Voices calling for parity between the euro and dollar are growing louder as a number of factors align against the single currency. The Russia Ukraine conflict has been a serious drag on the euro area’s growth prospects via two conduits – 1) Higher oil prices and 2) reduced trade flows. The recent announcement of the oil embargo will only exacerbate the already high energy costs. The plan is to phase out Russian supply within 6 months and refined products by year end. Hungary and Slovakia have already pushed back against this. It also needs to be passed by the EU parliament, which remains to be seen. However, this is a significant step.

The Chinese growth slowdown is also in full swing (seeing this in the Yuan as it depreciates rapidly against the dollar) as the country follows a very harsh lockdown policy as covid plagues key economic hubs. Europe is reliant on China for a lot of its economic growth and this adds further to the ominous growth outlook ahead. US inflation data out on Wednesday could provide the euro with some temporary relief if the print misses expectations and confirms the belief by some that price pressures are peaking. The read on this would be dollar negative and a potential scepticism of the circa 200bps priced in through the end of this year.

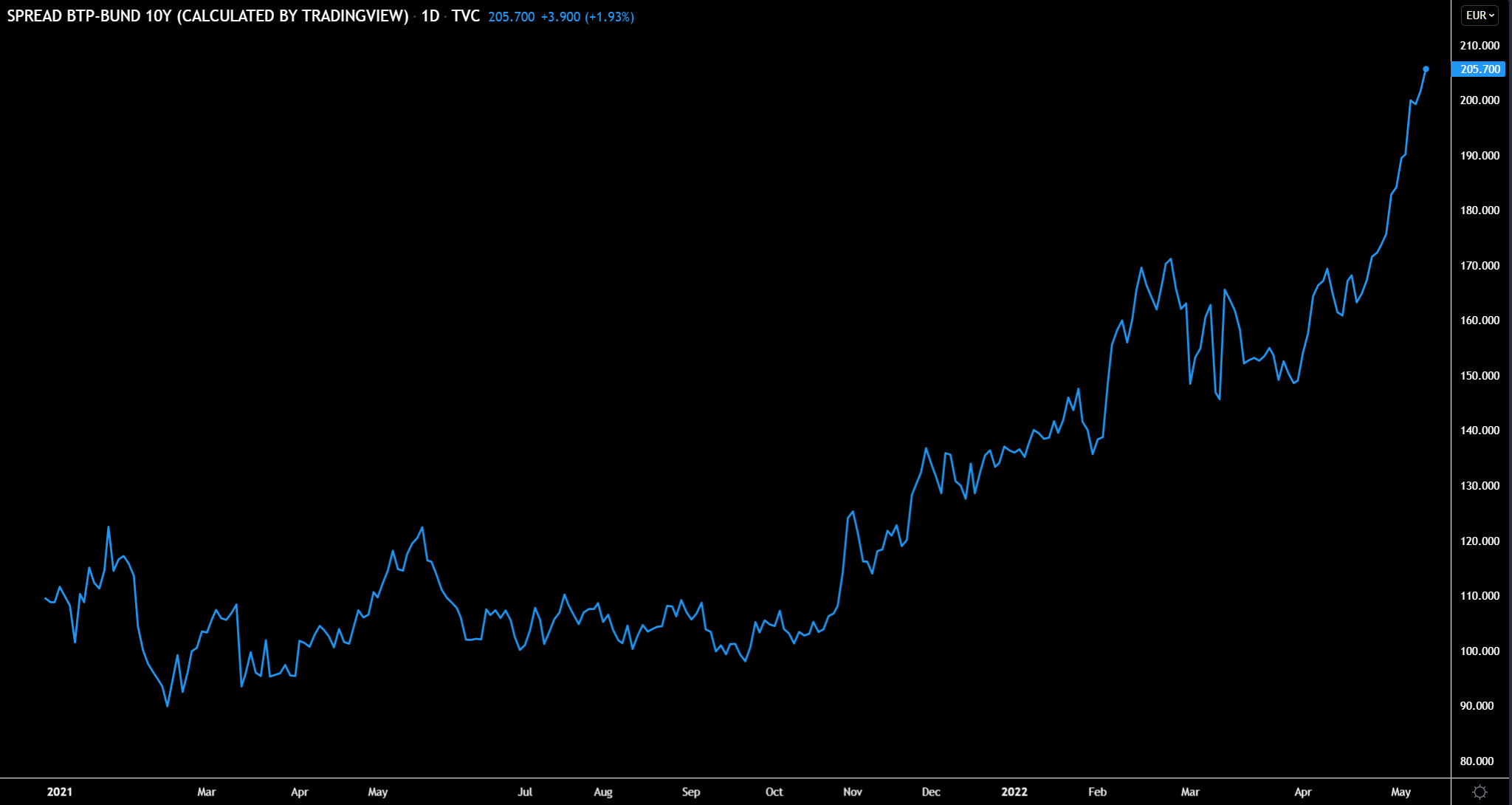

Positioning data for the euro flashes as only slightly net short. There is clearly scope for this to grow, which could add to the downside momentum. The BTP-Bund spread (difference between the Italian 10-year yield and German 10-year yield), a closely monitored financial indicator to measure the risks associated with the EU has breached the key psychological 200bps threshold. This comes at a bad time given the ECB are moving ever closer to tightening policy. A blowout in periphery spreads is the last thing they’d want to deal with.

(Source: TradingView - BTP-Bund Spread, Past performance is not indicative of future performance.)

Markets are currently pricing in just shy of a 22bps hike come July and 90bps by year end. One factor which could work in the euro’s favour is USD pricing coming off (given how hawkish it already is) while a hawkish pivot by the ECB could push ECB rate expectations in the opposite direction. This could improve the carry profile of the euro and help stem further weakness. This would also help to reduce the negative pile of eurozone debt and could see some send flows back towards the euro.

A breach of 1.05 is the next step on the road to parity - if this can hold then parity becomes less likely.

(Source: TradingView - Past performance is not indicative of future performance.)

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg)