Analysis

For those running systematic strategies, executing through EA’s, we’ve put together some genuine thought leaders from the world of automated trading. Take a look at the run sheet and sign up for the live presentations.

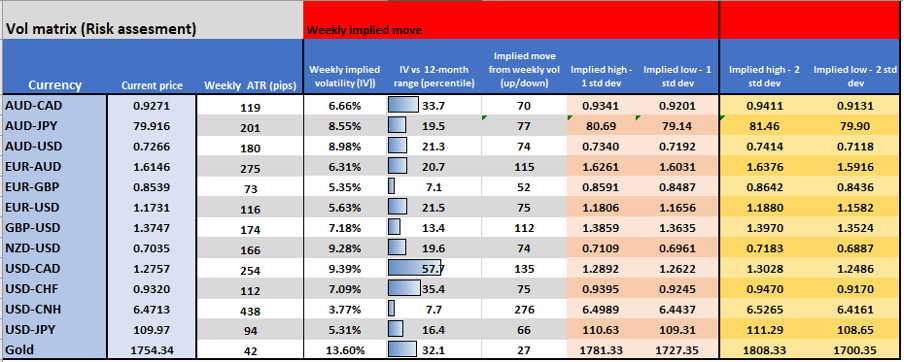

We can see from the volatility (vol) matrix that EUR implied vols are not that high, suggesting limited concern of big moves this week. The USD is not priced for any major explosion either and the low vol that’s priced may be challenged if the Fed throw a rate hike into the mix for 2022 – while that is not a consensus view, it’s a possibility, and that may spice things up a bit.

For context, the market is pricing a 1.4% move in the US500 on FOMC day, which is significantly higher than we’ve seen in prior meetings – tapering QE is one aspect, but as we saw in the June FOMC, it could be all about the ‘dots’ – recall, the Fed has tried hard to break the linkage between tapering and rate hikes – if we see one hike pencilled in for next year it could see the market challenge that view.

Vol matrix – I have sourced from Bloomberg and calculated the implied move from IV – this offers a sense of market movement, which can be important for our risk and position management.

(Source: Pepperstone - Past performance is not indicative of future performance)

Here’s what on the radar this week:

Monday

- Canadian election – this may affect the CAD, with the options markets pricing higher than usual volatility in USDCAD – a very niche event risk but for those with CAD exposure its worth understanding the risk.

- The GER30 index becomes GER40 – 10 new stocks entering the index re-weight the German equity index to have a higher contribution to growth companies, which could have longer-term implications for foreign investment flows and possible increased percentage moves, but shouldn’t be an initial volatility event – it’s just re-weighting the constituents – see more here.

Tuesday

- RBA Sept meeting minutes

- Riksbank (Sweden)

Wednesday

- BoJ meeting – there is no set time and shouldn’t be a volatility event at all. Next week’s Japan election may get some attention and could be JPY positive.

Thursday

- FOMC meeting (04am AEST) and Jay Powell Presser (04:30 AEST) – the Fed should give advanced notice that they will start to reduce (taper) the pace of monthly asset purchases in the months ahead. They may indicate (in the ‘dots plot’) one rate hike in 2022 - If they don’t, which is my own view, then chances are they will indicate a median expectation of 3 hikes in 2023 (up from 2). Looking ahead its likely we see 6 hikes to be pencilled in by the end-2024. This is the marquee event risk of the week, so watch USD, gold, and US equity exposure – the market leans into this for a hawkish statement and the event holds the premise to really move the dial on USD volatility.

- BoE meeting – With no new economic forecasts the recent forward guidance should not change. With 2 rate hikes priced into UK rates markets by the end-2022 the narrative needs to meet this pricing of expectations or we risk GBP sellers.

- Norges (Norway) meeting – 12 of 13 economists expect the Norwegian central bank to hike to 25bp. The NOK has been following the fortunes of crude, but can rates settings move the dial this week?

Friday

- German IFO survey expectations

- Fed Chair Powell and Vice-Chair Powell host Fed Listens Event

Sunday

- German election – we will cover this more extensively through the week, but this is one event that some see as holding gapping risk in EUR and GER30 for the upcoming Monday open. Personally, I see this as unlikely its but not out of the question, with the bookies firm favourite of a coalition of SPD/Greens/FDP or what is known as the “Traffic Light” coalition – the outcome is hard to call as the accuracy of the polls gets called into question and have been quite volatile and there are still a lot of undecided German voters.

- I’d imagine the outcome of an SPD/Green/FDP coalition would be mildly EUR and DAX positive, but it is also largely discounted. Consider, it may take a while to know the result and form a unity govt, so this reduces the prospect of gapping risk - but a volatility event would be a combo of SPD, Greens and Linke – the bookies have this left-leaning outcome as the second favourite outcome, but this could push EURUSD +1% or so on open.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.