Analysis

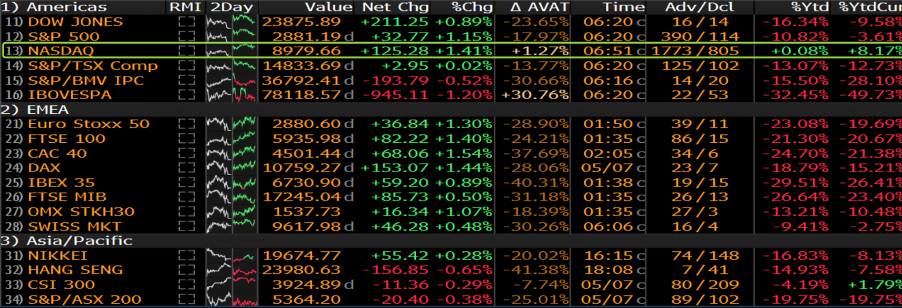

The NASDAQ 100 cash has broken out (topside) and the fact the index is now higher for 2020 won’t have gone unnoticed - although we’re yet to see the futures also break out, but it doesn’t feel far off. Small caps outperformed large caps, with the Russell 2000 working +1.6%, while the S&P 500 has closed +1.2%, with 78% of stocks higher, with energy, financials and materials leading the way, and healthcare moving to the bottom of the pile – how’s that for rotation?

(Source: Bloomberg)

I guess the bulls would have liked not to have seen a steady bleed lower into the close, with the index having been as high as 2901. So, the tail-off removes some of the gloss from a market that at one stage had seen the VIX index into 30.37%. Throw in some broad USD weakness, with USDMXN having a solid run lower and seemingly wrestling the mantra as the beckon of risk in FX from AUDJPY, and we’ve seen sentiment turn. Don’t discount the influence that has played out as a result of USDCNH weakness (yuan strength), with the market getting excited on reports that USTR Lighthizer and Chinese VC He will meet next week.

As I have mentioned in recent reports, if you focus on the macro to make trading decisions, with the US-China relationship a growing theme, then USDCNH must be on the radar – a stronger CNH is good for the AUD and equity sentiment more broadly.

We saw the weekly jobless claims come in at a slightly above consensus 3.169m claims, and while this is in no way a positive from a humanitarian perspective, its seems to have galvanized the market's confidence in forecasting tonight’s NFP estimate. Judging by the moves, this is not a market worried about holding risk in the jobs report, where 22m jobs are expected to have been lost and the unemployment rate to rise to 16%.

The US fixed income market may offer some clues here, with a solid rally seen all through the curve. New lows have been printed in US 2-year Treasuries, with the fed fund futures trading above par (100) through the December 2020 contract and now pricing an element of negative rates from December and into 2021. We saw this priced in the OIS (swaps) markets, which I highlighted yesterday, but now in fed funds too. We can point to comments in the session from Fed member Bostic, re-iterating its view of the Fed able to deploy its “full arsenal” – it’s hard to read into this too greatly given under the current legal system the fed funds effective rate cant drop below zero.

Some have also regurgitated an article from noted economist Kenneth Rogoff arguing for negative rates.

Either way, the rates markets is speaking out and this could have huge implications for the US banking sector, bond yields and the USD. It is a complicated subject, but it is interesting to see US banks working well despite the moves in rates and the slight flattening of the yield curve, with long-end yields coming lower more aggressively. One suspects Fed general Powell will try and put some perspective on this debate soon and let us know what he feels, and I suspect it may cause the market to part unwind these negative rate bets.

We saw a solid bid in crude, with Brent crude lifting into $32 before rolling over an hour or so before the US equity cash open. The Saudi’s may have talked about lowering the discount on crude shipped to key customers, but the initial euphoria has not held. What did hold were the gains in the NOK, and that despite a surprise rate cut by the Norges Bank. EURNOK shorts are working, although EURJPY has given some back as the JPY softened on the slight bid in risk.

On the docket today, there will be a small focus on the RBA’s SoMP but I can’t see this being a huge vol event for AUD traders, who continue to watch USDCNH and S&P500 futures.

By way of house news, we have put USDTRY on closings only given Turkey’s regulator has banned its local banks from dealing with three international players and liquidity is going to be an issue as sell-side banks and FX market makers are less willing to offer a two-way price. This could lead to incredibly dislocated markets and one that poses a risk to all involved.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.