Analysis

February 2025 BoE Preview: Slow & Steady Cuts To Continue

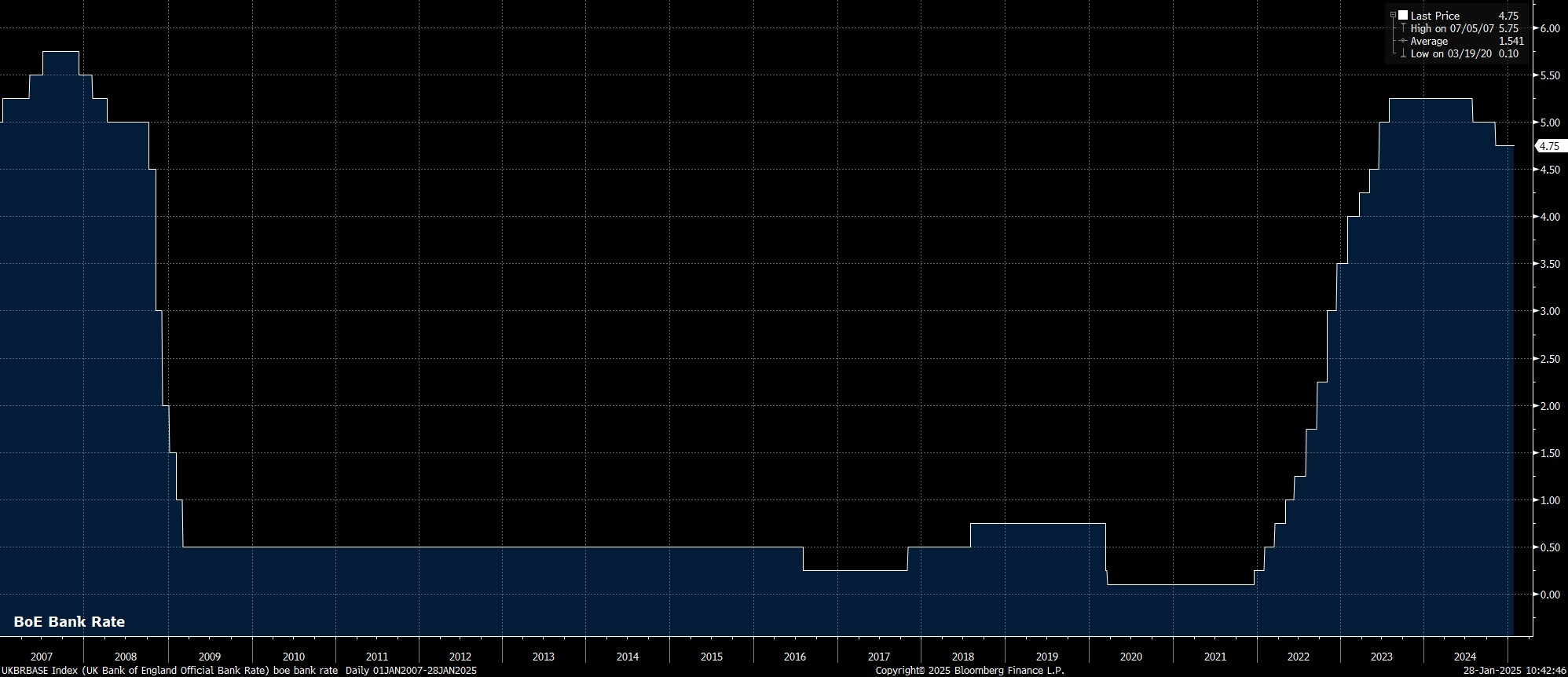

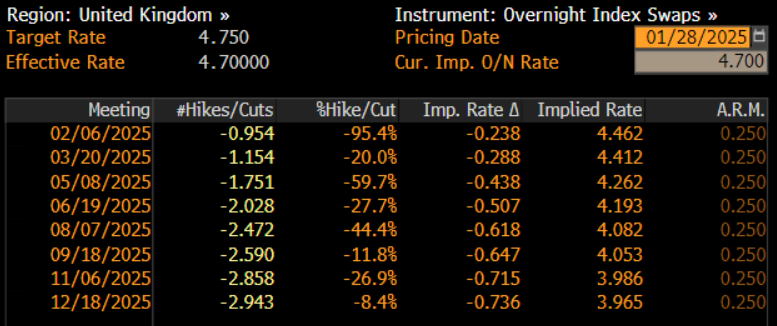

As noted, the MPC are set to lower Bank Rate by 25bp, to 4.50%, at the conclusion of the February meeting, continuing their slow and steady path back to a more neutral policy stance. Money markets, per the GBP OIS curve, price around a 95% chance of such a cut being delivered, with said odds having been strengthened by cooler-than-expected December inflation data.

However, as with the cuts that have already been delivered this cycle, the decision to further reduce Bank Rate is unlikely to be a unanimous one among the 9-member Committee.

In December, 3 members, Deputy Governor Ramsden, along with external members Taylor and Dhingra, dissented in favour of a 25bp cut. These three are likely to vote for a cut once again this time around, with the latter two having marked themselves out as the MPC’s uber-doves in recent months.

Joining them, is likely to be Governor Bailey, Deputy Governors Breeden and Lombardelli, as well as Chief Economist Pill. This, clearly, would create a majority of at least seven members in favour of a 25bp Bank Rate cut.

Uncertainty over the vote split stems primarily from the hawkish side of the equation, and external members Mann and Greene. Mann stands as the MPC’s most hawkish member, having noted that 100bp of cuts this year would be “too aggressive”, and that there remains a “tremendous” amount of inflation persistence within the UK economy. Greene, meanwhile, has thus far advocated for a “cautious” approach to rate cuts, having voted against the August cut, but in favour of the November reduction.

Combining all of that, an 8-1 or 7-2 vote in favour of a 25bp cut seems most likely, with the former being marginally more likely. In any case, following a cut at the February meeting, the curve fully discounts the next 25bp cut by June, while fully pricing 72bp of easing by the end of the year.

Accompanying the MPC’s split decision to deliver another rate cut, is likely to be guidance that broadly reflects not only that issued after the December meeting, but which also mirrors the language that has been used throughout the easing cycle.

Consequently, the statement is once more likely to reiterate policymakers’ focus on the risks of inflation persistence within the UK economy, while stressing that a “gradual” approach to removing policy restriction remains an appropriate one. Furthermore, the policy stance will likely need to “remain restrictive for sufficiently long” until upside inflation risks have further dissipated, with the broader policy stance to remain a data-dependent and meeting-by-meeting one.

Along with the policy decision, and statement, the February MPC meeting will also bring an update to the BoE’s economic forecasts.

Since the prior forecast round in November, market-based rate expectations have repriced in a marginally more hawkish direction, though the degree to which the early-January spike in Gilt yields is accounted for in the updated projections remains to be seen. In any case, significant revisions to the November baseline appear unlikely, particularly as the impacts of October’s Budget will not be fully clear until the second quarter of this year.

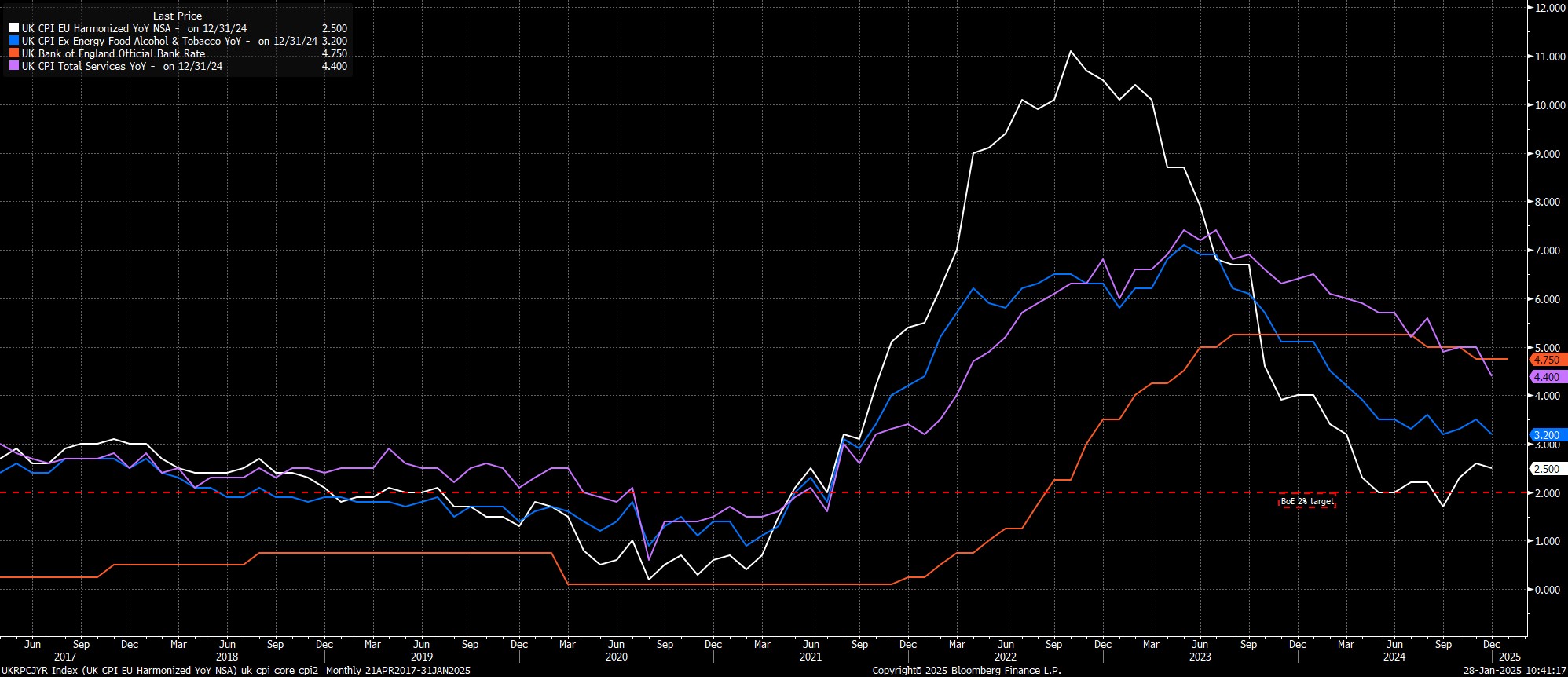

On inflation, the Bank’s projections are once again likely to see headline CPI returning to the 2% target in 2027, despite the GBP OIS curve having repriced, with the aforementioned Budget seen as presenting upside inflation risks, along with the likelihood that a further rise in energy prices, and unfavourable base effects, see headline inflation rise towards 3% by the middle of this year, before fading once more.

Nevertheless, recent inflation data does, perhaps, give the MPC some cause for cautious optimism, particularly with services CPI having fallen to 4.4% YoY, the slowest annual pace since March 2022. One-off statistical quirks, however, such as the reference data used to collect airfares, likely exerted significant downward pressure on the figures, and will probably lead policymakers not to read too much into the data.

In a similar vein, policymakers are highly unlikely to place significant weight on incoming labour market data, which remains plagued by inaccuracies and quality issues.

In any case, taking the figures at face value, the labour market does appear to be slowly but surely exhibiting a greater degree of slack, with unemployment having risen to 4.4% in the three months to November, a 6-month high. Despite that, earnings pressures remain intense, with regular pay having risen 5.6% YoY over the same period, a pace that is clearly incompatible with a sustainable return to the 2% inflation target over the medium-term.

The Bank’s unemployment forecasts are likely to be largely unchanged, though near-term expectations may be ‘marked to market’ and upwardly revised a touch. The impact of this on the policy outlook, though, will be negligible at best.

Finally, while the Bank’s expectations for GDP growth appear wildly optimistic, in light of the numerous headwinds facing the UK economy, any significant downward revisions here will likely have to wait until later in the year.

Meanwhile, at the February press conference, Governor Bailey is unlikely to offer anything in terms of explicit pre-commitments as to the future Bank Rate path, despite having previously indicated that a total of 100bp of cuts this year would likely be carried out under the MPC’s central scenario for the UK economy. Bailey is also likely to refuse to make any comment on the fiscal backdrop, or on recent Gilt market volatility.

Overall, while the February MPC meeting will likely see the ‘Old Lady’ deliver this cycle’s third Bank Rate cut, the decision is unlikely to be a game-changer in terms of the broader policy outlook. As such, a gradual, predictable pace of quarterly 25bp cuts remains the base case for now, though risks to this scenario do tilt in a dovish direction, were labour market weakness to dent demand to such a significant degree that the pace of services disinflation markedly quickens.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.