Analysis

March 2024 BoJ Recap: Normalisation, Slowly But Surely

This owed primarily to the fact that the policy action was incredibly well-telegraphed in advance, with an exit from negative rates having become the favoured outcome of the March policy meeting after the initial round of Rengo wage negotiations resulted in pay settlements north of 5% being negotiated, for the first time in 30 years. Naturally, BoJ insiders ‘tipping the wink’ to Nikkei journalists, who have an uncanny track record of being on the money with these things, also helped to sap vol from financial markets as the decision dropped.

So, that decision.

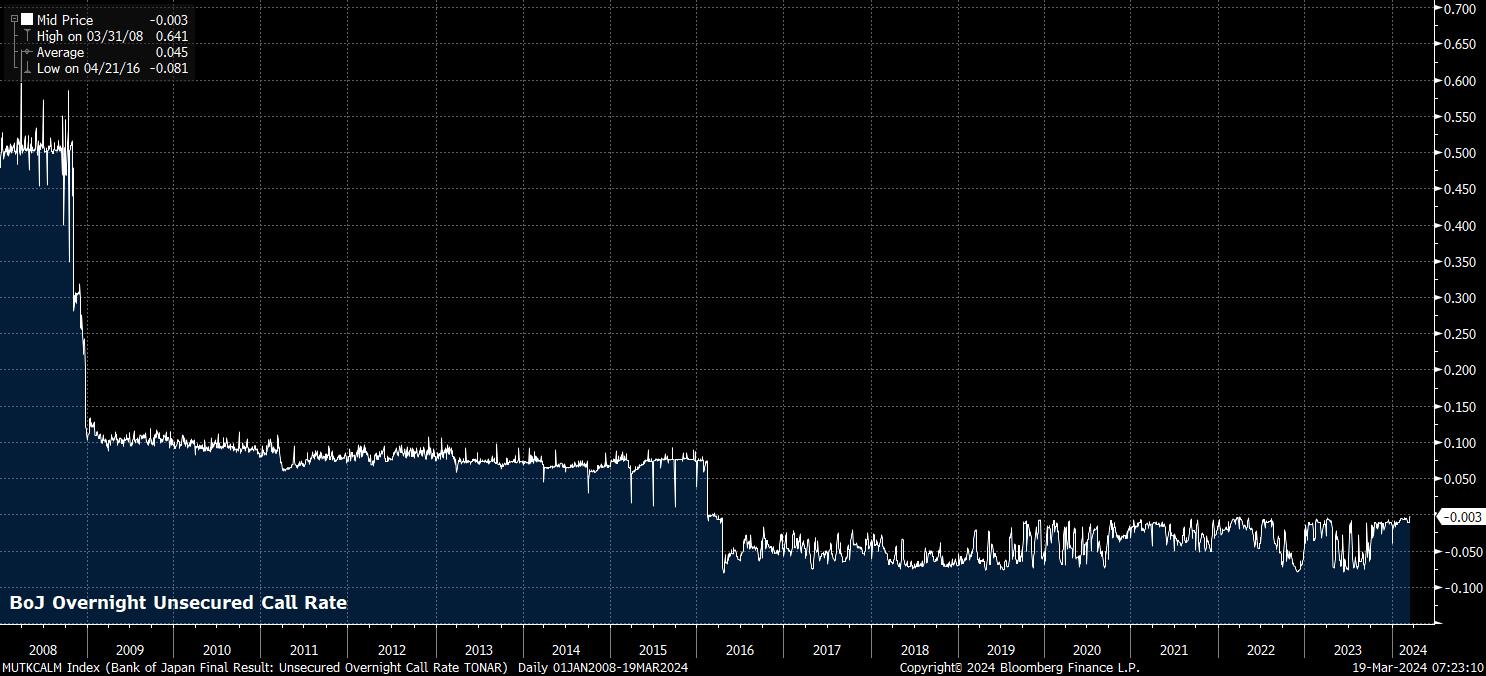

Not only was a 10bp hike delivered, ending the global era of negative rates (to which one hopes we never return), but the BoJ will now reference the unsecured overnight call rate, seeking to maintain said rate in an 0.0% - 0.1% range for the time being.

Furthermore, policymakers brought a formal end to yield curve control (YCC), removing the 1% ‘reference’ cap on 10-year JGBs, though reiterating a pledge to purchase long bonds “as needed”, primarily to ensure continued market stability; it will be interesting the degree to which markets attempt to take on the BoJ with regards to this pledge.

Finally, the BoJ also scrapped their ETF and Japanese real estate investment trust (J-REIT) purchase programmes. In the context of the Nikkei trading at, as near as makes no difference, a record high, and other normalisation measures, this shouldn’t come as a particular surprise.

With all of the above broadly in line with expectations, attention naturally turns to what the BoJ are likely to do next – namely, is this the beginning of a more prolonged tightening cycle, or is this rate hike going to be ‘one and done’.

Governor Ueda’s post-meeting press conference struck something of a balance between the two, with Ueda at pains to stress that the current ‘accommodative’ policy stance will remain in place for some time to come, and that policymakers will take a data-dependent approach to further policy tightening, with any future hikes to depend primarily on the inflation outlook, and the sustainability with which the 2% target is set to be achieved.

This will likely disappoint some JPY bulls, who had been expecting the BoJ to prove something of a hawkish outlier among G10 central banks this year. Such a scenario now seems relatively unlikely, especially with Ueda himself noting that a “rapid” pace of hikes is likely to be avoided based on the current outlook.

Consequently, and as has been the case for some time now, the JPY looks like it will remain a proxy US rates trade, as the below chart shows nicely. Here, near-term risks to Treasuries appear tilted to the downside, particularly after three straight hotter-than-expected US CPI prints, and with the risk lingering that the Fed’s median 2024 dot is bumped 25bp higher at the conclusion of the March FOMC.

_j_2024-03-19_07-23-38.jpg)

In fact, the JPY’s best hope of long-run appreciation seems to stem either from a sharp rolling over in US growth, forcing the FOMC into a drastically more dovish stance – which seems unlikely at present – or a dramatic flare-up in geopolitical risk, subsequently leading to a surge in haven demand, though the loosening policy backdrop somewhat insulates markets from said risk for now, and in any case such a move would likely prove relatively short-lived.

In summary, then, while the era of NIRP is now at an end, and the BoJ’s “unprecedented easing” has now ceased, headwinds facing the JPY remain as they were prior to normalisation getting underway.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.