Analysis

For a while now, I’ve been harping on about how equities should remain underpinned amid the supportive policy backdrop, with market participants content to increase their exposure to riskier assets safe in the knowledge that the return of inflation towards the 2% target means that the ‘central bank put’ is both back, and more flexible than ever.

In other words, G10 policymakers can cut rates when they want, by how much they want, and provide as much liquidity as needed, wherever it is needed, as a result of seemingly winning the battle against double-digit inflation that has been waged over the last couple of years.

At the same time, I’ve also flagged how the biggest risk to this view is that central banks don’t deliver the prolonged easing cycle, and return to neutral rates, that consensus heavily favours, and which markets continue to price.

Over the last couple of days, there have been a few notable developments hinting that the probability of this risk occurring has risen a touch.

Firstly, Fed voter Mester - who, admittedly, retires midway through the year - noted that she is considering raising her forecast for the long-run fed funds rate. In other words, shifting her rightmost ‘dot’ on the below plot higher.

This is significant, particularly if her thinking is mirrored by other FOMC members, as a higher long-run estimate (essentially a proxy for where the FOMC see neutral being) would naturally necessitate a shorter and shallower easing cycle to move to a less restrictive policy stance. In other words, the higher the long-run rate estimate, the fewer cuts need to be delivered for us to get there.

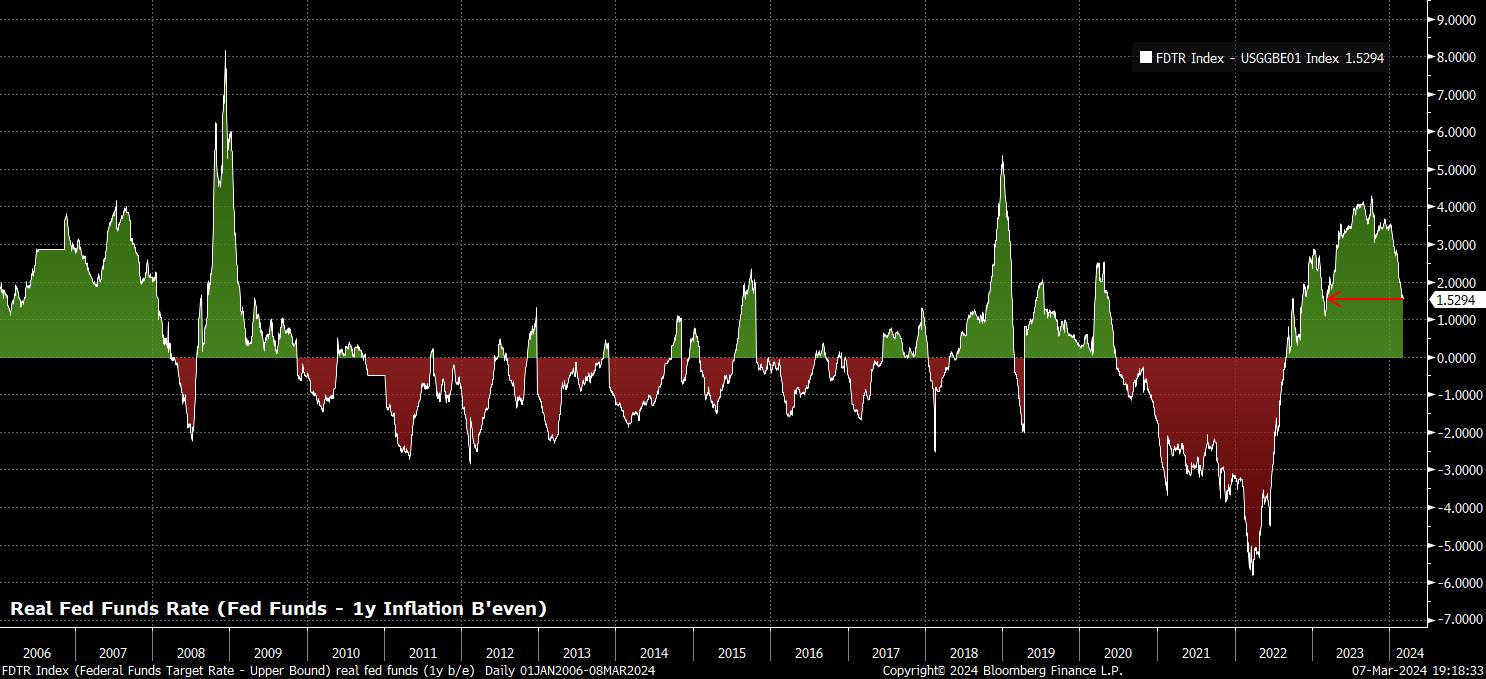

The second thing that has caught my eye is the real fed funds rate.

There are many ways of measuring such a concept, though Chair Powell’s preferred measure is to use the one-year inflation breakeven to perform the necessary adjustment. Using this measure, the real fed funds rate is at its lowest level in a year; by extension, making policy its loosest in twelve months.

Clearly, if policy is becoming looser, and the real fed funds rate is falling, there is less need, and likely significantly less desire, to begin to cut the nominal fed funds rate. If policy is becoming less restrictive without the FOMC doing anything, they are unlikely to want to add fuel to the proverbial fire by delivering a rate cut, particularly when certain corners of the market - e.g., crypto - are displaying signs of speculative frenzy and euphoria.

While these developments are notable, and risks that should remain on the radar, they are not enough for me to adjust my current base case that the path of least resistance continues to lead higher for risk.

However, a hot jobs report, and/or a hotter than expected inflation figure, will likely both serve to increase the risk that the Fed do not begin to refill the liquidity punchbowl quite as soon as markets would desire, while also raising the risk of a 25bp hawkish revision to the 2024 median dot at the March FOMC, in turn potentially being the catalyst for the next leg higher in the USD, and lower in Treasuries.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.