Analysis

2025 UK Spring Statement: Good News Is In Short Supply

Of course, today’s update was never supposed to be a major fiscal event, amid the Government’s stated desire for a sole such announcement to be held at the Budget each autumn.

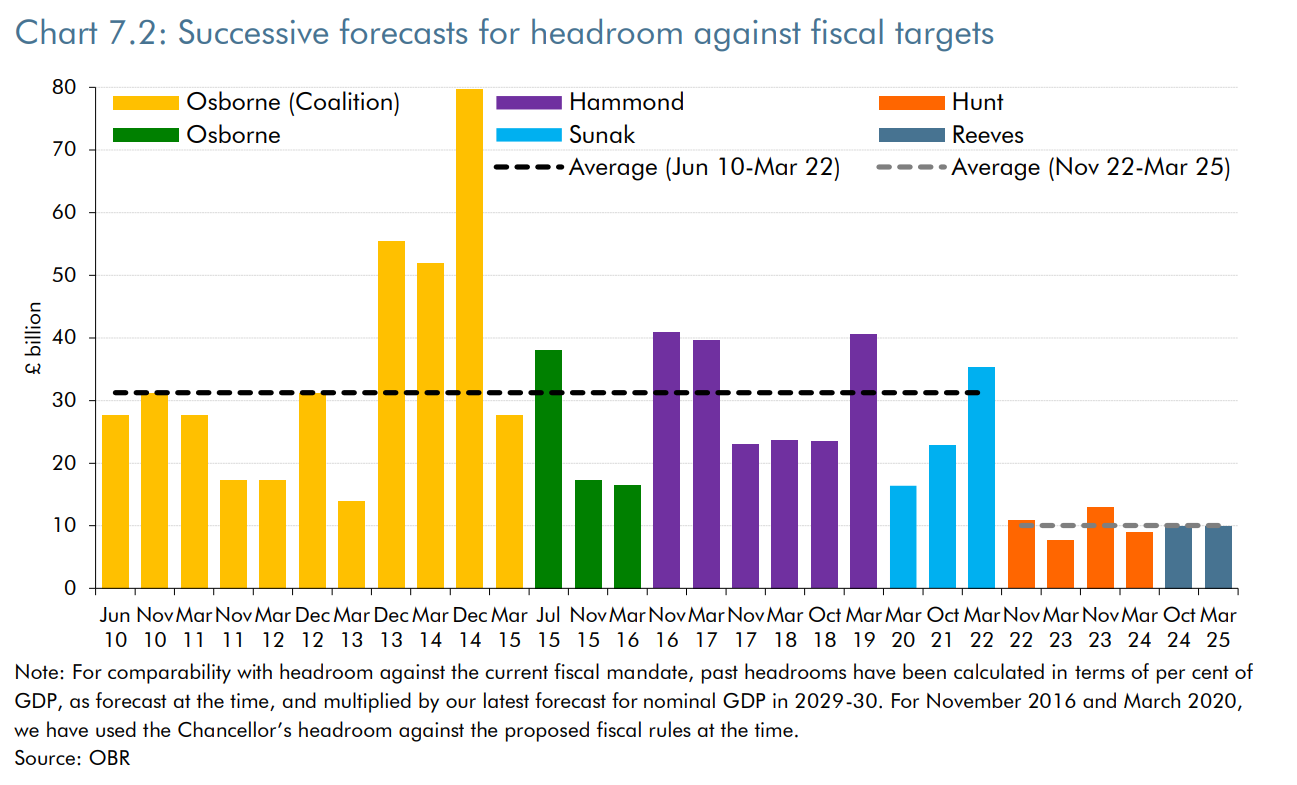

The ‘Spring Statement’ was, instead, merely set to serve as an update as to whether the OBR’s forecasts still held true, and whether the fiscal rules would continue to be met. However, with the Chancellor’s £9.9bln of headroom last October, becoming a roughly £5bln shortfall six months later, fresh measures were clearly required in order to ‘balance the books’.

That headroom, per the OBR’s updated economic forecasts, now stands at £9.9bln, back where it was six months ago. Notably, though, this margin remains considerably below the approx. £30bln average buffer that the Treasury operated with pre-covid.

On the subject of the OBR’s latest forecasts, which are of course notoriously unreliable, expectations for economic growth were slashed. The watchdog now expect the economy to grow by 1.0% this year, a dramatic downward revision from the 2% pace foreseen back in October. Growth is then seen recovering to an average of 1.75% over the remainder of the decade, which seems a very tall order indeed.

It is, however, pivotal to recall that the OBR’s forecasts are already stale, and were as soon as they were published. This is because of the timing of the snapshot of market data used to compute the forecasts, which saw Gilt yields inputted as an average of the 10 working day period prior to 12th February.

Unfortunately for the Chancellor, this means that the forecast is based on yields around 20bp lower than where Gilts presently trade. Hence, in reality, growth headwinds are rather more substantial, and fiscal headroom considerably more narrow, than the OBR’s latest report would lead one to believe.

_10_2025-03-26_13-09-56.jpg)

In any case, in order to – at least on paper – restore a fiscal buffer, Chancellor Reeves delivered a significant fiscal tightening, focusing squarely on spending cuts (figures per the OBR):

- A £4.8bln saving by delivering huge cuts to welfare and other benefits

- Saving £1bln by further tackling tax evasion

- Cutting “government running costs” by 15% by 2030, saving £2bln, along with a further £3.5bln cut to public spending plans, and a £6.1bln cut in “day-to-day” spend by 2029/30

While there were no changes to taxation announced in the Commons, nobody in the UK should get too excited on that front just yet. Tax increases seem, frankly, an inevitability at this stage, even if the Government have decided to punt decisions on that front to the Budget later in the year.

As was the case last autumn, HM Treasury again find themselves operating within incredibly narrow margins for error. Thus, even a minor macroeconomic shock, or a modestly slower pace of growth than the OBR have projected, will see fiscal headroom needing to be restored once more.

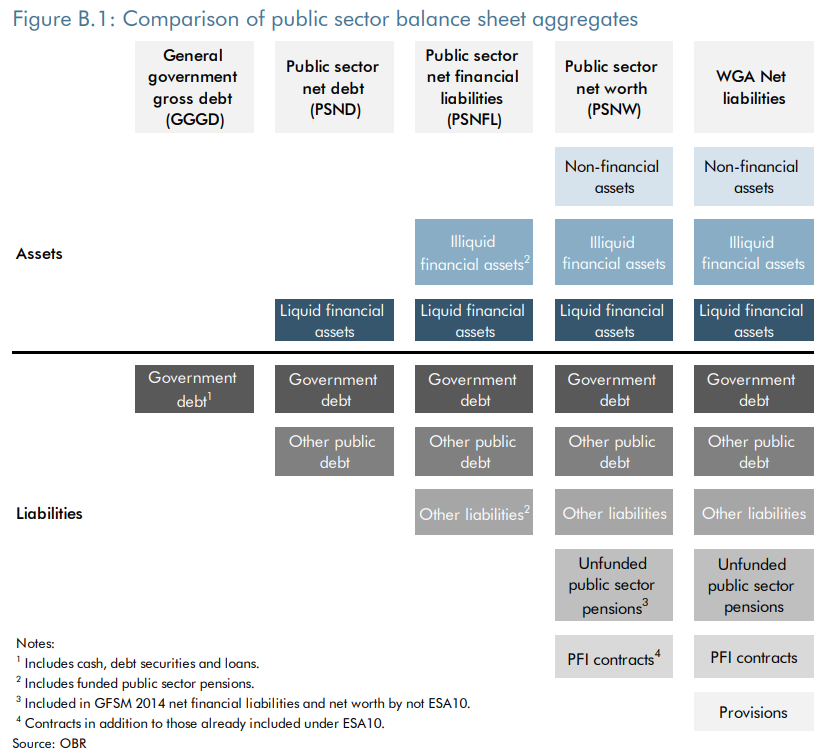

One way to break this doom loop of ever higher taxation, and ever lower government spending, would be to change the fiscal rules, in order to incentivise a more long-term view of the public finances, instead of never-ending short-term tinkering to ensure that PSNFL as a percentage of GDP is falling by the fifth year of the forecast period. The issue, however, is that Reeves lacks the credibility among market participants that would be required in order to enact such a change, without causing a significant adverse reaction, and likely spike in Gilt yields. Hence, the Chancellor continues to find herself stuck between a rock, and a hard place.

Speaking of Gilts, the Spring Statement saw the year-ahead issuance remit set at £299bln, below the consensus £302bln estimate among GEMMs surveyed by Bloomberg. Issuance, again, has been heavily tilted towards the front-end of the curve, as the DMO continue to try and shorten the WAM of overall Gilt sales.

Taking a step back, while the Spring Statement was broadly in line with expectations in terms of the measures delivered, it lays bare the grim state of the economy, the fragile fiscal backdrop which persists, and the Government’s appalling mismanagement of UK PLC. Further fiscal tightening in the autumn, via a combination of tax increases and deeper spending cuts, feels like an inevitability. Everyone would be better served if we simply called a spade a spade, and labelled this as the austerity that it is, even if such a moniker remains politically toxic.

On that note, today’s measures will do little-to-nothing to restore investor and market confidence in the Chancellor’s ability to effectively steward the economy. Consequently, where Gilts go next, or how far yields may now rise, is out of Reeves’s control. The Chancellor’s days appear to be numbered, with it being a question of whether a complete loss of market confidence, or manifesto-breaking tax hikes, eventually bring about Reeves’s demise.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.