Analysis

The big story across markets today was the large beats which came out from the US across retails sales, PPI and industrial production - stoking inflation concerns further and hence driving a steepening of the US 10-year yield, 10-year TIPS (real yield) and 2s10s curve. This spilled over into the DXY which is up around half a percent, knocking at the door of the 91 level at the time of writing. The US 10-year has come off a bit as the speed of the recent move was looking a bit stretched around 1.3% and the RSI was in overbought territory, obviously overbought can stay overbought but yields do have some mean reversion properties to them. The 20-year bond auction at 6pm GMT will be an interesting one to watch for bond appetite right before the FOMC minutes out 1 hour later. The minutes shouldn’t cause any large moves as the message of too early to taper will be rinsed and repeated.

The reason why inflation is important is because its effects spill over into other important asset classes such as bonds, equities, gold and FX. 10-year US breakevens notched a fresh 6-year high of 2.25% last night and it is starting to get very close to levels that have acted as resistance in the past (2.3%). The drivers of inflation differ slightly across Europe and the US, but the price of oil has been a notable driver across both regions recently as the reopening of economies due to more vaccinations helps on the demand side, while OPEC+ support and shut-ins in Texas (3.5 mln BPD) due to adverse weather keeps the supply side nice and tight. However, oil has softened slightly on the back of a WSJ article which has just reported that Saudi Arabia plans to increase its production in the coming months potentially bringing about 1 mln BPD back online.

.png)

Source: Federal Reserve Bank of St. Louis

The US also has a massive fiscal stimulus to aid consumer spending and is aggressively rolling out its vaccine in order to increase mobility whereby some of that pent up demand can be released back into the economy. The Fed sees higher energy prices being more of a transient nature, however, more and more banks are pushing a commodity super cycle and with the shift to the ESG theme (cancelling oil infrastructure projects) maybe higher oil prices won’t be so transitory overall? Base effects and in Europe more particularly a rolling back of VAT support will help inflation rise, but economic scarring will cause labour market slack which is not a very conducive environment for wage growth and hence inflation. That’s the million dollar question, will inflation just be a brief overshoot or will it be a longer lasting phenomenon as the answer to this will determine the Fed’s reaction function. With all the debt sloshing around the system I wonder where the Fed’s pain threshold is for the US 10-year. Will they tolerate yields north of 1.5%?

Nominal yields have been rising precipitously on the back of higher inflation expectations, but also real yields have arrived to the party and are flushing up higher (more optimism about the economy) around -0.935 levels. Some traders have been perplexed by all the talk of inflation and gold decreasing. This can be explained by the movement in real yields, given gold is a zero yielding asset there is an opportunity cost involved in holding it while yields are rising. Clearly, inflation has not become too much of a concern to warrant flows into gold, perhaps Bitcoin is also stealing some of the limelight away from the shiny yellow metal? A stronger dollar certainly doesn’t help either given gold’s inverse correlation to the greenback. It’s been a perfect bearish storm for gold both on the fundamental and technical front (death cross – 50-day SMA below 200-day SMA).

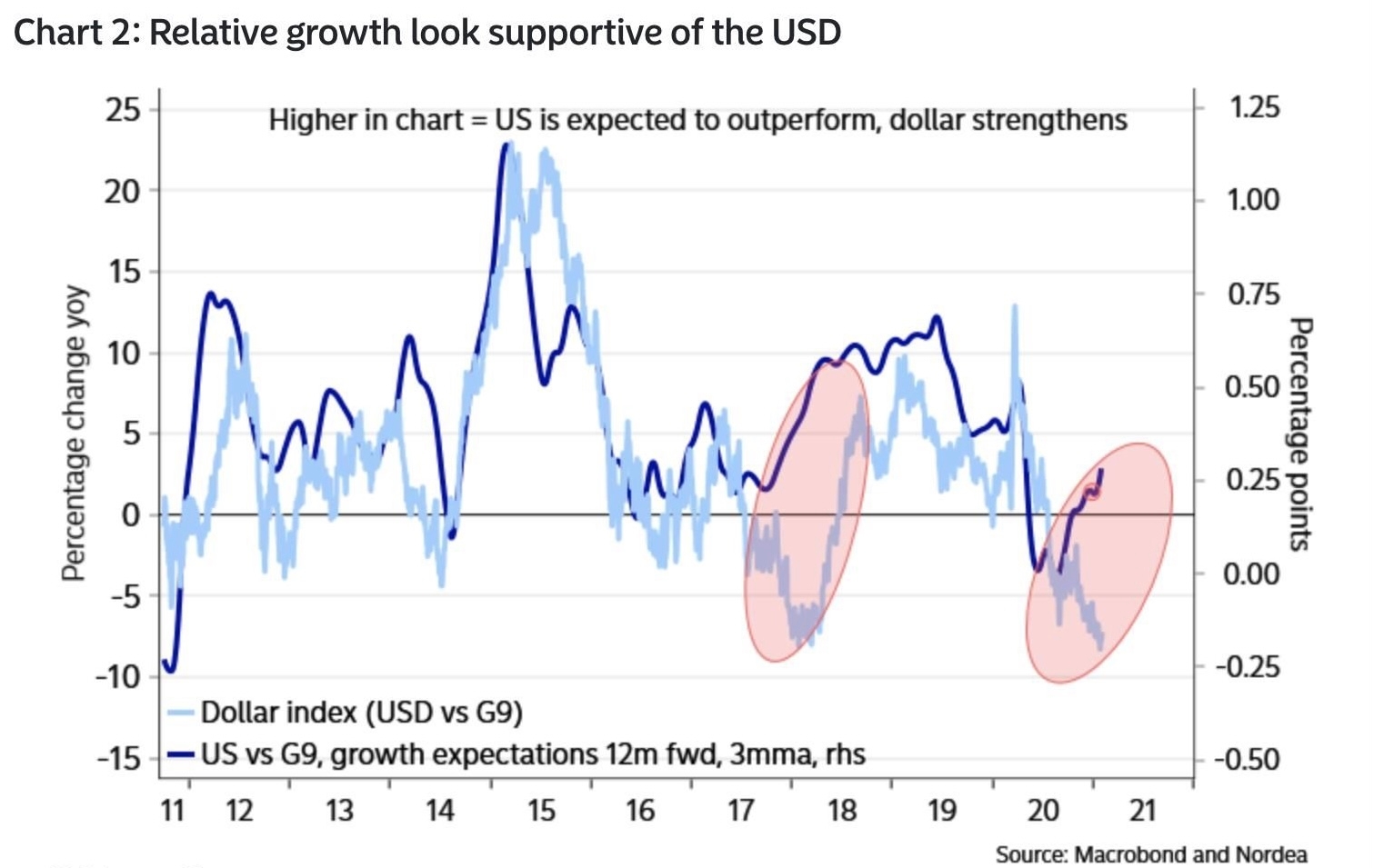

Dollar bulls must have been sweating over the past couple of days as price tested the late Jan lows of 90. However, the large movement upwards in real yields have worked in the bulls favour as price is now back above both the light blue 50-day SMA and pink 21-day EMA, eyeing trying to get back into the mini ascending channel. The RSI held the 45 support and has now bounced quite strongly off this level. Potentially some risk-off buying too as the S&P and Nasdaq rolls over. Nordea have created an interesting chart which is something I agree with (aided by the fiscal stimulus), is the idea of US growth outperformance like we saw back in 2017 - which I raised in my 2021 outlook. Major banks are upgrading their 2021 GDP growth forecasts for the US, ranging from 5-6%, whereas the EU Commission have cut its 2021 growth forecast from 3.8% from 4.2%. Equity investors typically want to invest in higher growing economies as this translates into better earning and therefore stock prices. In order to buy US equities you obviously need to buy the currency in which those equities are denominated – the dollar.

Source: Nordea

The tech space is another area to keep a close eye on with yields rising as they are considered a long duration asset – i.e. their value is derived from cash flows being discounted by lower rates. Once rates start increasing, those cash flows and hence price begin to come under pressure. The NASDAQ is rolling over today and is close to the pink 21-day EMA around 13487. On a larger correction we could see a revisit of the light blue 50-day SMA around 13k.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg)