Trader thoughts - taking a bullish bias as we head into mega-tech week

I expect this to get a decent run from clients, as will be the case with Apple, Google, Facebook, and Amazon – but when it comes to earnings. This is the only week that matters – there’s $7t of S&P500 market cap report in the after-market on Tuesday alone.

Consider we’ve now seen 23% of US corporates reporting quarterly numbers already, and 87% have beaten on EPS, by an average of 19.5%, while on sales 81% have beaten. It’s not just central bank liquidity, but earnings have certainly offered tailwinds, and this has justified the market lifting consensus EPS to $194 for this year and $215 for FY22, and as earnings have been revised higher, the P/E multiple has maintained a stable footing.

Good numbers this week and we could easily be looking at a market that is 1-2% higher and given the bull trend, it’s hard to be short with any conviction – longs are therefore clearly preferred both in the NAS100 and at a single stock level with Alphabet, FB, and Amazon, although holding leveraged positions over earnings obviously comes with risk.

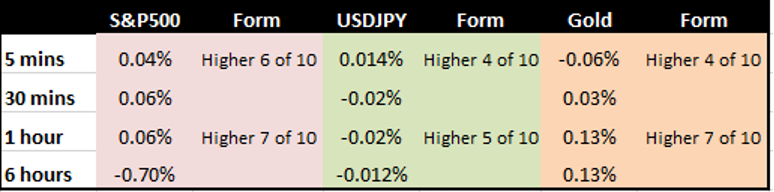

The FOMC meeting is also a risk, but as I explored last week it shouldn’t be a vol event like we saw in June – for context, the options market is pricing the S&P 500 for a -/+0.9% move through to Thursday – in fact, running the numbers and looking at past performance (over the past 10 meetings), we can see that the S&P 500 has fallen on average by 0.7% in the six hours from the time the FOMC statement drops.

If we look at moves in the S&P 500 an hour after the last 10 FOMC meetings, we see the average move is +0.06%, although I am interested in the trend, where 7 of them have resulted in the index closing higher. You can see the form here, with the pedigree in price moves (did it close higher?) in the past 10 meetings.

Bear fodder - Market breadth

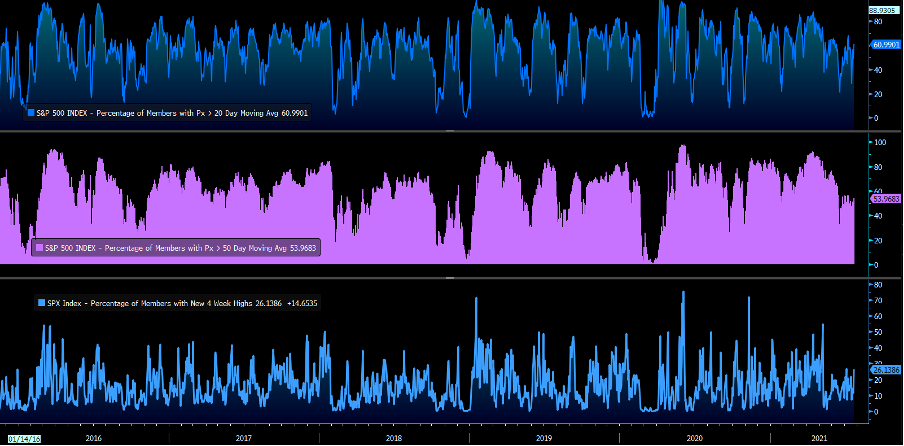

One aspect that many have read or seen has been the poor participation or breadth in the rally to all-time highs (ATH). There are a million ways to look at breadth, but in this case, I’ve looked at:

- Top pane - % of co’s > the 20-day MA – currently 60%

- Middle pane - % of co’s > the 50-day MA – currently 53%

- Lower pane - % at 4-week highs – 26%

(Source: Bloomberg)

In prior periods where the S&P 500 pushed to ATHs, we’d typically see 90% of S&P 500 members > the 20-day MA, 80%+ > the 50-day MA and 40%+ at 4-week highs.

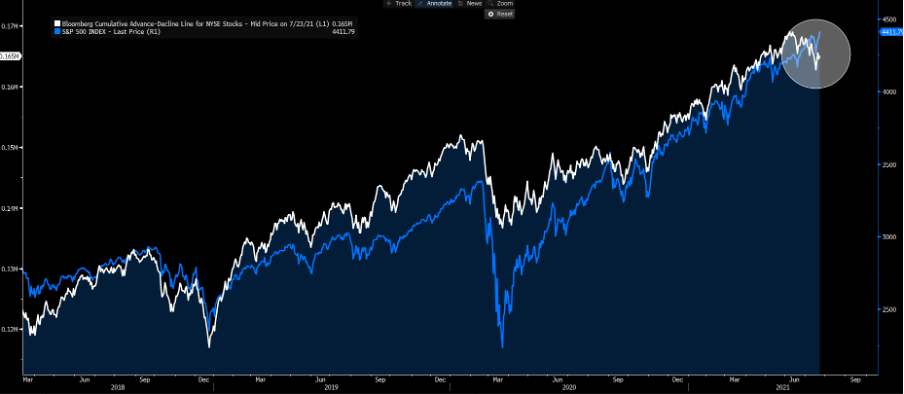

We can also look at the cumulative advance-decline line and see this having a period of divergence with the S&P 500 – this is fine when market players are rolling into mega-cap companies, while we see drawdown in financials and energy and alike. The impact, therefore, on the index is cushioned by the fact that such a concentrated group make 30% of the index weight. So for those trying to short the various Indices, the big 5%+ move comes when tech fails to find a bid in a risk-off vibe.

For short-sellers, rotation is bad, a general disdain for equity is good.

(Source: Bloomberg)

The question then becomes, will the earnings this week justify the recent bull trend? Naturally if further capital flows into tech on good earnings, then the market is only going one way this week. Recall these names have an incredible pedigree at earnings, and names like FB and Apple have beaten consensus on EPS and revenue in 8 of the past 8 quarters, Google 7 of 8 (on sales) and are up nearly 8% in the past 4 days - of the 45 analysts who cover Google 43 have a buy rating.

The next factor is what happens once we’ve heard from CEO’s and the outlook and news is discounted? A natural catalyst is therefore in the price and we’re back to watching macro trends - could the August period be a time when summer liquidity exasperates any drawdown?

For now, I think the balance of probability is skewed for risk to move higher, but things become interesting when you discount news.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.