Most Traded Stocks Of 2024

The stock market in 2024 has showcased dynamic activity across various sectors, reflecting shifts in investor interest, economic trends, and global events.

Key insights:

- High trading volumes: The most traded stocks in 2024 are dominated by large-cap companies in the technology, finance, and energy sectors, indicating investor confidence in these industries.

- Emerging market influence: Stocks from emerging markets are seeing increased trade volumes, reflecting global investor interest in high-growth potential regions.

- Tech giants lead the pack: Major tech companies remain at the forefront, driven by innovations in AI, cloud computing, and green technology, making them the top choices for active traders.

- Renewable energy stocks on the rise: Stocks in the renewable energy sector have gained traction as investors seek sustainable options amidst global shifts toward cleaner energy.

- Volatility draws day traders: With high volatility in sectors like biotech and cryptocurrencies, day traders are flocking to these stocks for rapid buy-and-sell opportunities, creating significant trading volume spikes.

What are the most traded stocks in 2024?

Identifying the most traded stocks of the year offers insight into market sentiment, popular sectors, and how certain companies have maintained or evolved their standing on major exchanges. This article provides an overview of some of the most actively traded stocks worldwide in 2024, covering companies in technology, energy, finance, healthcare, and other significant sectors.

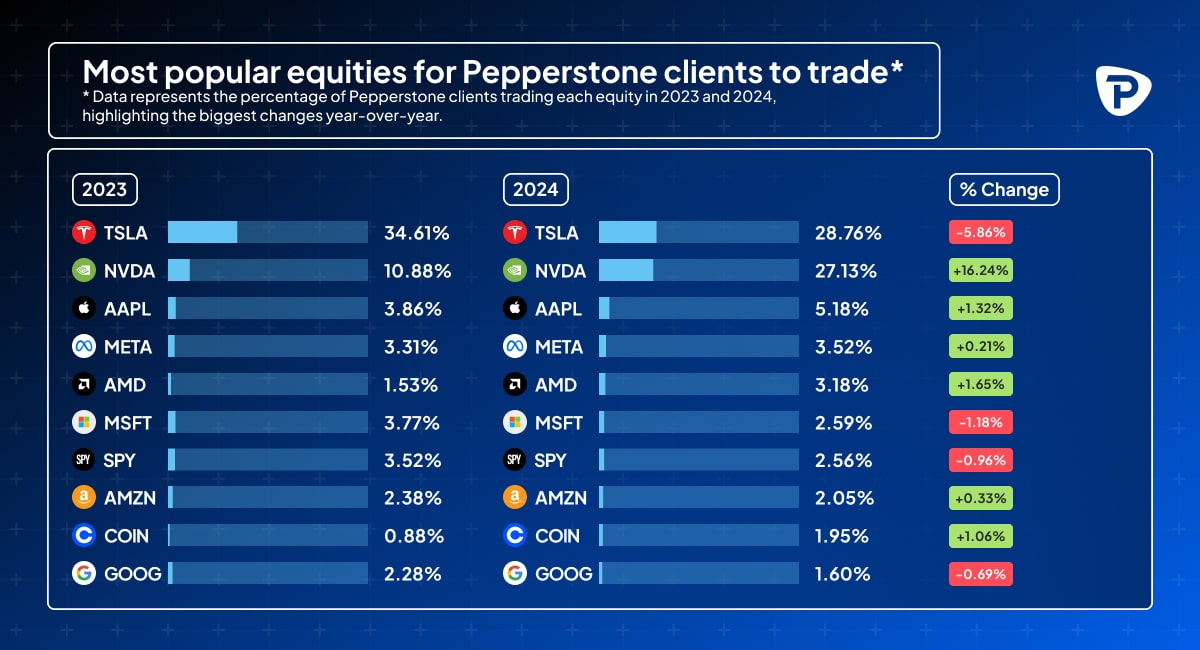

Here’s a comparison of the most traded stocks in 2024 versus 2023, highlighting shifting market dynamics and investor interests.

Note: Data represents the percentage of Pepperstone clients trading each equity in 2023 and 2024, highlighting the biggest changes year-over-year.

1. Technology sector: Innovation driving high trading volumes

The technology sector has remained a significant component of high-trading activity in 2024. Known for its resilience and adaptability, this sector has seen established giants and emerging

companies attract substantial investor interest. Key drivers in this sector include advancements in artificial intelligence (AI), cloud computing, cybersecurity, and renewable energy technology.

Notable mentions in the technology space include:

Apple Inc. (AAPL): Apple continues to capture investor interest due to its consistent revenue growth, expansion into augmented reality (AR) and AI, and its ecosystem of consumer products. In 2024, Apple announced new features in its product line, further integrating AI into user interfaces, thus driving high trade volumes. Its position as a market leader in consumer technology keeps it among the top-traded stocks.

Microsoft Corporation (MSFT): Microsoft's robust portfolio in cloud computing, enterprise software, and AI-driven solutions has kept it a popular stock in 2024. The company's expansion of its Azure cloud platform and integration of AI features across its software offerings has led to increased demand from enterprise clients, boosting trading volumes.

NVIDIA Corporation (NVDA): NVIDIA remains a primary player in AI and graphics processing, sectors that have gained substantial traction in 2024. Known for developing high-performance graphics processing units (GPUs) critical to AI and data analysis, NVIDIA's stock has been highly traded due to increased demand for its chips in the tech and auto industries.

2. Energy sector: Shifting towards sustainability

As the global energy transition progresses, companies in renewable energy and sustainable technologies have witnessed increased trading volumes. However, this momentum could face shifts depending on political landscapes, such as the potential policies under a Trump presidency, which might prioritise traditional energy sources over renewables. This shift reflects investor appetite for sustainable investments, often aligning with environmental, social, and governance (ESG) criteria. Meanwhile, traditional energy companies still retain investor attention, given the global demand for oil and gas.

High-trading stocks in the energy sector include:

Tesla Inc. (TSLA): Tesla's stock remains one of the most traded due to its pioneering role in electric vehicles (EVs) and energy storage solutions. In 2024, Tesla expanded its global footprint and continued leading EV technology innovations, further stimulating investor interest. The stock’s volatility and Tesla’s potential for growth have driven consistent trading activity.

ExxonMobil Corporation (XOM): ExxonMobil has performed well on major stock exchanges, especially with rising oil prices in 2024. As one of the largest publicly traded oil and gas companies, ExxonMobil has been a target for high trading volumes among investors who view it as a traditional yet reliable stock in the energy sector.

NextEra Energy Inc. (NEE): Positioned as a key player in renewable energy, NextEra Energy’s investments in solar and wind power have made it a popular stock in 2024. The company’s focus on renewable energy and sustainable initiatives aligns with global climate goals, attracting environmentally conscious investors.

3. Healthcare sector: Continued demand post-pandemic

The healthcare sector will remain relevant in 2024 as pharmaceutical and biotech firms work on advancements in healthcare technology, gene editing, and drug development. The demand for effective treatments and solutions has kept healthcare stocks among the most actively traded in 2024.

Stocks driving this sector’s trading volumes include:

Pfizer Inc. (PFE): Pfizer’s involvement in vaccine production, particularly with mRNA technology, continues to boost trading activity in its stock. Pfizer has remained a household name, and in 2024, its efforts in innovative vaccine research and expansion into other therapeutic areas have sustained investor interest.

Johnson & Johnson (JNJ): As a leading pharmaceutical and consumer healthcare company, Johnson & Johnson has seen consistent trading volume. Known for its diversified product

portfolio, Johnson & Johnson has been popular among investors seeking stability in the healthcare sector.

Moderna Inc. (MRNA): Moderna has attracted trading interest with its innovations in mRNA-based treatments beyond COVID-19 vaccines. The company’s work on vaccines for various diseases and potential applications in cancer treatment have made it one of the high-volume stocks in 2024.

4. Financial Sector: Resilient stocks amid economic changes

The financial sector remains a cornerstone of global markets, encompassing major banks, asset managers, and insurance companies. In 2024, factors like inflation, interest rates, and changing regulatory policies have influenced trading patterns in financial stocks, leading to notable activity for prominent players.

Noteworthy stocks in this sector include:

JPMorgan Chase & Co. (JPM): As one of the largest banks globally, JPMorgan’s stock has consistently attracted trading volume due to its performance in diverse financial services. The company’s adaptability to economic changes and digital banking innovations have made it a favourite among institutional and retail investors.

Goldman Sachs Group Inc. (GS): Known for its focus on investment banking and asset management, Goldman Sachs was highly traded in 2024. Its position as a leader in financial services and ability to adjust to market trends keep it relevant on trading platforms.

Berkshire Hathaway Inc. (BRK.A and BRK.B): Led by Warren Buffett, Berkshire Hathaway’s diversified holdings across sectors like insurance, utilities, and consumer goods make it a staple in many portfolios. The company's stock has attracted institutional and retail trading due to its long-term value strategy.

5. Consumer goods: Stability and growth potential

Consumer goods companies, including food, beverages, and retail, have shown resilience and attracted trading interest in 2024. These companies offer stability and growth, appealing to investors looking for defensive stocks with consistent returns.

Top traded stocks in this sector include:

Procter & Gamble Co. (PG): Procter & Gamble, a leading consumer goods company, has seen high trading volume due to its essential product offerings in personal care, cleaning, and health. Known for consistent dividend payments, it remains popular with income-focused investors.

Coca-Cola Co. (KO): Coca-Cola’s brand strength and consistent product demand make it a frequently traded stock. In 2024, Coca-Cola expanded into healthier beverage options, aligning with changing consumer preferences and contributing to sustained trading interest.

Amazon.com Inc. (AMZN): As a dominant player in e-commerce and cloud computing, Amazon has maintained its position among the most traded stocks globally. Its ventures into new markets and the continued growth of Amazon Web Services (AWS) drive high trading volumes.

6. Automotive and industrial sectors: Evolving with new technologies

Automotive and industrial companies have attracted substantial trading volumes in 2024, especially those innovating in electric vehicles and autonomous driving technologies. This sector also includes manufacturing and heavy industry companies, appealing to investors focused on industrial growth.

Key stocks in these sectors include:

Ford Motor Co. (F): Ford’s commitment to electrification and investments in electric vehicle production have made it a widely traded stock. The company’s ongoing shift towards EVs has spurred investor interest in 2024.

General Electric Co. (GE): General Electric remains relevant in the industrial sector due to its involvement in renewable energy, healthcare technology, and aviation. GE’s diverse portfolio and innovations make it attractive to traders seeking exposure to industrial growth.

Toyota Motor Corporation (TM): As a global automotive leader, Toyota’s focus on hybrid and electric vehicles has positioned it among the most traded stocks. Toyota’s diversified vehicle line-up and advancements in hydrogen fuel technology have kept it popular with investors.

7. Emerging markets and small-cap stocks: High-risk, high-reward potential

While large-cap stocks dominate trading volumes, small-cap and emerging market stocks offer high-growth potential, attracting speculative investors willing to navigate additional risks. Stocks in emerging economies, particularly in Asia and Latin America, have gained traction in 2024.

Examples include:

Alibaba Group Holding Ltd. (BABA): As one of the largest e-commerce companies in China, Alibaba’s stock has remained popular in 2024. Its retail, cloud computing, and logistics position appeals to investors interested in China’s market dynamics.

Sea Limited (SE): Based in Southeast Asia, Sea Limited operates in e-commerce, digital payments, and online gaming. The company's growth potential in emerging markets has attracted investor interest, particularly among those seeking exposure outside Western markets.

Tencent Holdings Ltd. (TCEHY): Tencent’s diversified interests in gaming, social media, and financial technology make it a frequently traded stock in 2024. As a major tech player in China, Tencent appeals to investors focused on Asia’s expanding digital economy.

Key insights into 2024's most traded stocks

The most traded stocks in 2024 reflect global economic trends, technological advancements, and evolving consumer preferences. Here are some key takeaways:

- Technology stocks remain strong: Companies in AI, cloud computing, and consumer tech continue to dominate trading volumes.

- Sustainable investments: Investors are increasingly drawn to energy companies with renewable energy and ESG commitments.

- Healthcare innovation: The demand for new treatments and vaccines keeps healthcare stocks among the most traded.

- Financial stability: Major financial institutions attract steady trading volumes, especially amidst economic shifts.

- Consumer goods and defensive stocks: Essential goods companies provide stability, appealing to risk-averse investors.

In conclusion, understanding the factors behind the most traded stocks helps investors make informed decisions and recognise the impact of market trends and sector developments.

FAQs

What factors influence which stocks are the most traded each year?

Various factors, including economic data releases, interest rate changes, geopolitical events, industry trends, and company-specific news like earnings reports or mergers and acquisitions influence trading volumes. For instance, in 2024, tech innovation and shifts in healthcare demand have had a strong impact, while global events and regulations in energy sectors have also driven trading volume for specific stocks.

Are the most traded stocks usually the most profitable investments?

Not necessarily. High trading volume reflects interest and activity but doesn’t guarantee profitability. Many frequently traded stocks are volatile and may attract both short-term traders and long-term investors. While some of these stocks may offer significant gains, they can also be high-risk. Investors must research each stock’s fundamentals and consider their risk tolerance.

How do most traded stocks in the US compare to those in other global markets in 2024?

In 2024, technology, financials, and healthcare sectors have primarily driven US stocks. In comparison, global markets, particularly in emerging economies, have seen higher trading volumes in sectors like energy, industrials, and renewable resources due to regional economic shifts. Major international events, such as trade policies and currency fluctuations, have influenced trading patterns differently across regions.

Are there any new companies among the most traded stocks in 2024?

Yes, 2024 has seen a few new entrants among the most traded stocks, particularly in the tech and green energy sectors. These companies, often driven by recent innovations or market disruption, have gained significant attention. Notably, emerging AI-driven and renewable energy companies have drawn interest from investors looking to capitalise on growth trends, leading to higher trading volumes.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.