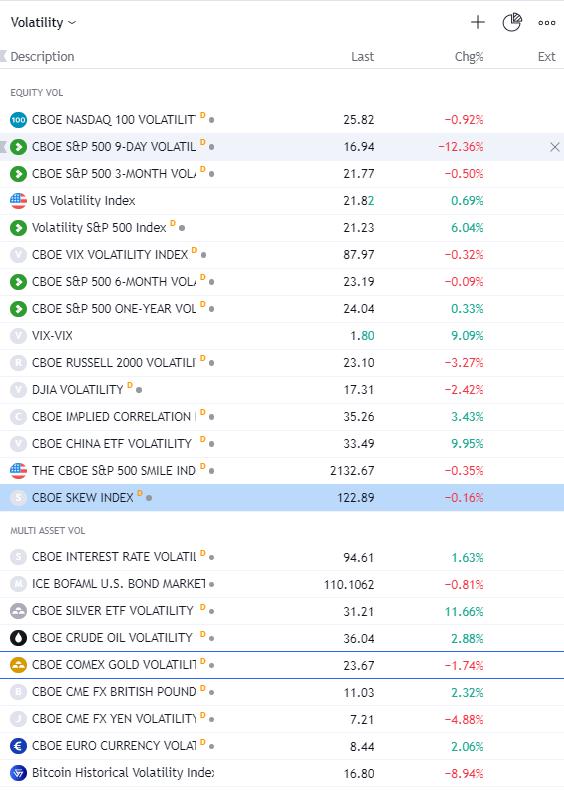

A number of traders have raised the notion that volatility (vol) has been fairly subdued of late – we see that in levels of ATR, ADR (average daily range), or measures of statistical measures – implied or realised volatility. I have put together a watchlist on TradingView of various volatility measures (see below). For me what is most important is where these sit within their own range – percentile rank is important here, as comparing the VIX index and rates volatility are very different - they take their feed from completely different options pricing – so we look at one measure of vol relative to itself.

Two measures I am looking at over others are the MOVE index and SRVIX index – the MOVE index looks at implied measures of volatility in US Treasuries, while the SRVIX measures interest rate swap vol (see the link for a more thorough explanation - https://cdn.cboe.com/resources/indices/srvix-white-paper.pdf).

Both are now moving higher and should be the leading light for higher vol in FX and equity markets – the repricing in the US rates markets has been consistent throughout February, where the peak Fed rate expectation has been moving higher and now sits at 5.32% - this has seen the US 2yr Treasury push up another 5bp on the day – rate cuts priced for 2H23 are being priced out, and we now see 24bp of cuts priced this year – on 1 Feb this was 60bp of cuts.

If we’re seeing higher implied vol in interest rates – as options trader’s price higher degrees of movement - then that should spill over into higher vol in the USD and equity markets too.

For me, this is the biggest risk to the markets we’re facing now. While some will focus on US/China relations and point to upcoming meetings between the Chinese and Russians this week, the repricing and push higher in interest rate expectations will eventually open up the downside in equity markets.

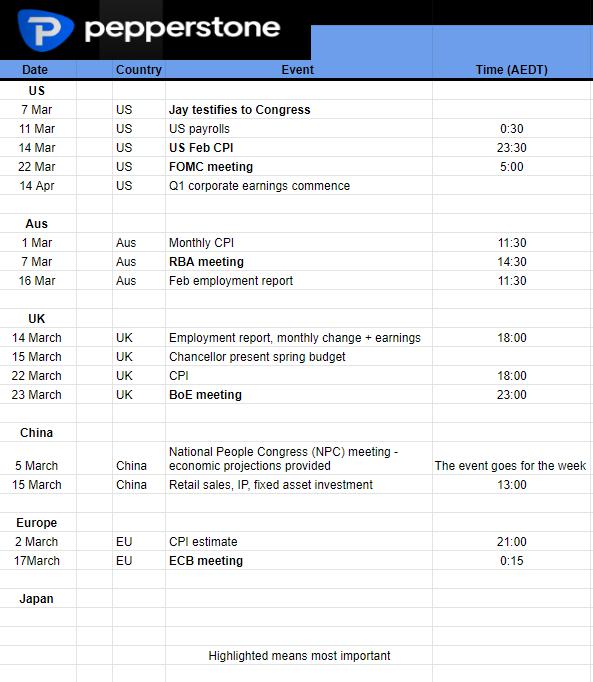

As suggested in the morning video, there are event risks in play this week (Fed FOMC minutes, personal income, Core PCE), but it’s really the March period where things get real – I’ve put this loose calendar together to highlight some of the absolute marquee event risks to look ahead to – the 22 FOMC meeting is key, but the US CPI print will set off expectations ahead of that – in the lead-up we watch to see if the market continues to push up rates in the near term – we ask, where is the point where risk breaks?

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.