What is Metal Trading: How to Trade in Gold, Silver, and More

Precious metals, due to their rarity and intrinsic value, add an additional layer of significance, often sought after not only for their practical uses but also as investments or in the form of jewellery.

What are the different precious metals to trade?

Among the various precious metals, gold, silver, and platinum are the most commonly traded. Historically, both gold and silver have been utilised as forms of currency and continue to serve that purpose to some extent today. All three metals are prominent in the jewellery industry; however, silver and platinum also have a range of industrial applications, with gold being used less frequently in this context.

Gold is notably employed as an alternative investment, a store of value, a hedge against inflation, and as a largely uncorrelated asset. According to the UK’s Royal Mint, for a metal to be classified as "precious," it must occur naturally and be relatively rare. Among these metals, silver is the most abundant, platinum the rarest, and gold the most extensively held and traded.

The World Gold Council estimates that throughout history, less than 213,000 tonnes of gold have been mined, most of which remains in circulation today.

What affects the price of precious metals?

The prices of precious metals, including gold, silver, and platinum, are influenced by a range of factors that contribute to price movements and fluctuations. These metals are governed by the principles of supply and demand. Generally, an increase in supply tends to lower prices, while a rise in demand usually leads to higher prices.

The market price of these metals will adjust until it reaches a new equilibrium where supply meets demand. However, the supply chains for precious metals can be lengthy and susceptible to disruptions due to the complex processes of mining and smelting. Consequently, interruptions in production at major mining sites can be prolonged, and new sources of supply cannot be quickly introduced.

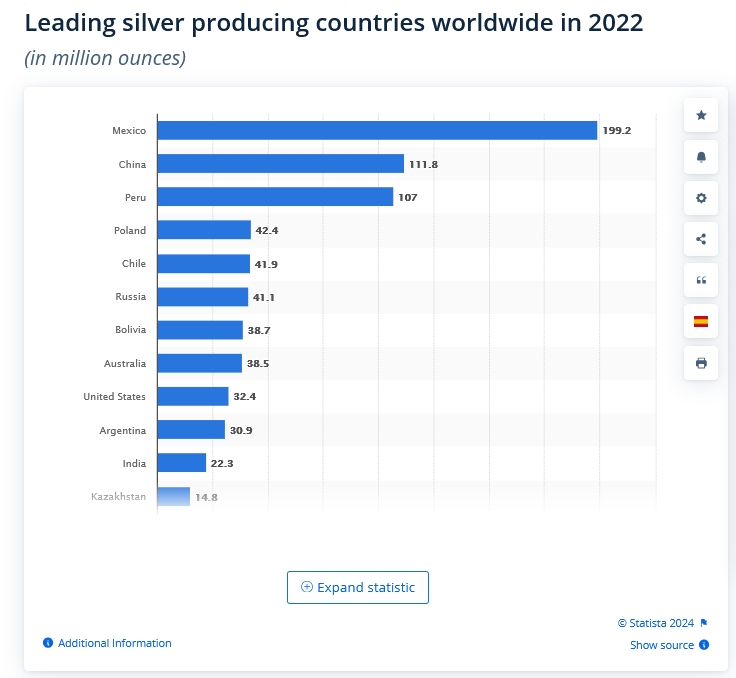

For instance, Mexico, China, and Peru are the leading producers of silver, collectively accounting for nearly half of global production. Additionally, the prices of precious metals are also influenced by fluctuations in the value of the US dollar, as these metals are typically priced and traded in dollars. Changes in the dollar's value can, therefore, impact precious metal prices.

Pepperstone provides clients with the option to trade gold, silver, and platinum against various currencies, including AUD, GBP, and EUR. Furthermore, investor sentiment can affect gold and silver prices. In periods of heightened risk aversion, investors often move capital into gold and, to a lesser extent, silver, seeking safety. Conversely, during periods of risk appetite, investors may sell off precious metals in favour of higher-risk assets.

Major silver producers

Source: statista

CFD trading metals in financial markets

Contracts for Differences (CFDs) enable traders to speculate on the price movements of financial instruments without owning the underlying asset.

CFDs are settled in cash, allowing traders to engage in both long (buy) and short (sell) positions according to their strategies.

For example, if a trader anticipates an increase in the price of gold, they may enter a long position, aiming for the price to exceed their entry level. This would result in a profit, which can be realised by closing the position when the price is favourable.

Conversely, if a trader expects the price of gold to decline, they might take a short position. Here, the goal is for the price to fall below the entry point, generating a profit that can be realised by buying back or closing the short position.

Why opt for CFD silver trading?

Trading silver through Contracts for Difference (CFDs) offers traders considerable flexibility not typically found with other trading instruments.

Here are key aspects to consider:

- Cash-Settled: Silver CFDs are settled in cash rather than through physical delivery.

- Non-Deliverable: Physical delivery of silver is not an option with CFDs.

- No Contract Length: Silver CFDs do not have fixed contract lengths or expiry dates.

- Long and Short Trading: Traders can easily take long or short positions in silver CFDs.

- Variable Contract Sizes: There are no standardised contract sizes for silver CFDs.

These features enable traders to develop metal trading strategies tailored to their individual trading styles, risk tolerance, directional views, and investment horizons.

While trading silver CFDs does not grant ownership of the metal, it provides exposure to its price movements, allowing traders to potentially profit from both upward and downward fluctuations.

However, it is important to note that CFDs are leveraged derivatives, and trading them involves a high level of risk.

How Can Technical Analysis Be Used to Identify Metals Trading Opportunities?

Technical analysis involves examining "Price Action," which encompasses price and volume data, directional trends, trader sentiment, and other market behaviours. This analysis is performed using price charts and various indicators.

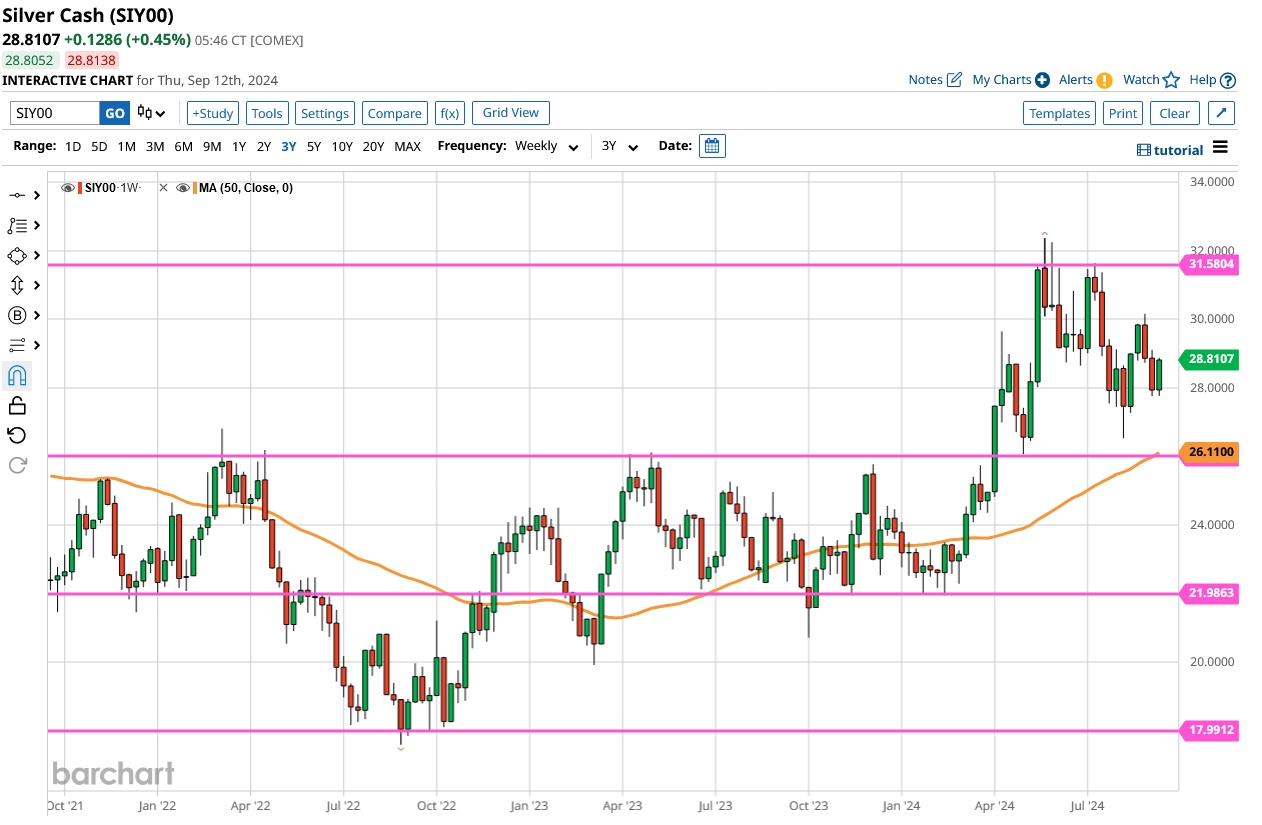

Price charts can reveal critical elements such as support and resistance levels, price extremes, breakouts, trend reversals, and other significant chart patterns. For instance, the chart below displays the spot price of silver over a three-year period on a weekly basis. The magenta lines represent horizontal support and resistance levels, reflecting the trading range throughout this period.

Source: barchart

The orange line on the chart denotes the 50-week Moving Average of the spot silver price. Each candlestick on the chart illustrates the opening, high, low, and closing prices of silver for each observed week.

Additional indicators can be applied to price charts to provide deeper insights into price action. For example, the 5-minute chart of spot copper price features a red price line and 10-period and 50-period moving averages, shown in blue and green, respectively.

Source: barchart

The chart highlights two instances where the moving average lines cross, coinciding with changes in copper's price direction. In the first instance, the 10-period moving average crosses below the 50-period moving average, leading to a decline in copper's price. Conversely, in the second instance, the 10-period moving average crosses above the 50-period moving average, resulting in a price increase.

By utilising these charts and indicators, traders can better understand price ranges and significant points within metal trading. Identifying and setting alerts for key price action points or interactions between moving averages and other indicators can signal potential trading opportunities that merit further investigation.

What Are Some of the Risks Involved When Investing in Precious Metals?

Investing and trading in precious metals come with various risks, particularly due to price volatility:

The prices of precious metals can fluctuate significantly. For example, silver has experienced two notable price surges in recent history—one in the late 1970s and another from late 2010 into early 2011. In both cases, silver prices increased by several hundred percent before eventually returning to pre-rally levels. Trading against such substantial price movements, whether upward or downward, can lead to significant financial losses.

Macroeconomic data surprises can also influence the prices of precious metals, especially when the data pertains to factors like inflation, unemployment, or overall economic activity. Unexpected data releases can shift market sentiment, driving notable price changes in precious metals. The greater the surprise in key economic data, the more pronounced the impact on precious metal prices, particularly if market sentiment shifts between risk-on and risk-off.

Additionally, the supply of precious metals is subject to various vulnerabilities since they must be mined and processed. Supply interruptions can arise from factors such as weather conditions, labour disputes, natural disasters, and geopolitical events. Unlike other commodity CFDs, the supply of precious metals cannot be increased instantaneously. For instance, palladium production is primarily concentrated in two countries, Russia and South Africa. Beyond these major players, only a few smaller producers contribute to global supply, and their output is minimal in comparison. A disruption in supply from one of the key producers could place significant pressure on the market and drive prices to extreme levels.

What Are Some Common Mistakes That Beginners Make When Trading Metals?

One of the most common pitfalls for beginners in trading precious metals is overtrading, which occurs when traders take on positions that are too large relative to their account size or have multiple trades open simultaneously.

Another frequent mistake is taking profits too early while allowing losing positions to exceed their stop loss, hoping for a reversal— a behaviour known as loss aversion.

Additionally, beginner traders may overlook the correlation between gold, silver, and platinum with the US dollar, and consequently, trade with each other. Holding positions in these three metals might seem like a diversified strategy, but under certain conditions, it could backfire, as their prices can move in the same direction simultaneously.

How Can Investors Stay Up-To-Date on Metals Market Trends and News?

To stay informed on metals market trends and news, it is essential to read broadly and analyse the charts of key metal contracts.

Pepperstone’s in-house analysts offer a weekly guide highlighting upcoming macroeconomic data releases, detailing market expectations and potential impacts.

Additionally, trade bodies like the Silver Institute and the World Gold Council provide extensive information on precious metal trends, including supply and demand, through regular reports and newsletters.

Traders can also monitor price movements in the metals market by utilising the charting tools available on their trading platforms.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.