Selling GBP isn’t without risk, but short GBPUSD works as a loose hedge against NAS100 upside and looks compelling both from a fundamental and technical perspective and would stop out on a close through 1.3365. Again, start small and add through 1.3279.

For now, I like US stocks from the long side but prefer to do so as market-neutral (long and short) strategies – but I'm watching Crude closely and this is a market that could easily turn as headlines roll in. This is a fickle market and could turn at any stage – being nimble will serve us all well.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.