Analysis

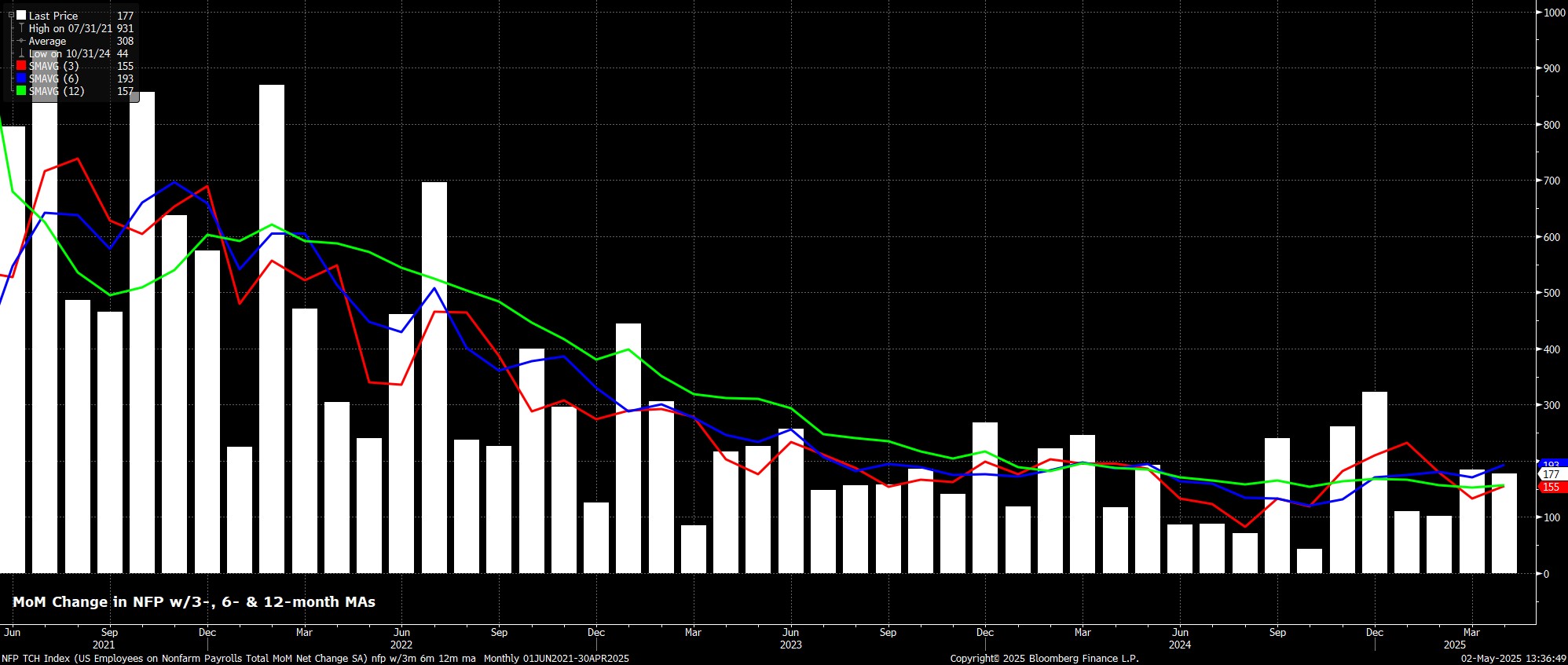

Headline nonfarm payrolls increased by +177k last month, above consensus expectations for a +138k increase, and also to the upside of the typically wide forecast range of +50k to +170k. Concurrently, the prior two payrolls prints were revised by a net -58k, in turn taking the 3-month average of job gains to +155k, broadly in line with the breakeven rate.

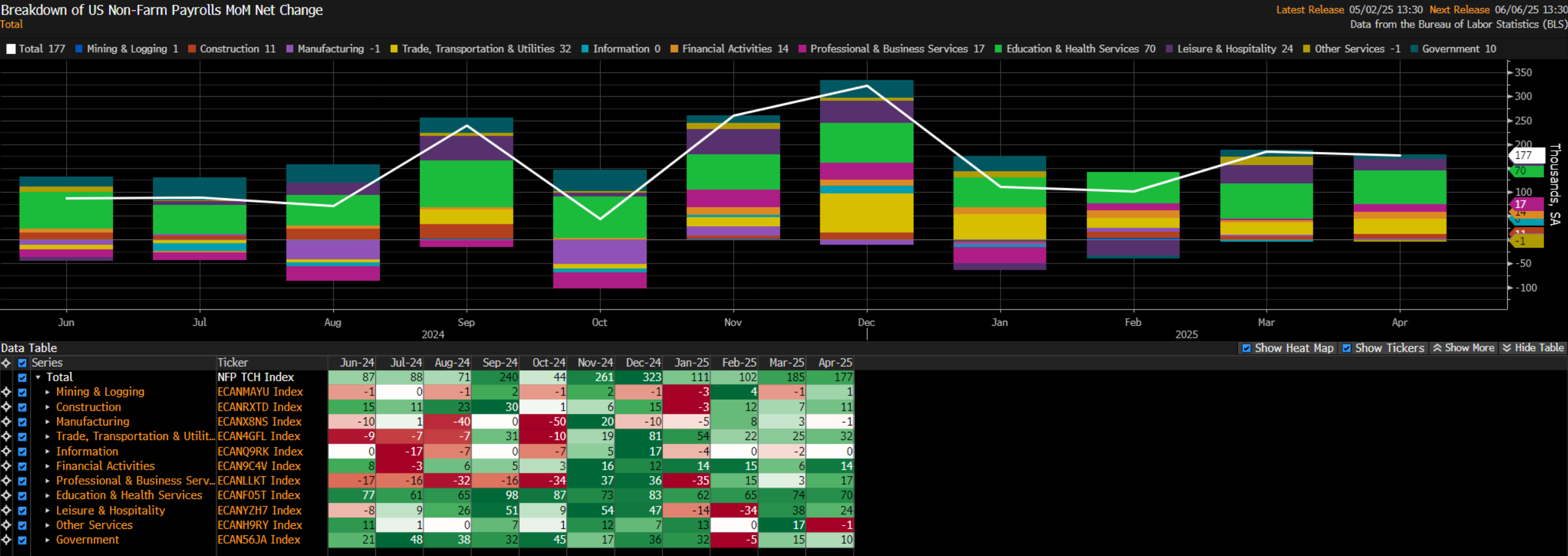

Taking a look under the surface of the payrolls print, job gains were surprisingly broad-based, with Education & Health Services and Transportation making up the bulk of the gains. On the other hand, just the Manufacturing sector saw a modest MoM employment decline.

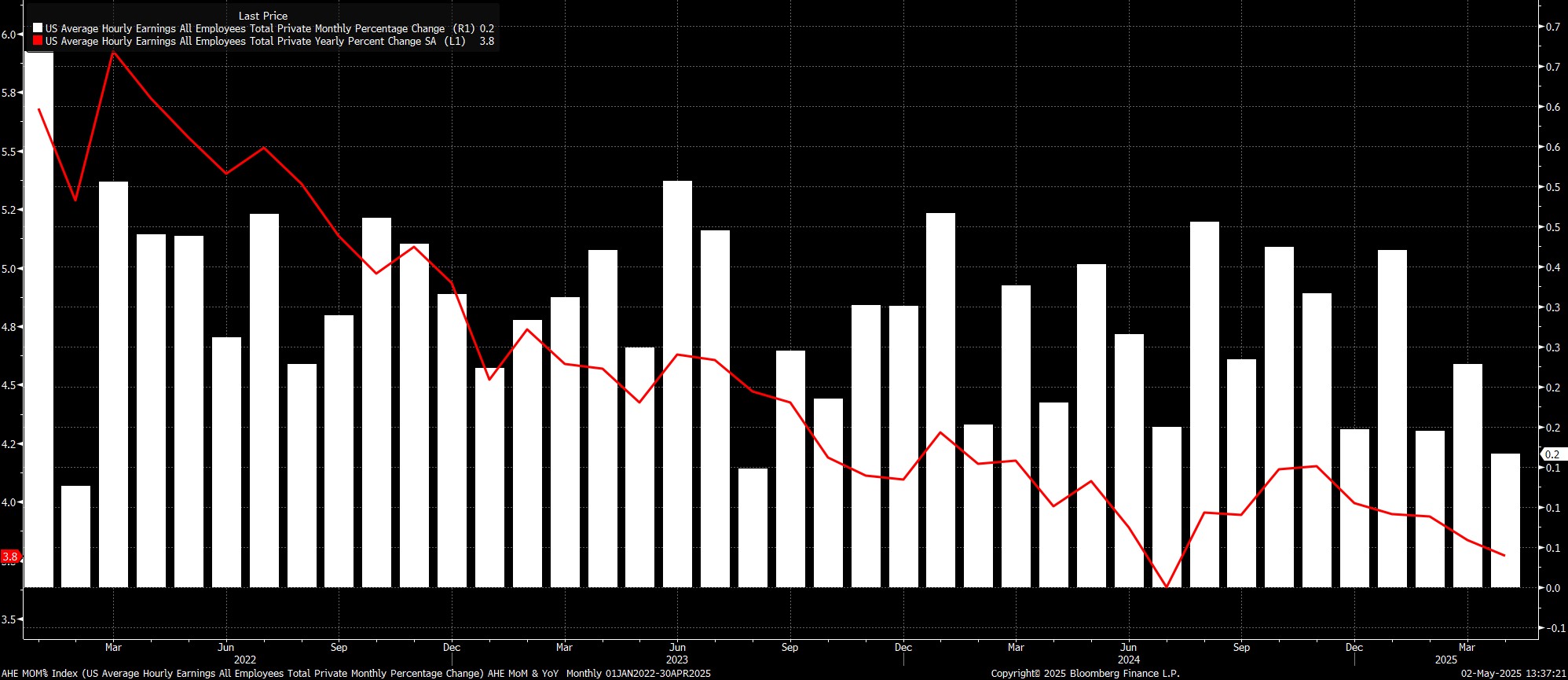

Staying with the establishment survey, the labour market report also indicated earnings pressures having remained relatively contained. Average hourly earnings rose 0.2% MoM, a touch below expectations, in turn seeing the YoY pace remain steady at 3.8%.

This data once more serves to reinforce what is now a long-standing view of FOMC policymakers, in that the labour market does not present a significant degree of upside inflation risk at the present time. That is not to say, though, that there are no upside price pressures at all, with said risks in fact being present in spades, as a result of the Trump Administration’s tariff policies.

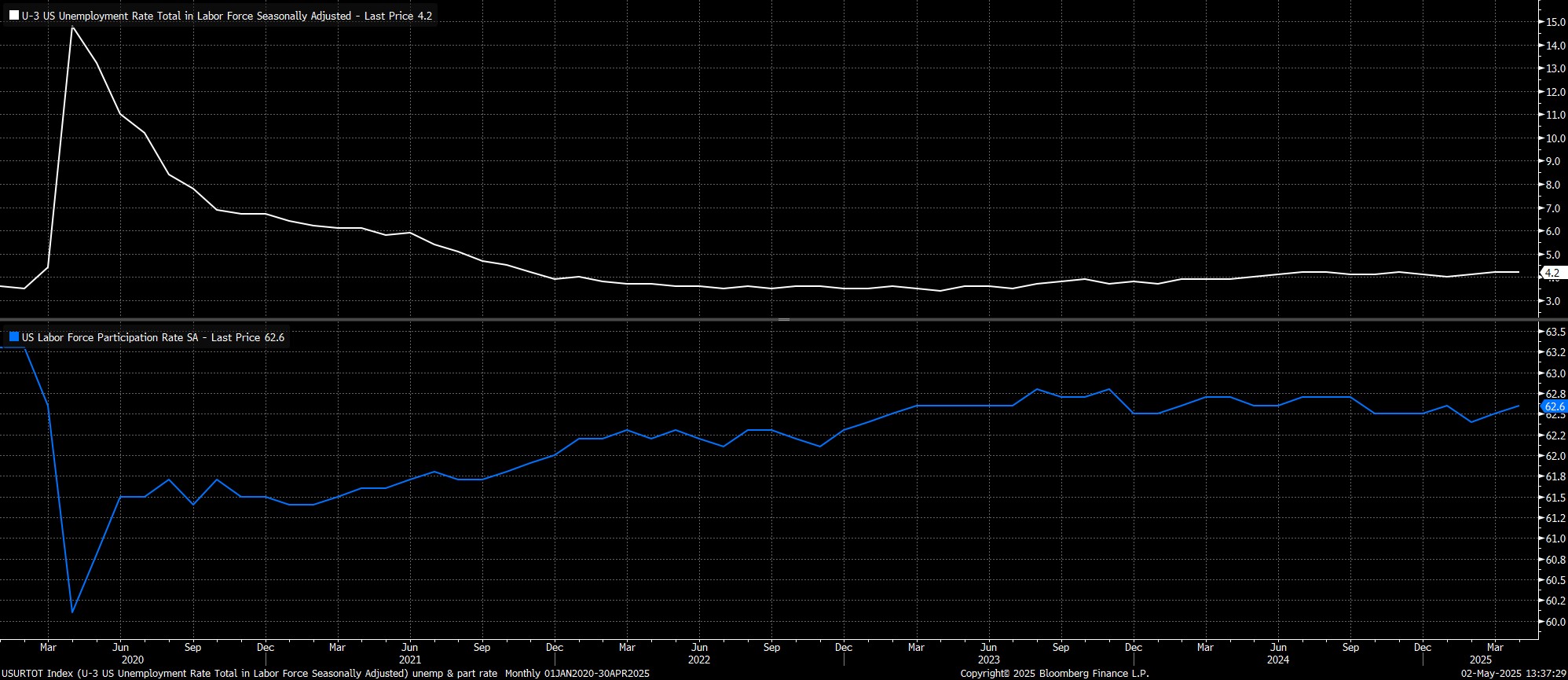

Turning to the household survey, unemployment held steady at 4.2%, despite labour force participation rising to 62.6%, its highest level since January.

This data, though, must continue to be taken with something of a pinch of salt, as the BLS continue to grapple with the impacts of falling survey response rates, and the rapidly changing size and composition of the labour force, particularly due to recent immigration changes.

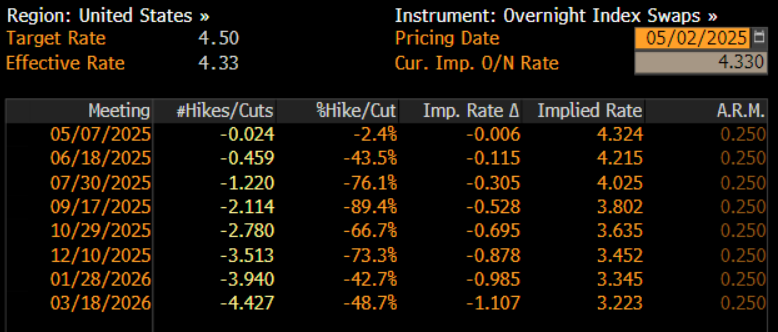

In reaction to the jobs report, money markets underwent a marginal hawkish repricing, now seeing a roughly even chance of a 25bp cut by June, compared to the 60% pre-release. By year-end, the USD OIS curve now discounts a total of 87bp of easing vs. 90bp prior.

Taking a step back, it’s tough to argue that the labour market report is a major game changer in terms of the FOMC’s policy outlook.

Powell & Co remain firmly in ‘wait and see’ mode for the time being, especially with mounting risks that each of the dual mandate goals – price stability, and maximum employment – come into conflict with each other, as the impact of tariffs, and associated policy uncertainty, brings a double-whammy of upside inflation, and downside growth risks, at least in the short-medium term. As a result, policymakers will likely seek to remain on the sidelines for the time being, until greater clarity on the economic outlook can be obtained, and until becoming convinced that there is minimal risk of inflation expectations becoming un-anchored.

Consequently, while the direction of travel for rates clearly remains lower, any cuts before the summer is out still seem a long shot.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.