Analysis

January 2024 FOMC Preview: Cuts Coming, But Not Yet

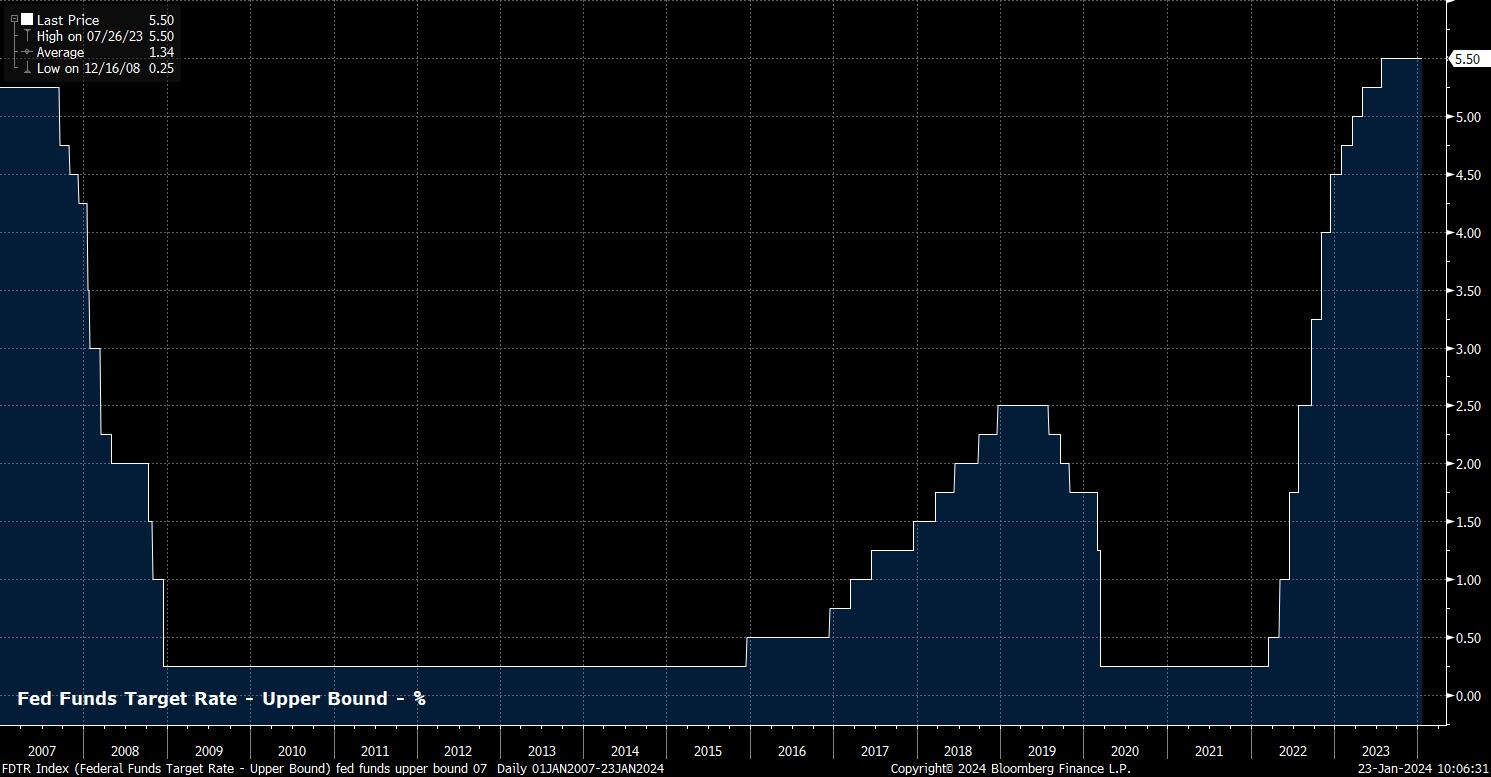

As noted, the target range for the fed funds rate is all but certain to be maintained at a 22-year high 5.25% - 5.50% at the January meeting, in what should be a unanimous vote. On that subject, it is worth noting that, as is typical, the January meeting sees the usual annual voting rotation take place, with Barkin, Bostic, Daly, and Mester replacing Goolsbee, Harker, Kaskhari and Logan as voting members. At the margin, this represents a modestly more hawkish makeup of voting regional Fed presidents, though the hawkish Cleveland Fed President Mester is set to retire in June.

Unsurprisingly, money markets price next-to-no chance of any rate move at the January meeting, though do continue to price a relatively aggressive path of rate cuts for the remainder of the year. At the time of writing, OIS implies around a 45% probability of the FOMC delivering this cycle’s first cut at the March meeting, though this has pared from a peak of around 80% at the turn of the year.

Further out, this pricing becomes even punchier, with OIS fully discounting the first 25bp cut by the time of the May meeting, while also pricing around 135bp of easing across the year as a whole. Of course, this is significantly more dovish than the FOMC’s most recent ‘dot plot’, presented at the December meeting, which pointed to a median expectation for 75bp of cuts this year, while also being rather ahead of recent rhetoric from FOMC speakers, the vast majority of whom have continued to flag that it is too early to declare victory over inflation. This includes Governor Waller, whose dovish remarks in November helped risk to rally strongly into the end of 2023, who also noted the need to be “methodical and careful” about easing once cuts begin – two words that one could not reasonably use to describe the current market-implied rate path.

In any case, largely in reflection of the aforementioned recent Fedspeak, substantial changes to the FOMC’s policy statement appear unlikely at this stage. Hence, the statement is likely to once again make reference to “the extent of any additional policy firming that may be appropriate”, with the addition of ‘any’ having been made at the December meeting in an apparent nod towards the hiking cycle having wrapped up.

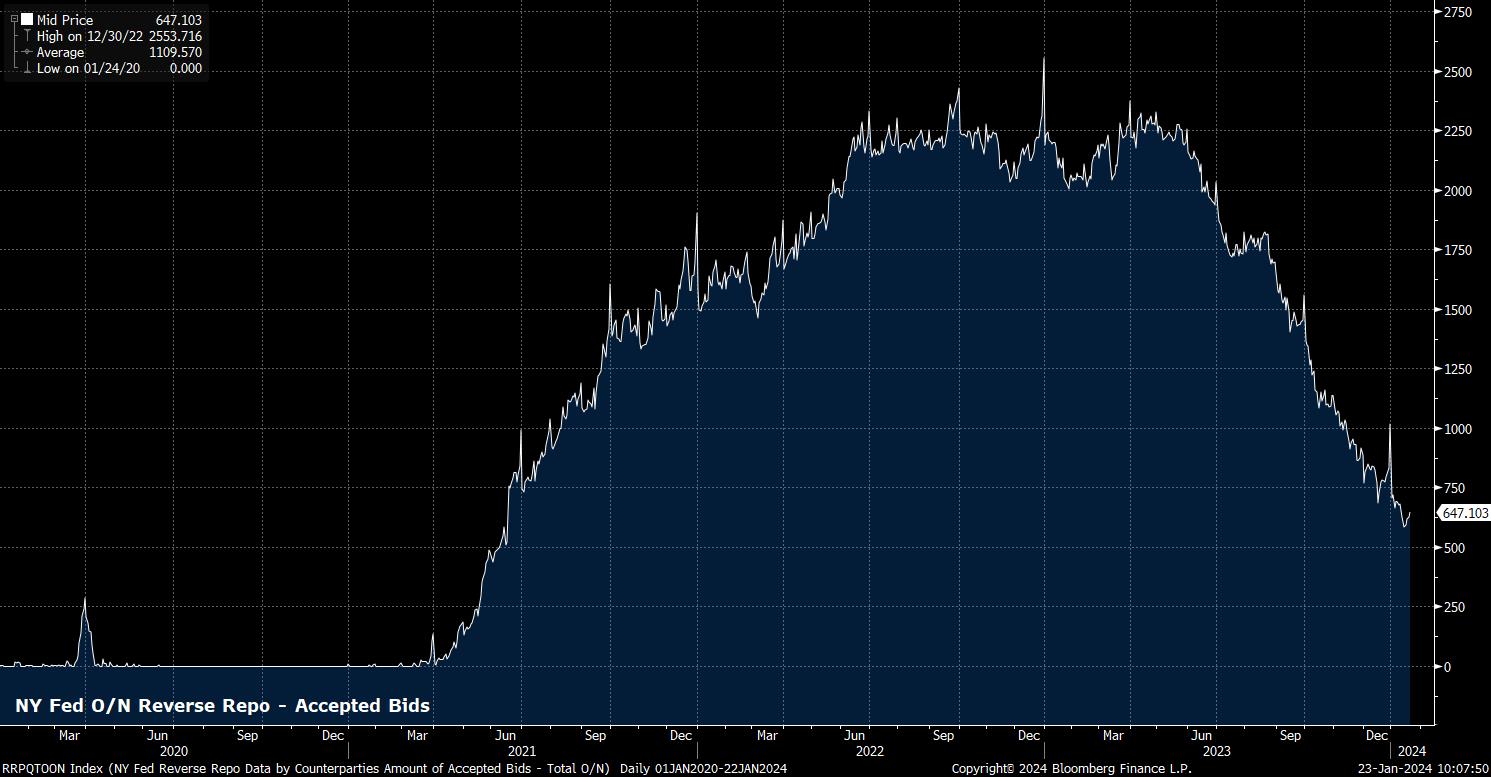

Other policy guidance is also unlikely to see anything by way of significant changes, with incoming inflation data, labour market reports, and international developments continuing to comprise the key determinants of policy shifts. Furthermore, any fresh comments on quantitative tightening – in the statement, at least – are also unlikely, though dwindling overnight reverse repo take-up, and the financial system more broadly continues to approach the lowest comfortable level of reserves (aka the ‘LCLoR’), mean this topic is likely to be raised at the post-meeting press conference.

The continued resilience of the US economy gives the FOMC little need to make drastic alterations to the policy stance at the current juncture.

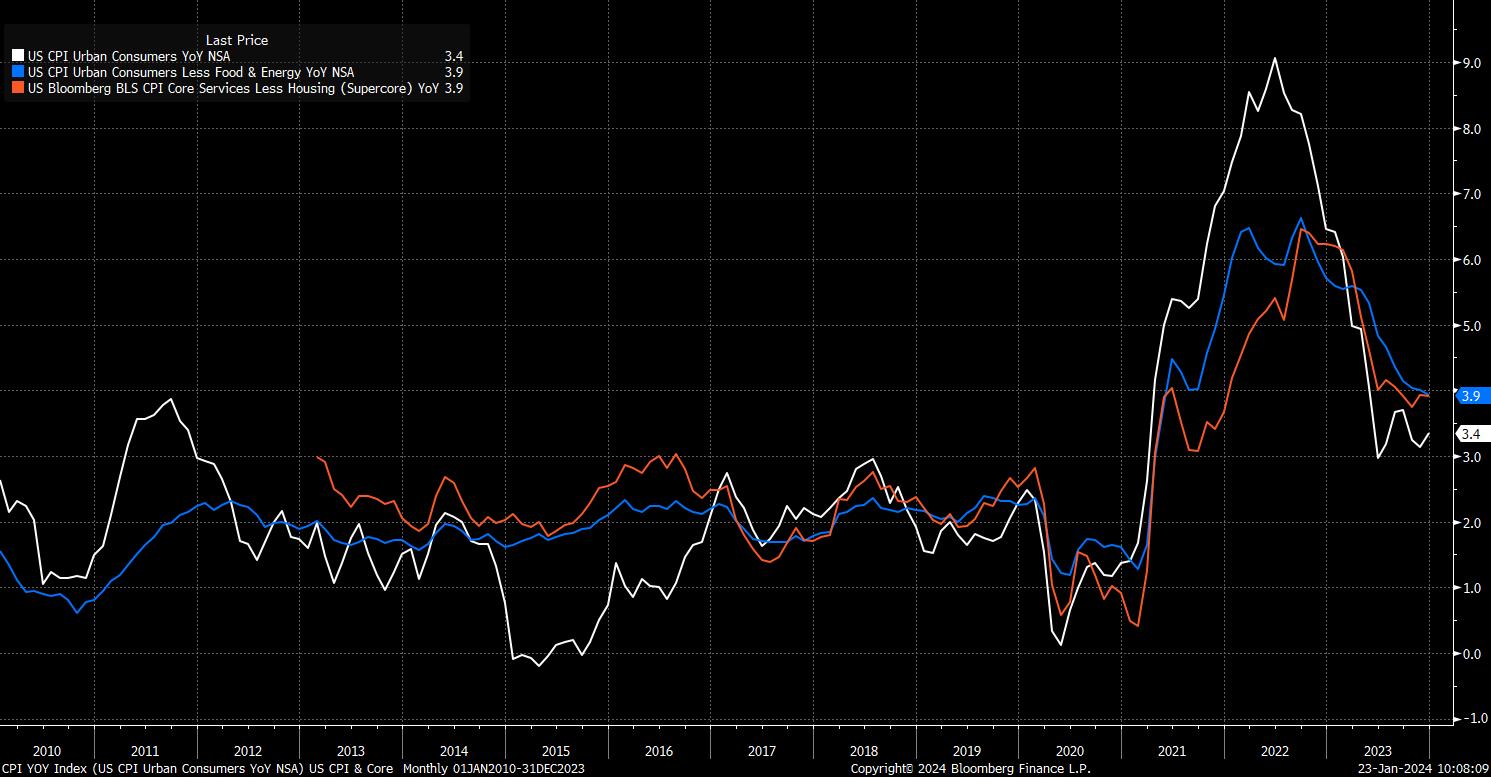

On inflation, progress on returning to the 2% target continues to be made, though the pace of said disinflationary progress has slowed in recent months. While core CPI has continued to decline, now sitting below 4% for the first time in over two years, headline CPI ticked marginally higher in December, to 3.4% YoY, though said uptick was largely driven by energy-induced base effects.

Likely of more concern to policymakers is the continued sticky nature of ‘supercore’ inflation – prices excluding food, energy, and housing – which has remained around the 4% handle for the last six months, and made little progress since last June. As has been the case for some time, signs point towards the ‘last mile’ of disinflation being the most difficult, further lessening the chances of substantial near-term rate cuts.

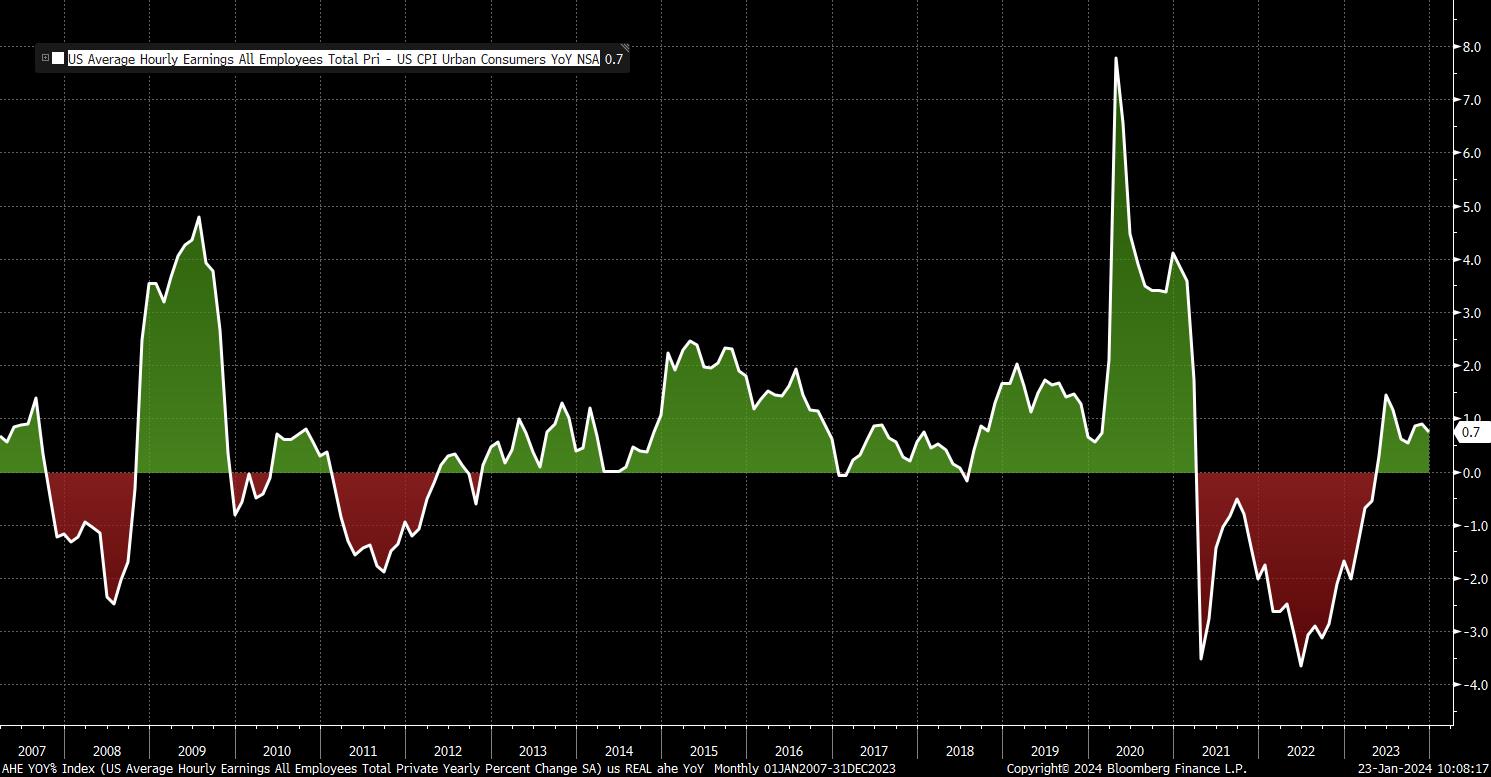

Meanwhile, as inflation continues to decline, the labour market has remained tight. Headline nonfarm payrolls rose +216k in December, the fastest pace in three months, extending a streak of consecutive monthly job gains into a 36th month, the fifth longest such run since BLS records began.

Other areas of the latest jobs report also continue to indicate tightness, with unemployment having remained close to cycle lows at 3.7% as last year drew to a close, while average hourly earnings rose 0.4% on the month, pushing the annual pace to 4.1% YoY. That, however, still represents real earnings growth of just 0.7% YoY, a rate that is highly unlikely to concern policymakers, with the risk of a wage-price spiral developing, particularly this late in the cycle, now miniscule.

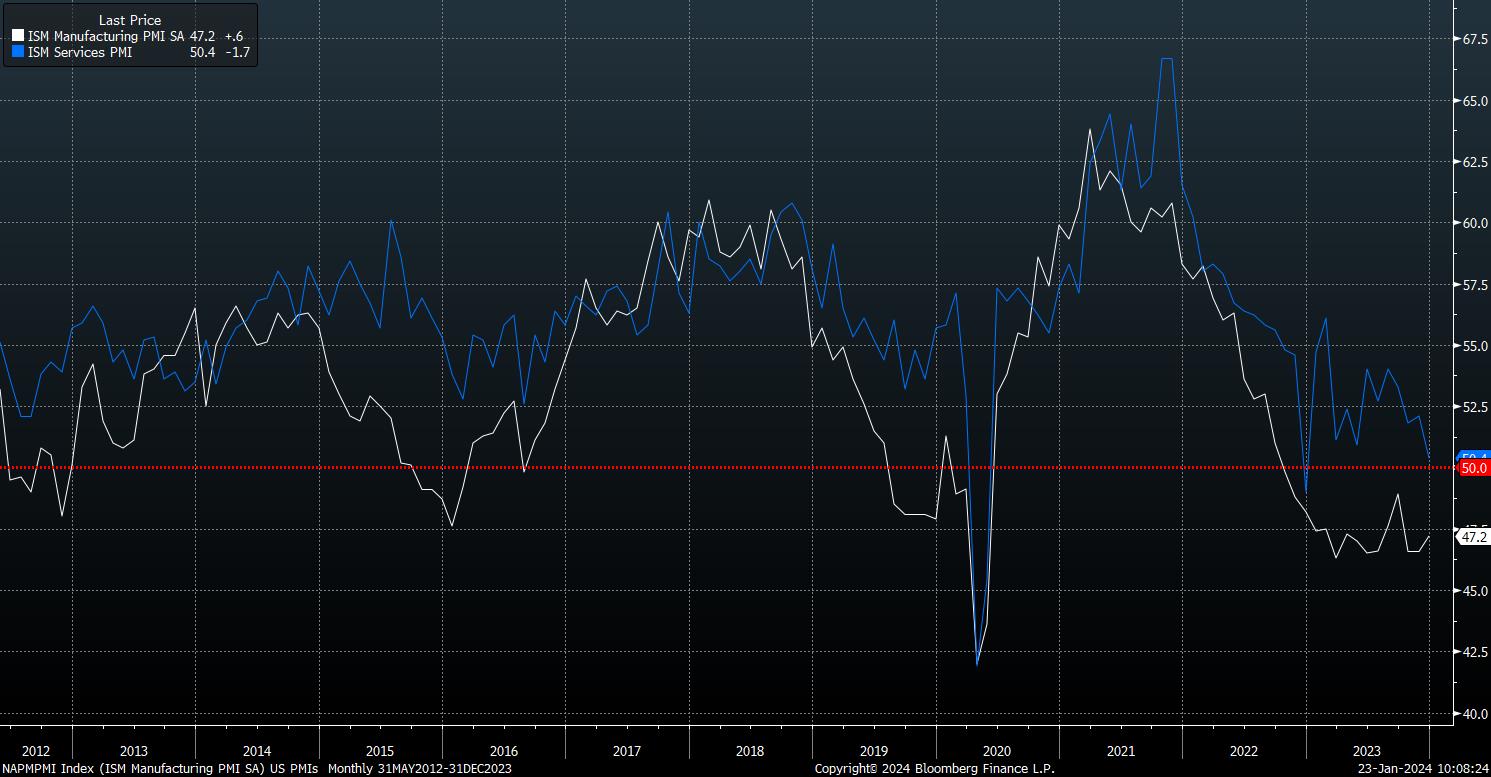

Turning to growth, the outlook remains positive, though economic momentum does continue to wane, and some blots are beginning to appear on the copybook, not least the chunky downside surprise in December’s ISM services print – falling to a one-year low 50.4 – as well as the recent Empire State Manufacturing Survey, which dived to a post-pandemic low -43.7 to kick-off 2023.

Nevertheless, though the economy does show signs of slowing, this appears more to be a continued moderation of activity as the economy glides towards a ‘soft landing’, rather than any warning signs of a deeper contraction, though of course Committee members will remain attuned to any risks as they develop, particularly in the geopolitical sphere.

Altogether, with the assessment of current economic conditions, and the outlook, likely larger unchanged, Chair Powell’s post-meeting presser is likely to, by and large, be a repeat of that seen after the December meeting, noting that inflation remains too high, the Committee are “proceeding carefully” at this stage in the cycle and that, while prepared to hike again if required, the timing of rate cuts remains under discussion, though the actual delivery of said loosening remains some way off.

Risks, however, likely point to Powell being a touch more hawkish than after the December decision, given the aggressive dovish repricing and easing in financial conditions seen towards the tail end of 2023. Furthermore, given the likely scarring of the 2021-22 period whereby price pressures were dismissed as ‘transitory’, only for policymakers to then embark on the most aggressive tightening cycle in four decades, the FOMC are likely to err on the side of caution in terms of timing the first cut, in an attempt to avoid a stop-start approach to the eventual easing cycle.

For markets, the bar for a dovish surprise from the FOMC to kick-off the year is a relatively high one, given the aforementioned OIS pricing, even if bets on a March cut have faded of late.

Consequently, although explicit pushback on the idea of easing policy in the first quarter is unlikely, even a ‘copy and paste’ from the December decision may be viewed through a hawkish lens via market participants. In turn, this likely poses upside risks to the USD, which has rallied well against most G10 peers to begin the year, while also posing a further downside risk to the front-end of the Treasury curve, though the Treasury’s quarterly refunding announcement will of course also play a role here.

_d_2024-01-23_10-09-44.jpg)

Equities, meanwhile, also have plenty to digest, as all three major US benchmarks trade at new record highs for the first time in three years. While the FOMC, of course, will have an impact, Q4 earnings from the ‘magnificent seven’ and other ‘big tech’ names are likely of more importance for the stock market over the medium-term.

Here, strong corporate guidance likely required to accompany any earnings beats (compared to already downwardly-revised consensus expectations) in order to re-affirm present earnings growth expectations and to ensure a more sustainable rally.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.