Analysen

Russia, Brazil and Turkey all hiked by more than anticipated, with the latter resulting in President Erdogan sacking the head of the Turkish central bank. The wash-up is we have several EM central banks aiming to get ahead of the curve, with inflationary trends becoming somewhat problematic.

In the developed market (DM) space, these diverging trends are less pronounced, but they are emerging and giving trading signals to fundamental-focused traders.

The Norges Bank (Norway) have detailed that they will hike later this year. The RBA, BoC and BoE are clearly in no rush to hike but may need to sooner than they are guiding too if economics continue their current trajectory.

The Federal Reserve has shown us they have an incredible tolerance for inflation and will actively pursue it believing that after base effects push inflation towards 3%, these pressures will be transitory and inflation will gravitate back towards 2%. The biggest risk being debated on the floors is what happens if these pressures aren’t transitory.

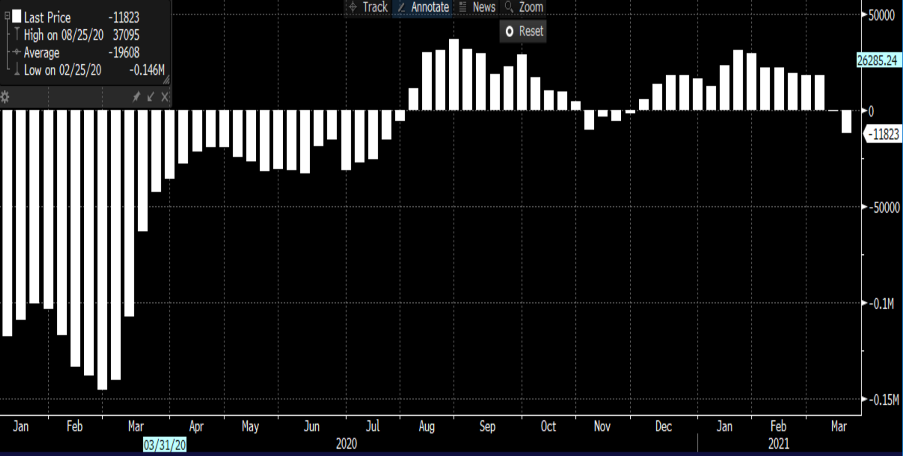

The ECB remain relatively dovish and continue to bring in new easing measures, aimed at targeting nominal bond yields by increasing the pace of asset purchases at a “significantly higher pace”. The market has seen US ‘real’ (inflation-adjusted) 10-year US Treasury yields widen to a 92bp premium over German bunds (also inflation-adjusted). US vs EU short-term rate differentials have increased in favour of the USD, with US interest rates market priced for three hikes by end-2023, while EU rates are largely unchanged. The EUR is the dominant funding currency for carry strategies and it’s also no surprise that leveraged funds have increased their net short EUR exposure to -11,823 futures contracts – the most since July 2020.

(Weekly CFTC report – Leveraged accounts holdings of EURUSD futures)

(Source: Bloomberg)

The BoJ continue to tweak policy, allowing 10-year Japanese government bonds to move in a slightly more flexible range. Ultimately the BoJ won’t be lifting rates anytime soon and the central bank remains dovish.

The risk of an inflation overshoot

So, there are divergences afoot in the central bank landscape that are causing gyrations in financial markets and need monitoring. These changes will provide some excellent FX trading opportunities. However, the elephant in the room remains Fed policy and the prospect that they become dangerously behind the curve if the labour market evolves, fiscal stimulus lifts growth substantially and animal spirits kick in.

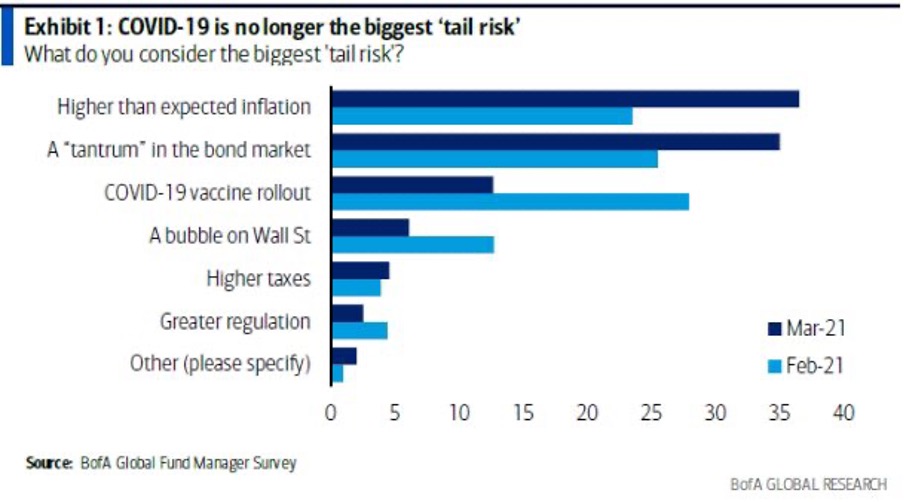

The Bank of America fund manager survey

If we focus on the recent Bank of America fund manager survey, we see by far the biggest tail risk highlighted by this pool of influential market participants is that of higher-than-expected inflation. This is the type of inflation that isn't seen as temporary and more secular and would cause the Fed to slam on the hand break.

This argument may take time to play out and it may be true that the Fed are correct in its judgement call that inflation spikes are temporary.

How will we know inflation is transitory?

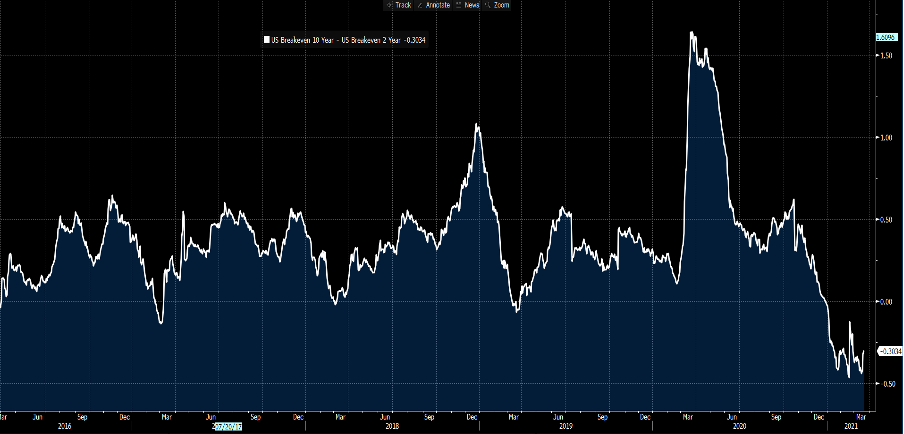

The best indicator we have lies in the bond market and specifically the ‘breakeven’ rate – this is the difference between the TIPS markets (Treasury Inflation Protected Securities) and nominal Treasury yields. Breakevens measure the expected average CPI inflation over the set duration, say 2,5 or 10-years.

10yr Breakevens – 2yr breakeven inflation expectations – currently -30bp

(Source: Bloomberg)

If I look at the ‘breakeven curve’ or the difference between 10-year inflation expectations and 2-year inflation expectations we see this at -30bp. The 5-yr breakeven rate trades at a 6bp discount to 2yr breakevens. In essence, we see short-term inflation expectations trading at a premium to medium and longer-term inflation expectations. Therefore, the market shares the view that inflation will meet the Fed’s inflation target but will prove to be transitory and not cause a shock. This is positive for risk markets like equities.

However, should this dynamic change and we see medium and longer-term inflation expectations at a premium to short-term expectations it will indicate the market is betting that the Fed are now behind the curve and will need to be far more active in reining in price pressures. This is where the tail risk is realised, bond yields rise even faster and will have deeply negative implications for equities and risk FX but will likely be positive for the USD and gold. This is the model to watch as the economy evolves.

Related articles

Bereit zu traden?

Es ist einfach, ein Pepperstone-Konto zu eröffnen. Stellen Sie Ihren Antrag innerhalb von Minuten, auch mit einer geringen Einzahlung. Beginnen Sie Ihre Reise mit Pepperstone noch heute.

Diese Inhalte stellen keine unabhängige Finanzanalyse dar, sondern gehören zu unserer Werbemitteilung. Folglich sind die gesetzlichen und regulatorischen Bestimmungen, die sich auf unabhängige Finanzanalysen beziehen, nicht auf diese Website und unsere Kommunikation anwendbar. Diese Inhalte (unabhängig davon, ob sie Meinungen wiedergeben oder nicht) dienen nur der allgemeinen Information und berücksichtigen Ihre persönlichen Umstände oder Ziele nicht. Die Inhalte unserer Webseite und unserer Kommunikation sind nicht als Finanzberatung, Anlageberatung oder andere verlässliche Beratung gedacht und dürfen auch nicht als solche betrachtet werden. Keine auf der Website wiedergegebene Meinung stellt eine Empfehlung seitens Pepperstone oder seitens des Autors dar, nach der eine bestimmte Anlage, Transaktion oder Anlagestrategie oder ein bestimmtes Wertpapier für eine bestimmte Person geeignet wäre.

Obwohl die in dieser Werbemitteilung enthaltenen Informationen aus Quellen, welche als verlässlich betrachtet werden können, bezogen wurden, gewährleisten weder Pepperstone noch der Autor die Richtigkeit oder Vollständigkeit dieser Informationen. Alle Informationen sind nur indikativ, können ohne vorherige Mitteilung abgeändert werden und können jederzeit veraltet sein. Weder Pepperstone noch der Autor übernehmen Haftung für Verluste, welche Sie entweder direkt oder indirekt durch eine Anlageentscheidung, die Sie auf Grundlage einer auf dieser Webseite enthaltenen Informationen getroffen haben, erleiden. Diese Website kann Graphiken enthalten, die frühere Wertentwicklung eines Finanzinstruments und/oder Schätzungen und Prognosen abbilden. Informationen über die frühere Wertentwicklung eines Finanzinstruments lassen keine verlässliche Schlussfolgerung auf die zukünftige Entwicklung zu.