Analysis

The ‘Big, Beautiful Bill’ Has A Potential Ugly Sting In Its Tail

It’s a bit of a ‘rule of thumb’ that there are some subjects which, when market commentators end up writing about them, it’s not a particularly reassuring sign.

Market ‘plumbing’ is the classic one, as whenever it’s necessary to dig into the intricacies of funding markets, and how liquidity moves around the financial system, it’s often an indication that something has gone fairly significantly wrong. Now, I’m going to add tax legislation to that list.

There has been a lot of focus recently on the ‘The One, Big, Beautiful Bill’ passed by the US House, thought most notably on the tax cuts (no tax on tips, TCJA extension, SALT cap increase), as well as plans to raise the debt ceiling by $4tln, ahead of the ‘X date’ in mid-Q3. Somewhat understandably, given that the bill runs to well over 1,000 pages, some of its details have been glossed over, but the catchily-named ‘Section 899 - Enforcement Of Remedies Against Unfair Foreign Taxes’ does bear a closer look.

Cutting through all the legalese and jargon in the Bill itself – which, of course, is yet to pass the Senate, and could still be amended – this particular section focuses on ‘unfair taxes’ imposed by foreign countries. While the Treasury will have some discretion over the countries to which Sec. 899 applies, the definition of ‘unfair foreign taxes’ is a very broad one, encompassing a whole host of measures that have been adopted by countries across the globe, most notably the digital services taxes that have been implemented in the EU, UK, and some parts of APAC.

The Bill proposes to address these ‘unfair taxes’ in an incredibly punitive way. Individuals, sovereigns, and firms, depending on the precise ownership structure, would be subject to significant retaliatory measures, with withholding taxes on US interests to be increased by an “applicable number of percentage points”, starting at 5pp, and increasing by a further 5pp per annum, not exceeding 20pp. These huge retaliatory tax increases could apply no matter the cross-border tax treaties that apply between the US and other nations, meaning that entities such as sovereign wealth funds, and public pension funds, could prove the most affected by these changes.

Now, all of this sounds very technical, but these provisions do potentially bring with them some very important market implications, if the Bill, and this section, pass the Senate in their current form.

Firstly, the passage of the legislation in its current form would be another factor likely to weigh on international market participants’ allocations to the USA. Not only would this provide investors with little incentive to re-up allocations, which have been trimmed substantially in the wake of ‘Liberation Day’ at the start of April, but it could in fact provide an incentive to trim those allocations even further.

Consequently, one must assume that, increasingly, demand for US assets will have to come from domestic market participants, as opposed to those overseas.

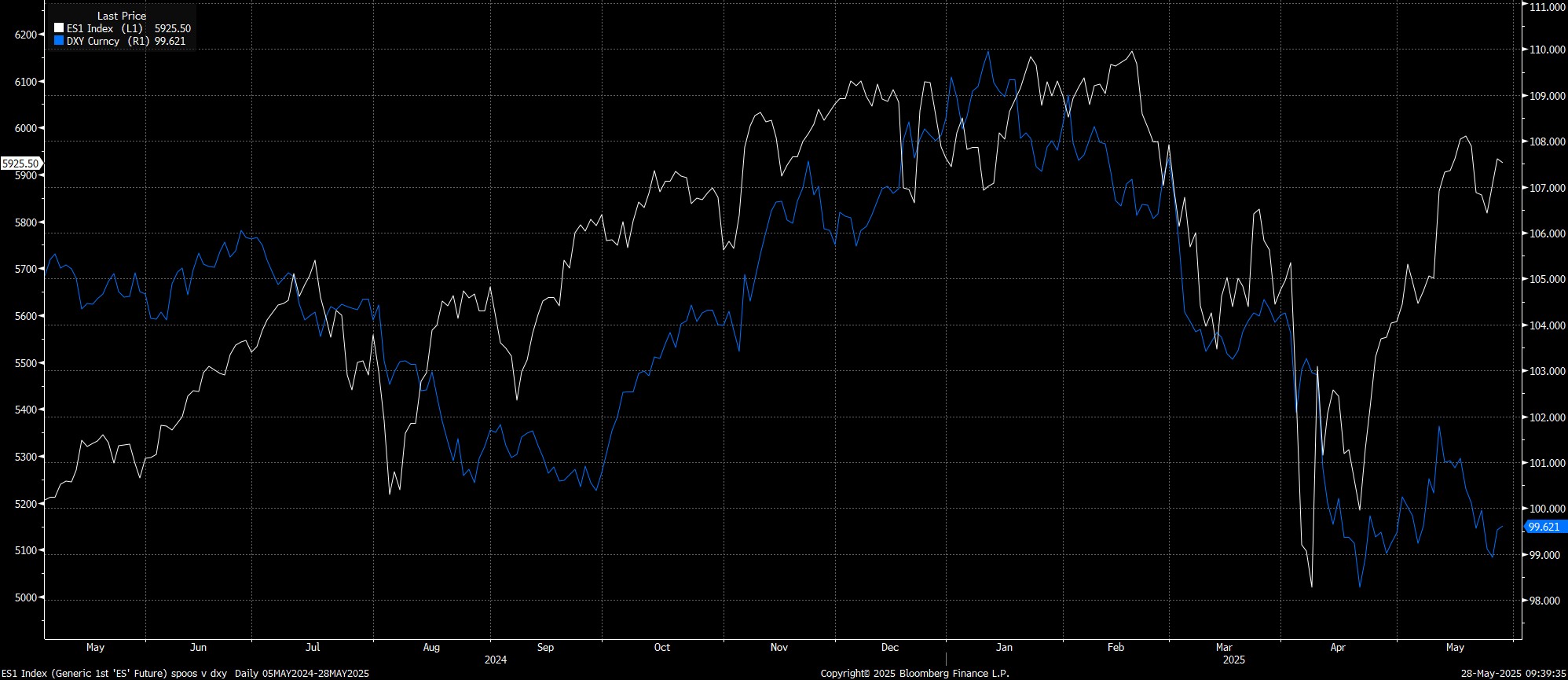

In the equity complex, this is likely to result in the previously close correlation between the S&P 500, and the USD, remaining ‘broken’. That’s not to say that the bull case for US equities isn’t still a solid one – it is – instead, it’s to say that there is the potential for RoW markets to outperform, or at least not lag as significantly, and that demand for stocks on Wall St will increasingly have to come from US-based investors.

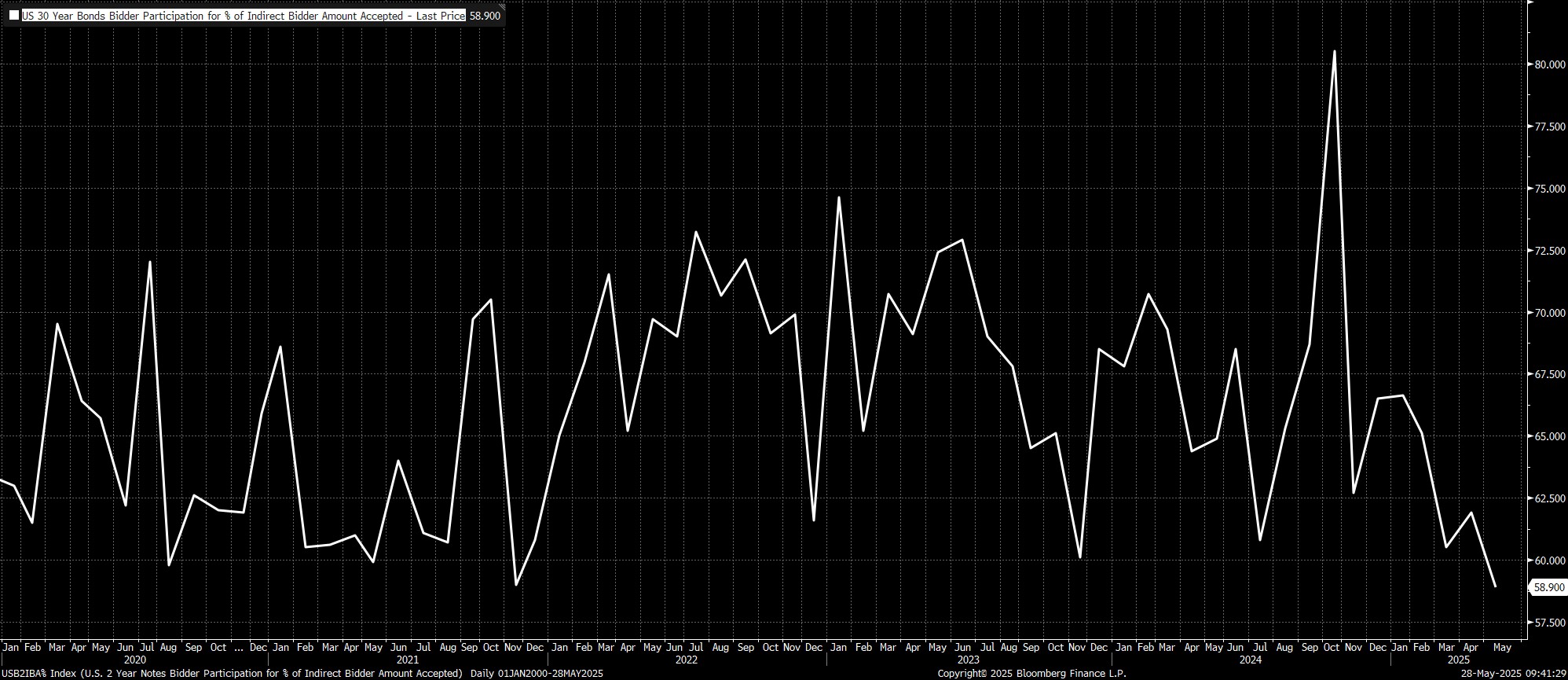

The same can also be said of the fixed income complex, where disadvantageous changes in tax treatment are likely to result in overseas investors having even less desire to soak up the huge amount of Treasury issuance that remains in the pipeline. Indirect demand is, hence, likely to continue to decline, again as US participants are forced to step up and accept an increased share of the pie.

Alternatively, if overseas investors are to continue with their current levels of participation in the Treasury complex, they are likely to require an increased yield by form of compensation, further compounding the fiscal headache that the Trump Admin faces.

To conclude, there remain an awful lot of unknows here, especially with many stages of re-drafting in the Senate still to take place. However, with President Trump wanting the Bill on his desk in time for Independence Day, these provisions could come into effect relatively soon.

Progress of the Bill, and its intricacies, remains an important theme to keep on the radar, even if provisions on overseas taxes may not be as glamorous-sounding as chunky tax cuts, and a huge debt ceiling increase.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.